What are Consumer Staples?

Consumer staples are necessary products which include typical products like beverage, food, feminine hygiene products and household goods. These categories also include items like tobacco and alcohol. These are those products which the consumers are unable to or unwilling to cut down from their shopping lists irrespective of their financial situation.

These are different from the consumer discretionary products because of non-negotiable priority accorded to spending on these items.

The consumer staples are generally sub-categorised into six industries:

- Personal products

- Retailing of Food and Staples

- Beverages

- Food products

- Tobacco

- Household products

Are Consumer Staples Stocks Good for Keeping in Portfolio?

There are many characteristics of consumer staples stocks which makes it worth keeping in a portfolio. The businesses of these stocks are protected from short term economy driven demand swings. These stocks tend to grow steadily, regardless of how the economy is performing.

Letâs have a look at six consumer staples stocks listed on the ASX.

Select Harvests Limited (ASX: SHV)

Select Harvests Limited is engaged in the business of growing, processing, packaging and marketing of almonds from company owned orchards and investor owned orchards, and the processing, packaging and marketing of nuts, fruit based, and associated products to the Australian retail and industrial markets. The market capitalisation of the company stood at $718.98 million on 26th November 2019.

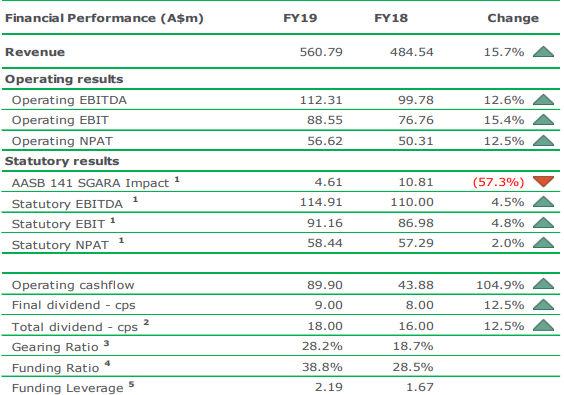

Highlights of 1H FY19 Results

In 1H2019 the company reported almond volume of 22,200 to 22,500 MT, which were up by 41.4% to 43.3%. The growth in volumes were due to maturity profiles which continues to deliver underlying volume growth. Almond prices also saw an increase of 6.8% to 8.1% to $8.60/kg to $8.70/kg. 80% of the crop have been contracted at an AUD/USD exchange rate below of 0.71 cents.

EPS of the company increased by 81% to 21 cents per share and it also declared an interim dividend of 12 cents per share fully franked. Annualised ROCE increased by 5 ppts to 12.4%. This improvement in ROCE was due to orchards maturing and starting to yield with improved efficiency.

1HFY19 Financial Overview (Source: Company Reports)

1HFY19 Financial Overview (Source: Company Reports)

Crop Update for 2019

Mr Paul Thompson, Managing Director of the company, has announced that the 2019 yields are above industry standard and exceed the previous forecast. The continuous improvement in the SHVâs almond yields shows the benefit of the ongoing focus on high-performance horticultural programs. With 95% of the crop now processed the company is forecasting a crop volume of 22,200 -22,500 MT. The remaining 5% represents the tail end of the crop which is generally of lower yield and poorer quality.

Stock Performance

The stock of SHV was trading at $7.380 per share on 27th November 2019 (AEST 01:02 PM), down by 1.6% from its previous closing price. The company has a market capitalisation of $718.02 million as on 27th November 2019 with an annual dividend yield of 2.53%. The total outstanding shares of the company stood at 95.74 million. The stock has given a total return of -6.02% and 17.92% in the time period of 3 months and 6 months, respectively.

Tassal Group Limited (ASX: TGR)

Tassal Group Limited is a Salmon grower and Salmon and Seafood marketer, seller and processor and it produces and sells quality Salmon and Seafood products for the Australian domestic and export markets.

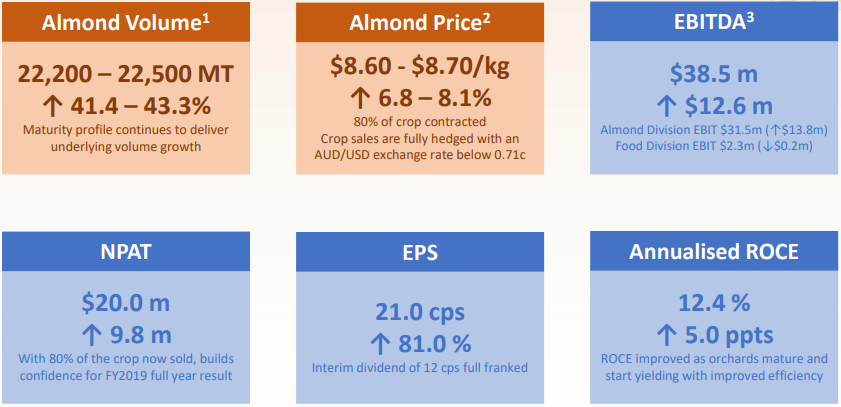

Highlights of Australasia Conference 2019; Revenue Up by 15.7%

In FY19, the company reported revenue of $560.79 million, up 15.7% from $484.54 million in FY18. The operating EBITDA also increased by 12.6% to $112.31 million in FY19. The company declared a final dividend of 9 cents per share, making the total dividend for the year to 18 cents per share.

Performance in FY19 (Source: Companyâs Report)

Outlook for FY20

Positive market dynamics and prawn ramp-up likely to drive continued earnings growth â earnings for FY20 more 2H weighted.

- Targeting FY20 prawn production of circa 2,400t;

- Seasonality of prawn harvesting and sales predominantly 2H skewed;

- Total capital expenditure, including the acquisition of Exmoor Station, is expected to be $156m in FY20.

Stock Performance

The stock of TGR was trading at $4.320 per share on 27th November 2019 (AEST 01:04 PM). The company has a market capitalisation of $900.01 million as on 27th November 2019 with an annual dividend yield of 4.15%. The total outstanding shares of the company stood at 207.37 million. The stock has given a total return of -1.59% and -11.07% in the time period of 3 months and 6 months, respectively.

Bega Cheese Limited (ASX: BGA)

Bega Cheese Limited is engaged in the business of cutting, processing, manufacturing, and packaging traditional cheese products, and into the manufacture of other high value dairy products.

Appointment of New CFO

The company has announced the appointment of Pete Findlay as Chief Financial Officer who commences with the Group today. He is a commercially focused Chief Financial Officer with over 20 yearsâ experience in professional services and senior finance and operational roles in private and publicly owned businesses.

- He has held several senior CFO roles in a variety of industries including manufacturing, retail, information technology and distribution;

- He holds a Bachelor of Business Accounting Degree and is a member of the Institute of Chartered Accountants.

Outlook for FY20

The company is committed to diversifying its reach in the Australian dairy industry, growing its portfolio of high-quality food products and investing in and protecting its famous Australian brands. Nevertheless, extraordinary competitive milk supply conditions and easing demand from third party branded businesses has changed the profit outlook for this year. The company has announced that normalised EBITDA is expected to be in the range of $95 to 105 million for FY20, compared to $115 million in FY2019.

Stock Performance

The stock of BGA was trading at $3.910 per share on 27th November 2019 (AEST 01:05 PM), up by 1.295% from its previous closing price. The company has a market capitalisation of $826.99 million as on 27th November 2019 with an annual dividend yield of 2.85%. The total outstanding shares of the company stood at 214.24 million. The stock has given a total return of -1.58% and -28.26% in the time period of 3 months and 6 months, respectively.

Webster Limited (ASX: WBA)

Webster Limited is one of Australiaâs agribusiness leaders. It operates orchards containing almond and walnut in Tasmania and NSW. The company possesses irrigable land for cotton and other crops grown annually, dorper sheep and cattle production, an apiary business and a portfolio of water entitlements in NSW.

Webster announces Agreement with PSP Investments

Webster has entered into an Agreement with Sooke Investments Inc and PSP BidCo. These companies are individually indirect subsidiaries of PSP Investments, among Canadaâs largest pension investment managers. PSP BidCo proposes to acquire the outstanding equity capital of the company at $2 per share.

Stock Performance

The stock of WBA was trading at $1.965 per share on 27th November 2019 (AEST 01:08 PM), up by 0.255% from its previous closing price. The company has a market capitalisation of $710 million as on 27th November 2019 with an annual dividend yield of 1.53%. The year to date return of the stock stands at 23.27%.

Australian Agricultural Company Limited (ASX: AAC)

Australian Agricultural Company Limited is a fully integrated branded beef business with three principal activities:

- Production of beef including breeding, backgrounding, feed lotting and processing of cattle.

- Ownership, operation and development of pastoral properties;

- Sales and marketing of high-quality branded beef into global markets;

Highlights of H1FY20

The company reported strongest half-year of Wagyu meat sales figures to date with sales growth of almost 10%, highlighting a positive first half of the financial year, as the company continues to roll-out its premium branded beef strategy.

- The company conducted seven launches in the United Kingdom, the United States and Asia of premium brand, Westholme and increased global sales of Westholme by 106% on prior year;

- Increased sales across Asia by approximately 8%, Europe and the Middle East by approximately 26% and North America by 7%.

Stock Performance

The stock of AAC was trading at $1.057 per share on 27th November 2019 (AEST 01:09 PM). The company has a market capitalisation of $638.93 million as on 27th November 2019. The last three months return of the stock is 2.91%.

Bubs Australia Limited (ASX: BUB)

Bubs Australia Limited offers a broad range of infant goat milk formula products, organic baby food, and the fresh dairy products.

Bubs Launches into Bibo Mart

Bubs Australia Limited (ASX:BUB) today has announced that it has secured Bubs® product portfolio in Vietnamâs largest Mother & Baby store chain, Bibo Mart JS Company, with over 135 stores, mostly located in key metropolitan areas.

- Infant Milk Formula category valued at VND 28 trillion* (A$1.8 billion);

- Entry point to fast growing Vietnamese VND 34 trillion* (A$2.2 billion) infant nutritionals market;

- Appointed Channel Partner TVV, currently suppling circa. 20,000 retail outlets, including Bibo Mart

Stock Performance

The stock of BUB was trading at $1.100 per share on 27th November 2019 (AEST 01:09 PM), down by 0.901% from its previous closing price. The company has a market capitalisation of $570.62 million as on 27th November 2019 and the YTD return of the stock is 143.96%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.