A new decade has just begun with a plethora of potential opportunities and experiences that are likely to make us better through its wisdom. Nonetheless, the 2010s had been phenomenal for bond markets.

The size of global debt increased by USD 7.5 trillion in the first half of 2019, according to a report by the Institute of International Finance in November 2019. The report unveiled that the size of global debt might exceed USD 255 trillion by the end of 2019, which was around USD 250 trillion in the first half of 2019.

In October 2019, the International Monetary Fund (IMF), in its Global Financial Stability Report, expressed concerns over rising corporate debt levels and noted that around 70 per cent of economies, globally, have lowered their interest rates.

An easing and accommodative stance by central bankers, globally, in a bid to uplift global growth, has helped to push up asset prices along with equity markets. However, the policy actions also caused stretched valuations in stock-bond markets in emerging and frontier economies as well as Japanese and US stock markets, according to IMF.

While the level of corporate and sovereign debt is on the rise, we witnessed around USD 17 trillion was sitting on the negatively yielding bonds, which means paying bond-issuers to borrow more money.

Good Read: Key World Economies Facing Towering Debt Accumulation: Looking at the Bigger Picture

Amid a material economic slowdown, companies with the inability to service interest-expenses on debt through earnings could rise to USD 19 trillion, which could be half-severe as compared to the global financial crises, noted IMF.

2020s have started on a positive note, particularly in light of geopolitical perspective, looking at the probability of completing phase-one trade deal between the US and China, and the much-awaited exit of the United Kingdom from the European Union potentially.

If fiscal policy responses would be favourable globally augmented with efficient monetary policy, the world might grow at a better pace and that would be favourable for the decade’s first year.

Earnings growth remains a major concern going into the decade, while it is apt to say that earnings growth should remain a major concern, particularly for investors, as it serves as a catalyst in accessing better returns.

And, if corporate earnings would grow at a sustainable pace, the possibility of a financially catastrophic event led by large piles of corporate debt could be lowered. Moreover, earnings growth in corporations should act as tailwinds to default rates in the burgeoning corporate bond markets.

How has the Bond Market Performed in 2019?

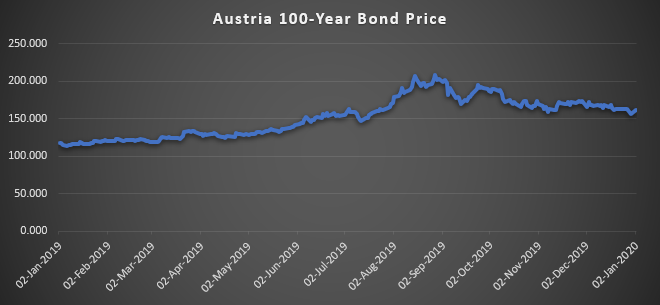

In 2019, bond markets had a phenomenal year, backed by recession fears and increasing volatility. Looking at one of the longest-dated maturity bonds, globally – Austrian Government 100-Year Bond; the price of the bond had a drastic movement, as yields plunged and increasing recession risks helped the safe-asset rally during the year.

Source: Thomson Reuters, Kalkine

Let’s take a look at some other indicators of bond market performance.

International Indicators

iShares Core Global Corporate Bond (AUD Hedged) ETF delivered a return of 11.52 per cent over the year to 31 December 2019 with four distributions during the period, equating to a gross dividend of approximately 445.49 cents per unit.

This ETF reflects the performance of Bloomberg Barclays Global Aggregate Corporate Bond Index, which hosts companies from a wide range of geographies. It can also serve as a proxy for the underlying performance of investment-grade corporate bonds across the global market.

SPDR® Portfolio TIPS ETF invests in US treasury inflation-protected securities that are designed to provide protection against inflation, and in turn, the fund acts as a hedge against adverse impacts to purchasing power due to inflation.

On a YTD basis to 30 November 2019, the fund has delivered a return after taxes on distributions of 7.25 per cent, with one-year return after taxes on distributions of 7.69 per cent. This ETF could act as a proxy for real returns.

Domestic Indicators

iShares Core Composite Bond ETF has delivered a return of 7.09 per cent over the year to 31 December 2019, and it also paid four distributions during the period.

This ETF tracks the performance of the Australian bond market and invests in investment-grade fixed income securities issued by corporations and domestic public outfits, including semi-government, supranational and sovereign entities.

And, it can serve as a proxy for the performance of the debt issued by these corporations along with government debt in Australia.

iShares Treasury ETF delivered a return of 7.59 per cent over the year to 31 December 2019 with four distributions during the period. This ETF provides the performance of the debt issued by Australian treasury.

SPDR® S&P®/ASX Australian Bond Fund posted a total return of 11.31 per cent over the year to 30 November 2019. The fund invests in Australian Dollar denominated investment grade bonds.

Bond Market in 2020

In December 2019, the Australian Office of Financial Management announced that it expects to issue $55 billion worth of treasury bonds in the year 2019-2020, which is slightly down by $3 billion from the initial estimate.

Internationally, the market experts are anticipating a steady rise in bond yields, and lower returns than the previous year are also expected. The US 10-year Treasury is believed to reach 2.25 per cent to 2.50 per cent due to pick-up in the global growth and easing recession fears.

Central bankers are likely to hold the interest rates due to the lag impacts of rate cuts into an economy and to monitor the incoming economic data. In 2020, the bond returns could be relatively lower with fewer price gains and steady income gains.

In Australia, the status quo appears to be similar, backed by highly coordinated monetary policies. If the incoming economic data is to improve, the market expectations of another rate cut could be suppressed.

In an economic context, the Australian economy is lagging with subdued consumption levels, while public spending and construction activity have held up the levels of economic growth.

The domestic corporate bond market presents opportunities to invest in highly rated companies, which have fundamentally sound business, history of sensible management and lower gearing levels that could deliver better returns compared to the other fixed income options.

In the last year, the geopolitical risks fuelled pretty good volatilities in the markets, and the rotation to safe assets was prevalent. In 2020, such unexpected risks are likely to be present, and the investor sentiment could be adversely impacted, possibly triggering some volatility in the markets.

The probability of the fixed income market to be better than 2019 is less due to unexpected developments in 2019 that led to price gains. And, for Australian bond markets to do better in 2020, the favourable economic data would likely act as a tailwind. With economic data, we mean improving labour conditions, participation rate, wage growth, unemployment rate, consumer confidence and spending. Further, it is likely that additional monetary and fiscal policy actions would help to revive the economic side of the country.

Predicting markets remains one of the mightiest tasks, and maybe the ramifications of globalisation have made countries more dependent on each other. Therefore, any adverse developments in geopolitical and global scale could impact the markets and investments drastically.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.