Hey! Are you a risk-taking investor and are keen on investing in small cap companies engaged in the internet and cloud operations? Then, we have highlighted in this article about two such companies which have generated profits in the past five years and have also provided dividend to its investors.

If you are planning to invest in small cap companies and you prefer to keep technology companies in your portfolio, then we have two companies for you.

Through this article, we would try to provide a guide to the two companies which might help you in taking an investment decision. We would talk about the company profiles, businesses and the recent results announced by them.

Let’s dig in:

Data#3 Limited (ASX: DTL)

Data#3 Limited (ASX: DTL) is a top Australian IT services & solutions provider which focuses on assisting clients answer complex business problems applying innovative technology solutions. Data#3 has more than forty years of experience, plus world-leading vendor technologies, Data#3 provides an integrated collection of solutions covering cloud, security, mobility, data & analytics as well as Information Technology lifecycle management.

DTL made its debut on ASX during 1997 and has more than 1.2k staff, with $1.4 billion revenue in FY2019, 12 facilities across Australia & Fiji, 15.4 million items sold in FY19, 4,933 transacting clients and 170k service desk calls by customers.

DTL’s base is its highly trained resources, vendor skill along with established success. Through these, the company provides the building blocks for the solutions to its customers.

DTL’s services include:

- Consulting Services: DTL helps to solve complex business challenge and provide successful business transformation.

- Procurement: From strategy and procurement through to lifecycle & supplier management, the company solves the difficulties that are usually linked with procurement.

- Project services: The company helps customers line up business & technology strategies and ensure that the desired result is obtained. With its highly competent people, strong relations with top vendors, & established methods, DTL assist its clients in managing difficulties related with project management.

- Managed services: With expert skills and an established track record in implementing managed services, the company takes the time to understand the business of its client from each and every aspect. The clients can choose the model which suits their requirements. From fundamental services to a full outsourced solution, the company becomes an extension of the IT team of its clients and a trusted partner that knows the technology as well as business needs.

- Resourcing: DTL assists its clients in sourcing, placing and retaining IT professionals. DTL has a detailed knowledge of the technical skills & capabilities that are required to obtain the full value from the technology investment. From augmentation services to fully outsourced IT staffing solutions, the company helps in managing ICT capability needs, either on-site or remotely & has the best people & resources that match the ongoing technology needs of its clients.

1H FY2020 Result; Growth across all important metrics:

On 19 February 2020, Data#3 Limited released its 1H FY2020 results and reported an 11.6% growth in its revenue to $718.9 million, which includes $251.9 million revenue from a public cloud service.

Total gross profit was $88.6 million, up 7.7% as compared to the previous corresponding period. Gross margin dropped marginally from 12.8% to 12.3%, which shows a shift in the sales mix.

Staff cost during 1H FY2020 soared by 4.7% to $65.1 million, which indicates the rise in the headcount & market-based increases. Operating expenses declined by 1.1% to $11.8 million, with savings from the decommissioning of the Data#3 Cloud platform

The net profit before taxes was up 40.6% to $12.7 million while net profit after excluding the minority interest went up by 41.5% to $8.7 million. EPS increased by 41.5% to 5.65 cents. The company declared an interim dividend (100% franked) of 5.1 cents per share, up 41.7% as compared to the previous corresponding period.

The company maintained a strong balance sheet with no material debt.

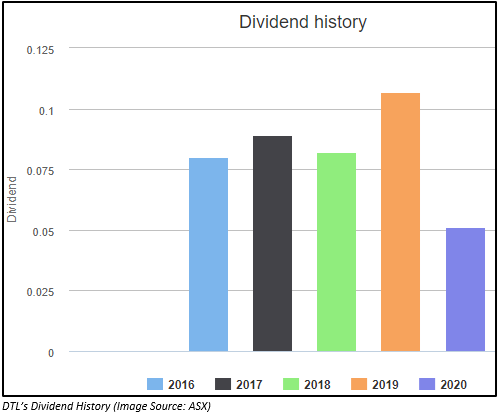

In the past five financial years, DTL has provided its shareholders with a dividend.

Over the Wire Holdings Limited (ASX: OTW)

Over the Wire Holdings Limited (ASX: OTW) is the provider of cloud ,telecom & Information technology solutions and has a network spread nationally with presence in all key capital cities within the country as well as Auckland in New Zealand.

OTW provides a comprehensive suite of services and products to business clients. These comprise of Data Networks & Internet, Voice, Data, Cloud, Centre co-location & Managed Services.

Solutions:

OTW provides four types of solutions:

Data Network:

Data networks form the foundation of any business as it helps other businesses to connect to their suppliers and staff. Whether it is a private network or SD-WAN, OTW offers businesses with improved access.

OTW’s Business Data Network Solutions:

- Business Internet: In business internet, internet connectivity is present in more technology alternatives. OTW provides a broad array of reliable fibre ethernet, mobile data & NBN services. With uncontended bandwidth alternatives to provide trustworthy speeds, the company utilizes the top technologies to boost the internet uptime of its client for real business-grade connectivity.

- Private Networks: Connecting the staff and systems of the businesses securely irrespective of where they are located. The benefits of an Over the Wire Private Network are:

- One network, anywhere

- Dedicated support

- Tough security

- Automatic failover

- Reliable performance

- Integrated

- Hybrid Networks: A hybrid MPLS & SD-WAN might provide the best in networking architecture efficiency. Through Over the Wire hybrid networks solutions, one can expect:

- Application Prioritisation

- Cost savings

- Flexible bandwidth

- Greater visibility

- One size never fits all

- 24/7 Support

- SD-WAN: SD-WAN can improve performance, visibility & remote monitoring over any WAN infrastructure. Its features include multi-path optimisation and first-class reporting characteristics

Voice Solution:

Voice services must not be restricted to just speaking over the phone. OTW voice solutions gain from complete access to local & specialty numbers, complex routing, & a powerful custom-built user interface.

With superior & high-availability features provided as the standard, the business IP solutions (voice based) of OTW include SIP & hosted PBX services for the enterprise. Irrespective of the business size and type of business, OTW’s voice solutions can scale to up to meet any demand.

Hosting solutions:

The company’s Hosting services are provided via its national data centre network. Through its facilities in Sydney, Brisbane, Melbourne & Adelaide its delivery systems are constructed in a way to offer a superior, secure cloud environment for corporate data. The hosting services help in simplifying infrastructure, enhance security & make it simple to implement cloud solutions.

IT Support Services:

Expert help on hand to deliver trusted, high-performing IT Support Services

1H FY2020 Result:

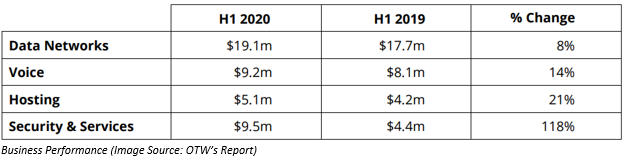

- Total Revenue increased by 25% to $42.9 million as compared to the previous corresponding period.

- EBITDA went up by 1% to $8.2 million.

- NPAT declined by 27% to $2.3 million.

- Since FY2016 till FY2019, the company has provided its shareholders with an increasing dividend and in 1H FY2020 board declared an interim dividend (fully franked) of 1.50 cents per share.

Business Performance:

Business Outlook:

OTW’s business is progressing well as per its strategy, and it continues to generate encouraging operational cash flow & helps preserve a solid balance sheet. The company is placed well to provide organic growth & pursue more accretive acquisitions.