Property prices to end 6 per cent higher in 2020, with Sydney and Melbourne witnessing price rises of 9 per cent and 7 per cent respectively, anticipated HSBC in its latest analysis.

Before you get overjoyed, let us make clear that the multinational bank’s projections assume gains accumulated prior to the COVID-19 pandemic to offset the fall in prices predicted in the second half. The bank anticipates a fall of between 2 to 12 per cent in property prices in 2021, with prices declining by 15 per cent and 17 per cent in Sydney and Melbourne, respectively.

Just few days prior to HSBC analysis, Commonwealth Bank of Australia (ASX:CBA) also predicted a pessimistic scenario for the nation’s property market, anticipating a fall of about 11 to 32 per cent in house prices by 2022. The pessimistic projections are largely driven by a sudden pullback of buyers and sellers amidst coronavirus driven lockdowns and restrictions.

Must Read! Shedding Light on Market Mood in AU Property Space

However, on the bright side, the recent Home Value Index results revealed by the property consultant, CoreLogic, for April 2020 demonstrated no material decline in property prices, with market observing a monthly pace of growth of 0.3 per cent in house values. Besides, an improvement in auction clearance rates for the week ended 10th May 2020 offered further impetus to the property market.

Undeniably, COVID-19 is weighing on the Australian property sector in some way or the other, posing threat to real estate stocks reliant on the robust housing market. However, few real estate stocks are exhibiting a considerable potential to sail through the coronavirus crisis.

Let us discuss three such real estate stocks in some detail below:

Stockland Remains Cautious over Market Recovery

Australian property development company, Stockland (ASX:SGP) recently updated the market on its third quarter (March quarter 2020) performance, highlighting that COVID-19 presented challenges across most areas of its businesses since early March.

The Company notified that the Retail Town Centres witnessed robust portfolio performance in the early two months of 2020; however, it faced non-essential services store closures, reduced foot traffic and high demand for essential services from the middle of March 2020.

Nevertheless, the Company saw resilience in Retirement Living and Residential Communities sales and settlements despite the challenging times.

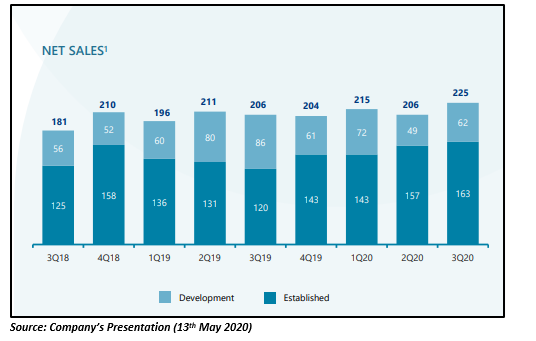

Retirement Living: The Company’s Retirement Living business attained 225 net reservations during the quarter, that was the strongest result for established sales in over two years. The Company further expects an increase in sales over time, backed by the continued growth in this demographic and their yearning for connected and safe living in the village style environment.

The Company completed 207 settlements in third quarter; however, volumes begin to be affected by broader market dynamics like extended timeframes for customers to sell their existing homes.

Residential Communities: The Company mentioned that though the business was performing well in Jan and Feb 2020, the COVID-19 induced restrictions contributed to a material drop in net sales to 137 lots in April 2020. The Company had 3,853 contracts on hand as at 30th April 2020.

It is worth mentioning that the Company’s new enquiry levels have recovered after a fall in late-March 2020 to early April 2020, with its sales offices fully operational in NSW, QLD and WA with easing of government restrictions.

Similar to these segments, the Company reported decent performances in its Commercial Property – Workplace and Logistics and Commercial Property – Retail Town Centres segments. However, the Company stays cautious about the speed and shape of market recovery. The Company’s outlook remains uncertain for the full year to 30 June 2020.

SGP last traded at $3.070 on 22nd May 2020, with a rise of 1.32 per cent.

Scentre Group Eyeing Reopening of Economies

Property developer and shopping centres operator, Scentre Group (ASX:SCG) is closely eying the reopening of the Australian and New Zealand economies.

The group notified in its first quarter 2020 operational update that it supports the reopening of economy, which will enable most of its retailers to reopen their store networks.

The group mentioned that around 57 per cent of its retailers representing 70 per cent of gross lettable area are already open in Australia, while more are expected to reopen in the coming weeks. Besides, its centres are well prepared to move to COVID Level 2 in New Zealand when the government will unveil its timetable.

The group reported strong operational performance for January and February 2020, witnessing a year-on-year growth of 1.9 per cent in customer visitation during the two months. However, its customer visitation fell during March and April to 39 per cent of the previous year’s level.

What’s worth mentioning is that the group observed significant increase in the level of visitations over recent weeks with the reopening of several retailers. Notably, the group completed 496 leasing deals during the quarter, representing around 80,000 sq. m of gross lettable area. Besides, the group increased liquidity to $3.1 billion in April 2020.

The group does not have any bank debt maturing until January 2022 as it has extended all bank facilities that were due to mature in 2021. Moreover, it maintains “A” grade credit ratings by Fitch, S&P and Moody’s.

SCG last traded at $2.240 on 22nd May 2020, with a fall of 1.32 per cent.

Domain Witnesses Recovery of New Listings in March 2020

Real estate technology and services business, Domain Holdings Limited (ASX:DHG) observed a recovery of new listings in March 2020 in key markets. The Company notified that its residential depth yield rose by 17 per cent during the month, backed by favourable impact from its new flexible pricing model and improved depth penetration across all states.

During the March 2020 quarter, the Company witnessed a rise of 3 per cent during the quarter and 15 per cent in March. Besides, the total revenue also surged by 1 per cent during the quarter and 10 per cent in March. The Company highlighted that its March performance offers confidence that it is well positioned when markets come back to normal.

However, the Company mentioned that its March performance does not reflect the impact of COVID-19 restrictions, which is visible in April listing volumes.

In April this year, the Company strengthened its liquidity position by signing agreement with its banking group for a fresh 18-months debt facility of $80 million. In comparison to the net debt of $147.9 million in December 2019, the Company’s net debt was $149.5 million in March 2020.

DHG last traded at $3.080 on 22nd May 2020, with a fall of 1.91 per cent.

With widespread economic downturn expected across the globe, the Australian property market might also have to bear the brunt of coronavirus crisis. However, investors may seek value in some fundamentally sound real estate businesses that are less immune to COVID-19.