Healthcare stocks have generated a stupendous return on a year-to-date basis. Investors have taken note of several stocks within the healthcare industry which operate across new avenues of healthcare segments. With the emergence of several chronic diseases, the emergence of new health care segments has become one of the prime requirements in the modern world. Modern healthcare businesses require improved manufacturing facilities in order to cater to the demand of health care products. We will be looking at the businesses which offer healthcare products and healthcare manufacturing devices.

Opthea Limited (ASX: OPT)

Opthea Limited is a drug development company which is engaged in the development of innovative, biologics-based therapies used for the treatment of eye disease. On 7 January 2020, the company reported that Bank of America Corporation and its related bodies corporate became an initial substantial holder with 5.03% voting power.

On 07 January 2020, OPT reported the completion of enrolment process for a patent for the Phase 2a DME study which is an important milestone in specialization for a second disease for the company. As per the study, the company received positive outcomes from Phase 2b wet AMD study.

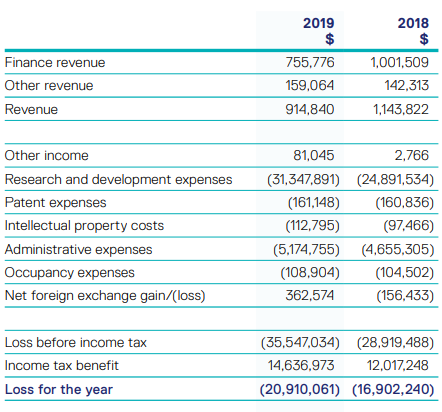

FY19 Operational Highlights for the Period ended 30 June 2019: OPT declared total revenue at $0.914 million as compared to $1.143 million in FY18. The company reported research and development expense at $31.347 million as compared to $24.891 million in the previous financial year. The company reported a net loss of $20.91 million as compared to a loss of $16.902 million in FY18. The company reported total current assets of $36.892 million which includes cash and cash equivalents of $21.543 million and current tax receivables of $14.636 million as on 30 June 2019. Total Assets stood at $37.660 million followed by a net asset of $31.119 million on FY19.

FY19 Income Statement Highlights (Source: Company Reports)

Stock Update: The stock of OPT closed at $3.40, up 4.938% with a market capitalization of $872.07 million on 14th January 2020. The stock has given stellar returns of 282.28% and 403.33% in the last six months and twelve months, respectively.

Polynovo Limited (ASX: PNV)

Polynovo Limited operates in developing and marketing of innovative medical devices. Recently, the company informed about the recipient of certificate of conformance (CE Mark) for NovoSorb BTM for the market of UK/Ireland and the European Union.

Recent Operational Updates: As per the December 2019 updates, PNV reported revenue of $2 million as compared to $890k in previous corresponding month, depicting a jump of 134% on y-o-y basis. During the first half of FY20, the company reported unaudited NovoSorb BTM revenue at $8.57 million as compared to $3.75 million in the prior corresponding period (pcp), showing a jump of 129% on pcp terms.

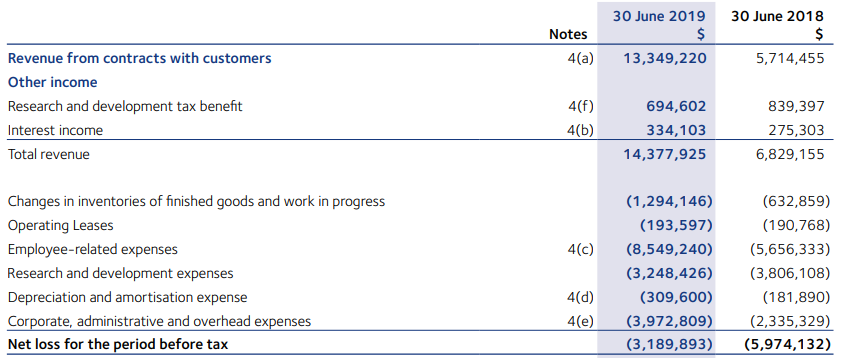

FY19 Financial Highlights for the Period ended 30 June 2019: PNV reported its FY19 financial results wherein, the company reported total revenue at $13.349 million, up 133.6% on y-o-y basis. The company reported a loss after tax at $3.189 million, down by 46.6% on pcp terms. Corporate administrative and overhead expenses stood at $3.972 million as compared to $2.335 million as on FY18. The company reported research and development expense at $3.24 million on FY19. The company reported cash on hand at $13.9 million during FY19. The company reported sales of goods revenue at $9.348 million as compared to $1.747 million in FY18.

FY19 Income Statement Highlight (Source: Company Reports)

During the year, the company reported lower losses, despite higher operating expenses because of the increased revenue realization from the NovoSorb BTM segment across multiple markets.

Outlook: As per the Management outlook, the company expects a tepid sales growth in FY20. The business is expecting sales growth within the US segment aided by the hiring of new staff. The company expects to be break-even in FY20.

Stock Update: The stock of PNV closed at $2.210 with a market capitalization of $1.37 billion on 14th January 2020. The stock has generated returns of 17.54% and 243.59% in the last six months and one year, respectively.

Compumedics Limited (ASX: CMP)

Compumedics Limited operates in the development, manufacturing and marketing of medical devices used for diagnosis of brain and sleep and to monitor ultrasonic blood-flow applications.

Operational Highlights for H1FY20 for the Period ended 31 December 2019:

- The company reported growth in its H1FY20 revenue as compared to the previous financial period aided by improved revenues from Asia, the Middle East and DWL.

- The business reported its first-ever shipments of neurological monitoring devices to Japan which was delivered in H1FY20 to the company’s new distribution partner Fukuda Denshi.

- For the first half of FY20, the company witnessed a delay in several key orders while the company did not report any loss of clients during the time period.

FY19 Financial Highlights for the Period ended 30 June 2019: CMP declared its FY19 financial results wherein, the company reported revenue at $41.505 million as compared to $37.002 million in FY18. Cost of sales stood at $16.75 million as compared to $15.815 million in the previous financial year. Sales and marketing expenses, during FY19, stood at $8.471 million as compared to $7.516 million in FY18. The company reported research and development expense at $5.319 million while administration expense at $6.424 million during FY19. Net profit stood for FY19 stood at $3.998 million as compared to $2.784 million in FY18.

Guidance: As per the FY20 guidance, the company expects revenue from the core business at $42 million to $44 million, while EBITDA is expected between $6.5 million to $7.5 million. The company expects its Appendix 4D to be released on 25 February 2020. The company expects H1FY20 revenues at ~$17.7 million.

Stock Update: The stock of CMP closed at $0.700, with a market capitalization of ~$124.01 million on 14th January 2020. The stock has generated positive returns of 2.94% and 12% in the last three months and six months, respectively. In the last 1 year the stock has returned 94.44%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.