Downer EDI Limited (ASX:DOW) is the leading provider of integrated services in Australia and New Zealand which designs, builds and sustains infrastructure, assets and buildings. The purpose of the company is to sustain the modern environment by maintaining relationships with customers. The results for the Company are reported under five service lines including Transport, Utilities, Facilities, Mining and engineering, Construction and maintenance.

Change in Directorâs Interest notice:

Peter Watson recently acquired 6,329 ordinary shares (on-market purchase) for a consideration of $7.90 per share.

Teresa Gayle has acquired 3,000 ordinary shares (on-market purchase) for a consideration of $7.90 per share, now owning 17,000 shares.

Dividend:

The Company recently announced to pay the final dividend of 14 cents per share (50% franked), to be paid on 2 October.

Preferred overhaul and capital work contractor:

The company announced that it has been recently selected as the contractor to deliver CS Energyâs overhaul and capital works program at its power stations in Queensland. The scope of work includes planning and execution of major overhauls, projects and engineering work to support CS Energyâs asset strategy.

FY19 Financial Performance (as at 30 June 2019)

- The results of the company featured growth in revenue by 6.6% to $13,448 million. This was primarily driven by increased activity in Utilities, EC&M and Mining, partially offset by lower revenue in Transport and Facilities.

- During the year earnings improved, and group underlying margin was increased by 0.4% to 4.2%.

- Statutory EBIT of $462.2 million was $257.4 million higher than pcp due to higher contributions from Transport, Utilities, Facilities and Mining, but that was partially offset by a lower contribution from EC&M. The full year EBITA result of $532.6 million includes a $17.0 million fair value gain on revaluation of existing interest in the Downer Mouchel joint venture.

- A good improvement was observed in operating cash flow and underlying NPATA which went up by 8% to $630.2 million and by 14.7% to $340.1 illion respectively.

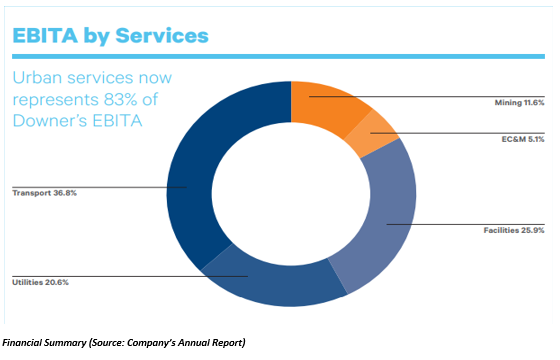

- 83% of EBITA was represented by urban services which include Transport, Utilities and Facilities while the rest 17% was contributed by Mining, Engineering, construction and maintenance.

- Total expenses increased by 4.5% and include a $45m loss due to the provision recognised in relation to Senvionâs scope in the delivery of the Murra Warra wind farm, while the previous corresponding period included $208.1 million of Individually Significant Items.

- During the year, Employee benefits expenses increased by 7.6%, or $306.2 million, to $4.3 billion and represent 35.1% of Downerâs cost base.

- Raw materials and consumables costs decreased by 3.9%, or $85.5 million, to $2.1 billion and represent 17.1% of Downerâs cost base. The decrease is due to the net impact of the divestment of Freight Rail, lower material requirements and the completion of contracts in Mining.

FY19 Balance sheet position

- The net assets of Downer decreased by 4.8% to $3.0 billion, predominantly due to the impact of the adoption of AASB 15 Revenue from Contracts with Customers. This resulted in an opening retained earnings adjustment of $258.0 million.

- Cash and cash equivalents increased by 17.2%, to $710.7 million. This shows the continued strong cash contributions from operations and proceeds from external borrowings drawn. However, this was offset by $78.4 million in relation to business acquisitions, investment in joint ventures and final working capital adjustments on the divestment of Freight Rail in FY18.

- Net debt increased from $940 million in FY18 to $1,012.6 million in FY19 due to the drawdowns made to support business activities, this was however offset by a higher cash position. The increased net debt position, together with a lower equity balance following $258m of adjustments, resulted in an increase in gearing to 24.9% from 22.7% in FY18.

- During the year, Current tax assets decreased by $11.6 million to $57.7 million due to the timing of tax payments while property, plant and equipment increased by $92.9 million to $1,373.3 million, as additional capital expenditure incurred in Transport and Mining exceeded the depreciation expense.

- Depreciation and amortisation decreased by 2.8% or $10.2 million, to $360.0 million and represents 2.9% of Downerâs cost base. This decrease is mainly due to project completion in Mining partially offset by additional amortisation on acquired intangibles following several bolt-on acquisitions and higher amortisation as the business transformation program was completed in 2018.

Division wise revenue

- Transport: Transport includes railroad services, transport infrastructure and rail businesses and comprises of 32.4% of total revenue. Transport revenue decreased by 2.8% to $4.3 billion due to completed infrastructure projects not being fully replaced, the Sydney Growth Trains project nearing completion and the divestment of the Freight Rail business in the prior period.

- Utilities: The company offers a range of services to its customers including renewable energy, gas and power, water and communication sectors and earns 18.7% of the total revenue. The revenue by utilities went up by 25% to $2.5 billion, due to continuing strong contributions from NBN contracts in Australia as well as new renewable energy projects including Numurkah and Beryl solar farms.

- Facilities: Facilities has earned one fourth of the revenue (25.3%) in FY19 operating majorly in Australia and New Zealand. Major services provided by this line includes defence, education, government, healthcare, senior living, sports and venues, resources, leisure and hospitality, airports, industrial, commercial, property, utilities and public private partnerships. During the FY19, revenue from facilities went down by 0.8% due to projects completed and not replaced, but this was offset by the higher building activities in New Zealand.

- Engineering, Construction and Maintenance: This service line has earned 12.7% of the total revenue in FY19, comprising Asset Services and Engineering & Construction businesses and works with customers in the public and private sectors delivering services including design, engineering, construction, maintenance and ongoing management of critical assets. ECM revenue went up by 23.7% as a result of increased activities from new maintenance contracts, the acquisition of MHPS Plant Services Pty Ltd and new contracts in Mineral Technologies.

- Mining: Mining contractors are serving in more than 50 sites in Australia, Papua New Guinea, South America and Southern Africa and has earned 11% of the total revenue in FY19. Mining revenue increased by 8.8% to $1.5 billion mainly due to increased activities at Blackwater and Carrapateena and from the contribution of newly commenced contracts.

Business Achievements:

The company has been awarded by the Australasian Reporting Awards with a Bronze Award for Sustainability Report. The Company was also awarded with âLeadingâ Infrastructure Sustainability the Infrastructure Sustainability Council of Australia. It also expanded the circular economy through acquiring 50% of Repurpose It, which is a waste resource company in Victoria.

Outlook:

The company is targeting NPATA of ~ $365 million for next financial year. The subcontract with the South Australian Government and Celsus is expected to be signed in the first half of the 2020 which includes settlement of historical abatement claims previously disclosed as a contingent liability by Downer and Spotless, a revised KPI and abatement regime designed to better reflect the services provided by Spotless and an increase to Spotlessâ monthly service fee.

Stock Performance:

The stock is currently trading at A$7.810 (2:57 pm, 27 September 2019) which is very close to its 52-week high of A$8.170. The market cap is $4.64 billion with an annual yield of 3.59%. The PE Ratio of the stock is 18.180 and the performance of the stock is increased by 11.91% in past 3 months (As per ASX).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.