Introduction to Travel and Tourism

A travel agency is a private retailer or public service which provides travel, tourism and related services on behalf of suppliers belonging to airlines, railways, car rentals, cruise lines, hotels, travel insurance and package tours.

Tourism is a fast-growing industry and is a set of all business activities which provides end-to-end facilities to tourists travelling to a destination as per their requirement. This industry aims to provide the best and hassle-free travelling experience and operates by associating with various other related industries, to meet tourist requirements as per their specification, budget and duration.

In this article, we would look at one of the largest travel agency group in the world and decipher the reasons that have brought it under limelight.

Flight Centre Travel Group (ASX: FLT)

Company Overview

Flight Centre Travel Group (ASX: FLT) ranks amongst the biggest travel agency groups in the world. It has company-owned processes located in 23 countries along with a corporate travel management network that covers over ninety nations. More than 19,000 people work for the company across the globe and FLT has an overall of 2,800 businesses.

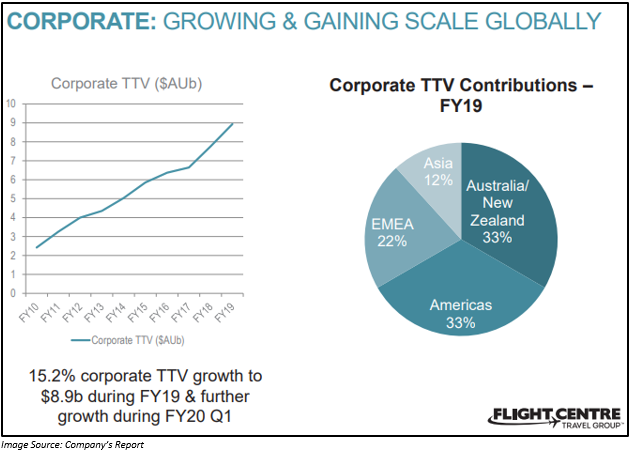

The company operates in three key areas which include leisure, corporate & in-destination travel experiences which is now known by the name The Travel Group or TTG. The leisure & corporate businesses of the company are in regions of Australia/NZ, Americas, EMEA & Asia.

Recent Development:

Q1 FY2020 Highlights:

On 9 October 2019, Flight Centre Travel Group reported robust growth in the online leisure sales in Australia during Q1 FY2020. The online leisure sales in the country doubled in the past 3 months to 30 September 2019 in spite the difficult trading environment. FLT generated $1.3 billion in total transaction value (TTV) from around the world via its leisure branded websites and online travel agency (OTA) brands.

The above details were also presented by Managing Director Graham Turner in a presentation at the Morgans Queensland conference.

In the presentation, Mr Turner highlighted that the total transaction value continued to rise strongly during the quarter across the group. There was also a growth in the new as well as the emerging leisure travel models in Australia.

The e-commerce business of the company which comprises of Jetmax OTAs, BYOjet and Aunt Betty, along with flightcentre.com.au generated over $250 million in the total transaction value in Australia during the quarter (Q1 FY2020). The Aunt Betty and BYOjet businesses of the company collectively reported a 140% rise in TTV in Australia.

Moreover, flightcentre.com.au removed its online booking fees in the later parts of FY2019, delivering a growth of 65% in TTV during the quarter. The growth in this business unit was catalysed by the growth in domestic travellers who were new to this brand.

In the corporate travel segment, FLT expanded at a faster rate in the recent years. With this, the company has been able to position itself amongst the largest corporate travel managers in the world. In Q1 FY2020, the company continued to perform well in this segment.

Mr Turner, in the Morgans Queensland conference, stated that Europe would be the future growth driver for the corporate business, due to the growing presence of the company on the continent. He also stated that Europe is amongst some of the largest corporate travel markets in the world. The company has its businesses in important countries like France, Germany, Finland, the Netherlands, Sweden, Switzerland, Denmark as well as Norway.

FY2019 Highlights:

- FLT, during FY2019 reported a total transaction value of $23.7 billion. The underlying profit before tax for the period was $343.1million.

- The companyâs performance was outstanding in the corporate travel sector internationally.

- The companyâs international businesses delivered a record contribution. From America, the business generated a net profit before tax of $100 million.

- The company declared a fully franked dividend of $3.07 per share.

Outlook:

Although Q1 FY2020 witnessed strong growth in TTV, the company expects its underlying profit to be below its previous corresponding period during 1H FY2020. Stabilisation is expected during Q2 FY2020 after a tough Q1 FY2020.

Contributing factors:

- In FY2019, the company noted a strong result in its initial four months of FY2019. The trading conditions and results were impacted in Australia, especially in the leisure business during November and December 2018 and stayed subdued.

- Apart from Australia, in other geographical locations, the profit growth slowed down.

- In the early FY2020, costs increased as a result of the introduction of the new wage model in October 2018. FLT, (with the new wage model) made a further payment of $4.2million in the form of wages to the leisure salespeople in Australia during Q1 FY2020 and had to bear an increased consultancy cost during the quarter.

- Below expectation profit was seen in its emerging in-destination businesses.

The company experienced a minimal impact of the collapse of Thomas Cook in the UK. The customers of the company were not much impacted by the failure. However, the company expected to incur in the order worth $7 million in costs related with its decision to confirm that clients were re-accommodated and not negatively influenced by the failure of Bentours and Tempo Holidays in Australia. FLT might split these costs from its underlying results of FY2020.

Ignite Travel Groupâs Acquisiton:

On 20 September 2019, FLT pleasingly announced the acquisition of Ignite Travel Group (Ignite), an awarded multi-channelled travel marketing company parent to My Holiday Centre (MHC), RewardsCorp and Holiday Exclusives with fourteen destination-specific brands under the MHC segment. With the acquisition of this business, FLT has strengthened its Australian leisure business.

Stock Information

The shares FLT have generated a decent YTD return of 16.58%. On 10 October 2019, they opened at a price of $40.700, down by $0.97 from its last closing price. At 1:31 PM AEST, the stock quoted $41.720, trading up by 0.12%. FLT has a market capitalisation of $4.21 billion with approximately 101.12 million outstanding shares, an annual dividend yield of 3.79% and a PE ratio of 15.930x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.