The holiday season is here and there are lot of chances that Christmas Rally can be witnessed this year also. There are several justifications for this rally to happen such as the holiday bonuses, sense of optimism and happiness for the New Year.

Investors keep great expectations with the year-end market events during December and beginning of January, expecting the Christmas Rally to deliver good rewards.

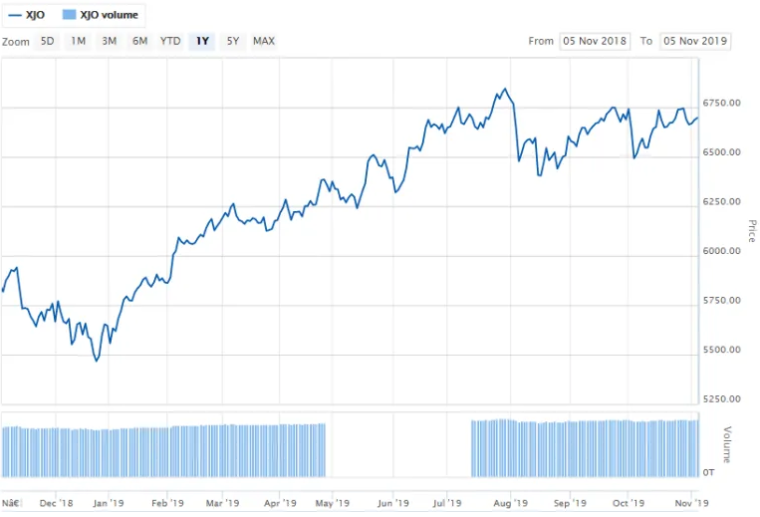

S&P/ASX200 Index Performance in December 2018

S&P/ASX200 last year performance (Source: ASX)

As can be seen the index recorded a decrease during the month of December 2018 but rallied just before the starting of January 2019.

Why does the market perform this way in December?

There are many reasons why the market experiences greater than average increase in stock values. Here are some reasons which have been suggested:

- People are investing in anticipation of the January effect when stocks rise more than usual;

- Mutual fund managers with large stock positions buy a little more in order to drive the price of their holdings up and show better returns for the year;

- Investors are likely to sell for tax loss harvesting before Christmas to ensure that it is done before the end of the year, artificially pushing stocks lower just before Christmas;

- End of year bonuses are given and are invested in the stock markets, boosting prices higher;

- People are in a more optimistic mood as a result of the holidays.

Letâs now discuss four stocks that may be a part of a Santa Rally.

Adairs Limited (ASX: ADH)

Adairs Limited is engaged in the retailing of home furnishing in Australia with a nationwide presence of stores across various formats and a growing online format. The company offers customers a segregated offer, which merges on-trend fashion products, quality staples, strong value and superior in-store customer service.

The Company Completes Acquisition of Mocka Limited

The company has completed the acquisition of Mocka Limited. Earlier the company entered into a binding agreement to do 100% acquisition of Mocka Limited for an enterprise value of NZ$80 million (A$ 75.5 million). The acquisition will be effective from 1st December 2019 and that means the company will account for a 30-week involvement of Mocka in its FY20 results.

Strong Sales Growth Achieved in FY19

During FY19, the company reported strong like for like sales growth of 7.2% across the business, which represents continued health and appeal of both retail store formats and online channels. Transaction volume increased across both online and stores, building on the momentum which was seen in FY18. During the year, the company transformed itself to a market leading omni-channel retailer with online sales growing by 41.7%, which now represents 17% of the total sales. This growth was received as a result of increase in online traffic and an improved conversion rate.

Key P&L Metrics (Source: Company Reports)

Stock Performance

The stock of ADH closed the dayâs trading at $2.300 per share on 20th December 2019, flat with respect to its previous closing price. The company has a market capitalisation of $388.88 million as on 20th December 2019 with an annual dividend yield of 6.3%. The total outstanding shares of the company stood at 169.08 million. The stock has given a total return of 28.13% and 26.37% in the time period of 3 months and 6 months, respectively.

Baby Bunting Group Limited (ASX: BBN)

Baby Bunting Group Limited is Australiaâs largest speciality retailer of baby goods, primarily serving to parents-to-be and parents with children from new-born to toddlers. The key products of the company are cots and nursery furniture, prams, toys, car safety kits, babywear, nappies and related products.

The Companyâs on a Right Track to Deliver Solid Performance in FY20

The company had a solid start for the year, and it is in track to deliver its FY20 guidance. The company reported comparable-store sales growth of 3.1% on YTD basis, which reflects the cycling of the unusual trading conditions in Q1FY19 as a result of the closure of Babies R Us and clearance activity of some high-end cots and prams in September 2018.

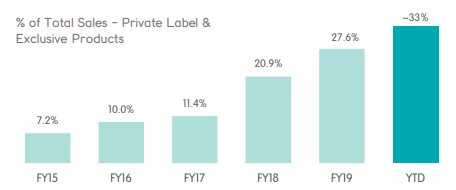

Baby Bunting reported gross margins of 36.6% in Q1FY20, up by 270 bps on the prior period, which is due to growth in private label and exclusive products range and fewer clearance activities relative to the prior period.

The company had a strong balance sheet by the end of the year with net cash of $2.7 million, and it also declared fully franked dividend of 8.4 cents per share, which was an increase from 5.3 cents per share in the prior year.

Private Label and Exclusive Products (Source: Company Reports)

Outlook for FY20

Companyâs FY20 outlook remains unchanged and the pro forma NPAT is expected to be between $20 million and $22 million, and EBITDA is expected to be in the between $34 million and $37 million. The comparable store sales growth to be mid-single digits for the year and full-year gross margin to progress in line with YTD performance and exceed 36% in FY20.

Stock Performance

The stock of BBN closed the dayâs trading at $3.460 per share on 20th December 2019, flat compared to its previous closing price. The company has a market capitalisation of $441.37 million as on 20th December 2019 with an annual dividend yield of 2.43%. The total outstanding shares of the company stood at 127.56 million. The stock has given a total return of 0.87% and 53.78% in the time period of 3 months and 6 months, respectively.

Lovisa Holdings Limited (ASX: LOV)

Lovisa Holdings Limited is engaged in the business of retail sales of fashion jewellery and accessories and it has 390 retail stores, which includes 36 franchise stores.

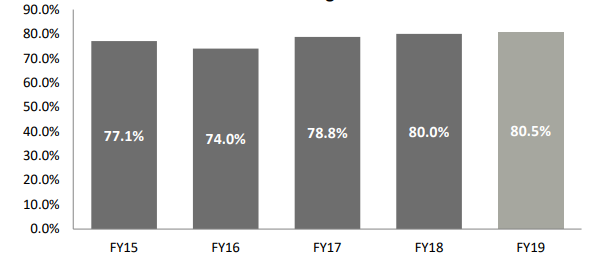

FY19 was a good year for LOV. The company reported revenue of $250 million, up 15.3% due to increase in store rollout. The company maintained its gross margins during the year, up 50 bps to 80.5%. USA and Europe region saw the major growth in revenues up by 1,146.8% and 105.1% respectively, mainly because of store additions.

Gross Margins (Source: Company Reports)

Outlook for FY20

The company is focused on store addition in and expects to increase the number of stores in FY20. Thirty-one new stores are added already, making the total number of stores to 421. Company will continue to invest in support structures, particularly in the USA, to support growth in store network and will help in expanding its business.

Stock Performance

The stock of LOV closed the dayâs trading at $12.220 per share on 20th December 2019, down by 0.163% from its previous closing price. The company has a market capitalisation of $1.29 billion as on 20th December 2019 with an annual dividend yield of 2.7%. The total outstanding shares of the company stood at 105.77 million. The stock has given a total return of -3.47% and 6.43% in the time period of 3 months and 6 months, respectively.

Beacon Lighting Group Limited (ASX: BLX)

Beacon Lighting Group Limited is involved in the retailing of ceiling fans, globes, energy efficient products and light fittings in the Australian market.

The Company Sold its Brisbane Distribution Centre

Recently, the company announced that it has sold its Brisbane Distribution Centre and dissolved its Beacon Energy Solutions business. The winding up of businesses will provide strategic realignment of resources and will also generate additional working capital for future opportunities. Under a sale and leaseback arrangement, the company sold Brisbane Distribution Centre for $28 million to Charter Hall. The company entered with Charter Hall a lease for an initial period of 8 years with three further five-year options on a yield of 5.38%.

Stock Performance

The stock of BLX closed the dayâs trading at $1.240 per share on 20th December 2019, down by 3.125% from its previous closing price. The company has a market capitalisation of $281.86 million as on 20th December 2019 with an annual dividend yield of 3.55%. The total outstanding shares of the company stood at 220.2 million. The stock has given a total return of 12.28% and 6.22% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.