Guidance

An outlook or guidance, in simple terminology, refers to a future view or a probable prospect. Guidance, also referred as earnings guidance, is a forward-looking statement, which a company provides to its investors about its estimate of future earnings. The guidance also gives an idea about the companyâs revenue estimate, as well as capital expenditures. The companyâs guidance gives a clearer picture of its expectation, in terms of its performance in the upcoming financial year or in the remainder of the existing financial year period. Also, the management, running a business, is aware of its challenges and is in a better position to predict the companyâs performance in the foreseeable future.

Importance of Guidance

In the past, guidance of the companies has not been systematic, planned and formal. Earnings guidance can be an add on data point for the analyst and the investor, but the guidance is based on the decisions taken by the senior management of the company.

These are also termed as âoutlookâ, so there is always a motivation for the company and its employees to meet the set outlook. The companies surpassing their outlook figures, often shows how reliable its estimates have been and how efficiently they have been managing their time, work and money. However, an investor must take care before investing in an entity based on its managementâs guidance.

Whenever a company provides its guidance report, it often has an effect on its stock price, so, it is important to know how the other companies in the same sector are performing. When an investor compares different companies of the same sector, he gets to know the different processes followed by the companies, and can find the best companies, who have been managing their resources effectively.

Let us have a look at the two companies, who provided the guidance report for the upcoming period.

Pioneer Credit Limited

Pioneer Credit Limited (ASX: PNC) is an Australian-based, leading financial services provider. The company specialises in servicing and acquiring retail debt portfolios.

Suspension Extension

The company has made a request to ASX for the grant of further extension on suspension, on 30 September 2019. As per its earlier notification, on 24 September 2019, the company mentioned that it has appointed Azure Capital to assess proposals obtained for the realisation of the value of its assets, comprising of change of control proposals and for the provision of funding, if needed.

PNC requested the voluntary suspension of its shares to remain in place until the company releases an announcement related to the process, which is being anticipated by the end of this month.

Financial Result for the year ending 30 June 2019

On 30 September 2019, the company announced the financial result for the FY 2019 closed 30 June this year, and below mentioned are a few highlights of the results:

- The companyâs revenue from ordinary activities has been decreased by 7.36 per cent to $74.7 million compared to the previous year same period.

- Profit from ordinary activities after tax of the company declined by 75.68% and stood at $4.2 million.

- Cash receipts increased by 14.7per cent to $120.8 million.

- EBITDA of the company increased by 16.7 per cent to $63.4 million.

- Cash and cash equivalents of the company stood at $11.1 million compared to $3.4 million last year.

- On the balance sheet front, PDP financial assets increased to $92.7 million.

- The companyâs total current liabilities increased to $178.7 million against $13.3 million last year.

Dividend

PNC further notified that it would not declare a final dividend for this reporting period. It anticipates updating shareholders on the plan as to when the trading of its securities would begin again on ASX.

The company also announced a Standstill Agreement with Commonwealth Bank of Australia, which can be accessed here.

Guidance

According to PNCâs Chairman, Mr Michael Smith, âthe company has a solid market position because of its servicing approach, and it continues to fund its PDP forward flow commitments in a sustainable manner from the cash flow. Also, liquidations started well in FY20 period, and from July onwards there had been several approaches from new and current vendors to sell the additional portfolios of the PNC. The company is anticipating capitalising post the completion of the Azure Capital procedure.â

He further added, âdespite disappointing NPAT due to Amortised Cost of the companyâs portfolio, they were satisfied with the rising metrics not getting affected by the accounting change, especially the companyâs EBITDA and cash liquations were soild from the initial months of FY20, which enabled for continued PDP investment.â

Stock Performance

The stock of PNC last traded at $2.460 on 23 August 2019. It has approx. $63.04 million outstanding shares. The 52-week high value of the stock was noted at $3.450. The stock has generated a negative return of 20.13 per cent in the last six months, and a negative return of 12.46 per cent on a year-to-date basis.

Gentrack Group Limited

A computer consulting entity, Gentrack Group Limited (ASX:GTK) is dual listed both on ASX and NZX. It offers important software for essential services, combining strong platforms containing deep market knowledge to aid utilities and airports decreased service costs, foster innovation and assertively navigate market reform.

Outlook Update for the year ending 30 September 2019

- As per its half-year report for the period closed 31 March this year, released on 24 August 2019, the company has contracted with 4 utilities in the UK region for its latest SaaS solutions and one airport in the Australian region.

- GTK has been witnessing rising acceptance of SaaS-based solution by utilities.

- On 30 September 2019, GTK provided the updated outlook for the financial year closed 30 September this year. It expects its full-year FY19 EBITDA outcome to be in the range of $25 million to $26 million.

- The company has changed its guidance report of the full-year EBITDA outcome from previously announced $27-$28 million due to increased bad and doubtful debt provisions for UK Utilities market.

Financial Result for the half-year ending 31 March 2019

Below are a few financial highlights from the half-yearly results:

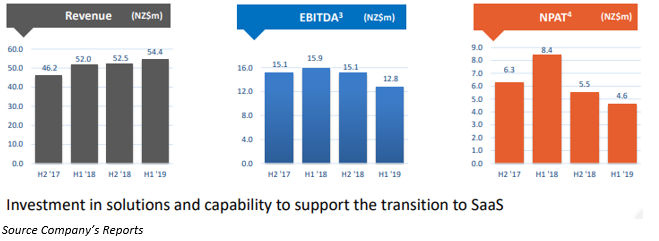

- The companyâs revenue decreased by 0.6 per cent to NZ$54,421 compared to the previous yearâs same period.

- Operating costs of the company decreased by 0.3 per cent to NZ$41,632.

- Net profit after tax increased by 0.5 per cent to NZ$4,641.

- EBITDA has decreased by 3.2 per cent to NZ$12,789.

Three Successful Acquisition

- Junifer launched in Australia and continues to obtain market share in the UK region.

- Evolve Analytics planned market entry in the Australian region.

- BlipTrack is expanding solidly in North American region and cross selling into the Veovo Customer base.

Stock Performance

The stock of GTK was trading at $4.66 on ASX on 2 October 2019 (AEST 12.08 PM), dipping by 2.917 per cent. The company has approx. $98.64 million outstanding shares and a market cap of $473.5 million. The 52-week low and high value of the stock is at $4.300 and $6.620, respectively. The stock has generated a negative return of 0.21 per cent in the last six months and a positive return of 1.91 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.