Investors always have a keen eye on the dividends of stocks they short-listed to invest in, for a simple conceptual reason that dividends are the ultimate fruit, rather reward, of their investing risk bearings. Good dividend returns, reliable capital availability, positive growth outlook and no controversies are some of the pointers in every investorâs checklist.

In this article, we would understand the all-inclusive concept of dividend pertaining to investing and focus on its impact on the stock price. We would also look at a few Australian Securities Exchange shares, which are considered as the best dividend stocks in the current time. Let us dive right it!

The Dividend Concept

Derived from the Latin word âdividendumâ, which means a thing to be divided, dividend can be best described as the reward from a part of the total earnings of a public entity, provided to the shareholders who invests in the company. It is the payment, a fixed amount per share, decided by the companyâs board and management and is regarded as the distribution of its profits. In an event wherein profit is generated, the company bears the potential to re-invest in the business and pay a part of the profit as dividend, which provides a stable income and boosts the confidence of shareholders. The distribution of dividend is ideally in the form of cash or in shares, in case of the presence of a Dividend Reinvestment Plan. Besides publicly-listed companies, various mutual funds and exchange traded funds pay dividends to their respective shareholders.

The best dividend paying companies are the large, well established ones that have more predictable profits. These companies are often on the look-out to maximise their shareholdersâ wealth. Financial institutions, oil and gas companies, healthcare and pharma players and utilities are a few sectors who are known to pay a chunk of profits to their shareholders.

The Dividend Payment Procedure

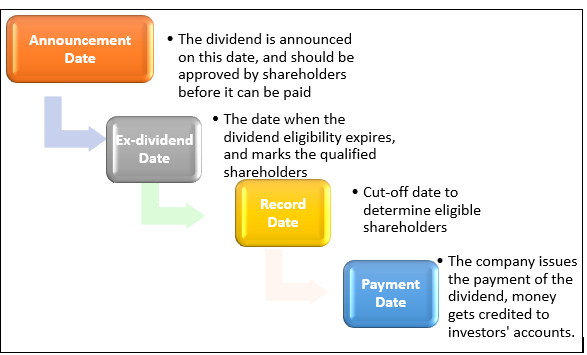

The payment of the profit reward portion to shareholders is a chronological event, with the below mentioned prime dates as process:

Importance of Dividends

Dividends, often referred to as passive income, and synonymous with the fruit of investing bears a lot of advantages. Few of which are as follows:

- Dividends provide a stable income run and aids in improving investment returns.

- They are the only actual return that is received by investors when they buy a stock.

- Dividends offer special tax advantages.

- They allow reinvestments, i.e. purchase of more shares to enhance the investorsâ existing portfolio.

- Dividends provide the evidence of the profitability of the company.

Effect of Dividend on Stock Price

Dividends affect the value of a stock in numerous ways and add value to a stock by offering investors a cash or stock pay-out for holding shares. It should be noted that dividends are not included in calculation of the most valuation metrics of a company. Hence, they do not have an impact on the valuation of stock investments but affect the price of the stock. Let us look at a few of the scenarios wherein the dividend affects the investorsâ sentiment and movement of the stock price:

- If a company increases its dividend higher than the market anticipation, it could be taken as a positive sign and enhance the stock price. On the contrary, a dividend cut would cause a slump in the stock valuation.

- Ideally, there is a rise of price of shares when the ex-dividend date approaches, and upon the distribution, the share price decreases. Some investors have often depicted the tendency to purchase a companyâs shares a few weeks prior to the ex-dividend rate, to take advantage of the rise in stock price. Upon distribution, shares previously purchased are sold to earn good returns.

- Dividends have a massive impact on the stock price on the announcement day of dividends, and can be higher or lower, depending on the market expectation versus the price quoted. When the dividend amount is lower, it causes a drop in the stock price. On the contrary, a higher dividend increases the stock price and makes investors expect a substantial growth in the company.

- There is a set of investors who have shown a trend to religiously invest in companies which announce good dividend and have a history of providing good dividend yields (calculated by dividing the dividend amount and the stock price, multiplied by 100).

- In case of an issue of a large amount of special dividend relative to the size of the company, which might occur through the sale of a subsidiary or a court settlement, the stock price is ideally adjusted permanently.

- Considering the fact that dividends are paid out of earnings, which are the primary factor that affects stock prices, they leave long-term effect on stock prices. It has also been noticed that dividend-paying stocks typically fluctuate less than stocks that do not pay dividends.

- The DDM or dividend discount model is a quantitative technique that is utilised to predict the price of a companyâs stock, undermining the market situation and takes the dividend pay-out factors and market calculated returns into consideration.

Australian Companies Offering Good Dividends

Australia is an attractive destination for investors in terms of dividend. Many ASX-listed dividend-paying shares have delivered great returns. Australia does not have a double tax on its dividends, unlike other countries and maintains cash rate at a low.

Let us look at a few public Australian companies that have persistently had their dividend game strong, and look at their respective stock performance, by the closure of the trading session, on 2 September 2019:

- National Australia Bank (ASX: NAB)- One of the Big Four Banks in the country, NAB has an annual dividend yield of 6.65 per cent. NABâs stock was last quoted at A$27.330, slipping down by 0.11 per cent from the last close.

- Wesfarmers Limited (ASX:WES)- A major player of Australiaâs consumer discretionary retail section, WES has maintained an annual dividend yield of 4.55 per cent. WESâ stock was last quoted at A$38.61, moving down by 1.253 per cent compared to the prior close.

- AGL Energy Limited (ASX:AGL)- Operating Australiaâs largest retail energy and dual fuel customer base, AGL has maintained an annual dividend yield of 6.28 per cent. Its stock was last quoted at A$19.080, edging up by 0.633 from the last closing price.

- Scentre Group (ASX:SCG)- Real estate player SCG has an annual dividend yield of 5.54 per cent, and its stock was quoted at A$3.970, going down by 1.733 percent as compared to its previous closing price.

- Suncorp Group Limited (ASX:SUN)- Financial player SUN has an annual dividend yield of 5.07 per cent and its stock was last quoted 13.740, down by 0.507 per cent from the previous closing price.

It can safely be stated that the concept of dividend is equally vital for both the management of the company and stockholders, because one group has to decide and make arrangement for the payment of dividend, while the other group has to receive it as a reward for their investment.

Moreover, dividends are depictions of the health of the company and an ardent income source for investors. However, it should be noted that dividends alone should not be relied upon while making investing decisions, and other factors including the technical analyses, forecasts and operations must also be under an investorâs scrutiny.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.