Platinum Capital Limited

Platinum Capital Limited (ASX:PMC) is an investment manager focusing on international shares, and building a portfolio of listed companies from around the world.

Top 10 Holdings (Source: Company Reports)

[optin-monster-shortcode id="wxhmli4jjedneglg1trq"]The fund has performed better than benchmark, with PMC delivering over 12.5% since inception as compared to MSCI AC World Index returns of 7%. However, during the recent quarter, the Platinum Capital Limited delivered 0.1% returns as compared to MSCI AC World Index returns of 4.4%. This pressure could be attributed to the repricing of companies in Asia and the emerging markets in general. Tightening of credit causes hurt the valuations.

For the month of July 2018, the unaudited pre-tax net tangible asset (pre-tax NTA) backing per share of Platinum Capital Limited (PMC) reached $1.7497 as compared to 30 June 2018 at $1.7495. The unaudited post-tax net tangible asset (post-tax NTA) backing per share reached $1.6460 from $1.6457 in 30 June 2018. However, the group sees that the Asian markets have adjusted to the new scenario and intends to leverage the attractive valuations of certain Asian markets. The group forecasts upward price spikes as the fear around the trade disputes is decreasing. The group is also maintaining shorts on the most aggressively priced segments of markets. PMC stock generated over 13.33% returns in the last one year (as of August 13, 2018) and has a solid 5.18% dividend yield while trading at an attractive P/E.

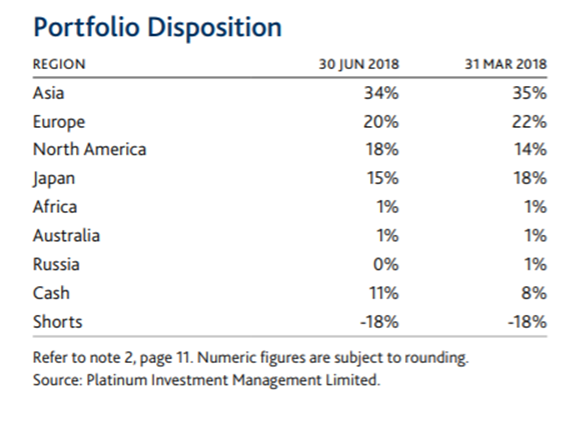

Portfolio Disposition (Source: Company Reports)

MFF Capital investments Limited

MFF Capital Investments Limited (ASX:MFF) holds a at least 20 listed international and Australian companies. The fund built a portfolio of firms with lucrative business at discounts to their intrinsic values. MFF monthly NTA per share reached $2.850 pre-tax as at 31 July 2018 as compared to $2.762 pretax in 30 June 2018 and $2.355 after providing for tax. On the other hand, MFF is subject to a major tax payment during 2018/19, which comprises $23.31 million current tax liability, while a 2019 instalment of $1.4 million was paid in July and subsequent instalments through the year.

Meanwhile, for the firmâs net assets rose by $285,057,000 as of June 2018 driven by market price movements for their investment portfolio coupled with proceeds from the exercise of MFF 2017 Options during the year. This led to a higher pre-tax net tangible assets (NTA) of $2.762 per ordinary share (before net tax liabilities of $0.473) as at 30 June 2018 from $2.324 per ordinary share (before net tax liabilities of $0.354) as at 30 June 2017. Post-tax NTA Â rose to $2.289 per ordinary share as at 30 June 2018 from $1.970 per ordinary share as at 30 June 2017. The group reported a fully franked dividend of 1.5 cents per share, which would be paid in November 2018.

WAM Microcap Limited

WAM Microcap Limited (ASX:WMI) is an investment firm managed by Wilson Asset Management, wherein investors could leverage the portfolio of undervalued growth companies. The group increased its listed equities portfolio to 81.6% as of June 2018 as compared to 76.1% in May 2018. The firm paid a maiden fully franked interim dividend of 2.0 cents per share to shareholders in April 2018. WMI Investment Portfolio outperformed S&P/ASX Small Ordinaries Accumulation Index since inception with WMI Investment Portfolio delivering over 31.2% returns since inception against S&P/ASX Small Ordinaries Accumulation Index returns of over 31.2%. WMI Investment Portfolio generated over 2.2% returns in the last one month (as of June 2018) as compared to S&P/ASX Small Ordinaries Accumulation Index returns of over 1.1%.

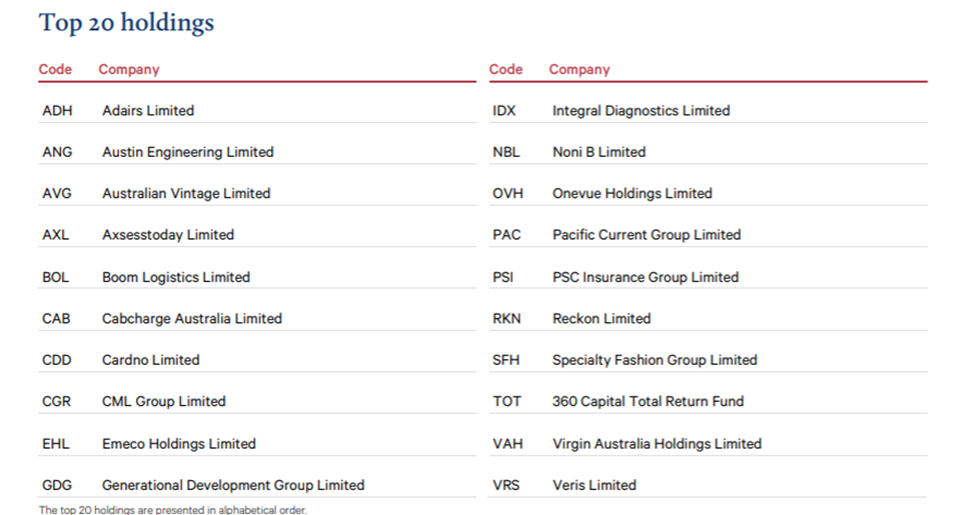

Top 20 holdings (Source: Company reports)

WAM Microcap (ASX:WMI) has been consolidating this year, generating only 0.7% returns (as of August 13, 2018) while one year returns have been decent.

Challenger Ltd

Challenger Ltd (ASX:CGF) is an investment management firm managing $79 billion in assets, which focus on clients with financial security for retirement. The business comprises a fiduciary Funds Management division and an APRA-regulated Life division.

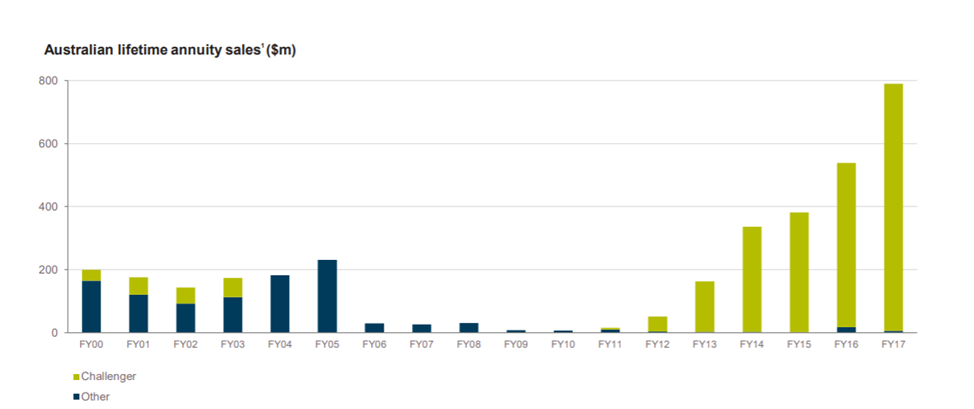

Major player in annuity space (Source: Company reports)

The target market opportunity for the group looks lucrative as Federal Budget on 8th May 2018 stated that the retirement phase of the superannuation system is currently under-developed. There is limited availability and take-up of products that manage the risks people face in retirement, in particular the risk of outliving their savings. These new rules would offer the industry with the confidence and stability to develop innovative products that could help retirees manage the risk of outliving their income. The group is well positioned to leverage this opportunity as they are a leading Australian annuities provider with Annuity sales rising at a 17% CAGR in last 5 years. The group continues to diversify product range and customer base in Life products which reported an FY18 YTD book growth of over 13% . COE margin varies by product on the back of the asset backing , funding cost incurred  and treatment of distribution costs. The group forecasts All product categories ROE of 18%. The group continues to add to its capability by adding new managers, strategies and building geographic footprint.

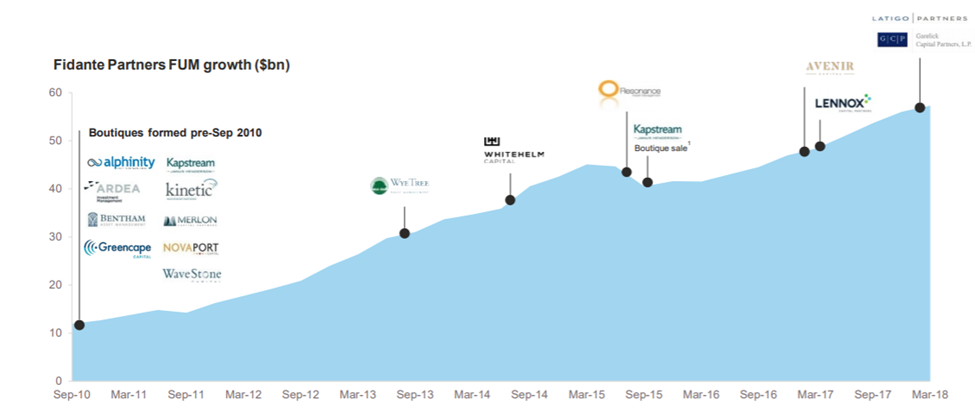

Expanding capability (Source: Company reports)

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.