Bonds/Debt Securities

Bonds are the kind of fixed income securities issued by the corporations and governments to raise capital in the form of a loan. Investors make a loan to the issuer of the bond, who will pay pre-defined interest on the face value of the bonds, which could be variable as well. Bonds are issued for a stipulated time period, and the issuer repays the principal amount once the tenure of the bond is finished. Bonds are one of the most liquid and popular asset class.

Issuers or Borrowers

Issuers include governments and corporations. The government needs capital to fund its various development, social, environmental obligations. It may use it to build schools, roads, infrastructure, defence capability, research & development.

Corporations may use the capital to fund a variety of objectives, including refinancing of existing debt, mergers & acquisitions, development of additional capacities, purchasing of assets, working capital requirement, project funding and so on.

Investors

Investors may include a range, including pension funds, insurance funds, investment management companies, wealth funds, retail investors, retirement trusts etc. Investors who are looking for a pre-defined source of income prefer bonds, and investors with less risk appetite also prefer bonds.

Fundamentals of Bonds

Face Value: The face value or the par value of the bond refers to the amount of the money to be repaid by the borrower at the end of the tenure of the bond. Bonds may be issued/traded at the discount or premium, but at the time of repayment, the repayment is made at the par value or the face value of the bond.

Coupon Rate: Coupon rate or simply referred to as the interest rate. It is the rate at the which the borrower makes payment of interest to the bondholders. Besides, it is an annual rate, and the payment schedule varies from borrower to borrower.

Coupon Dates: As we mentioned about the payment schedule, coupon dates provide the expected schedule of interest payment to be received by the bondholders. Borrowers may choose to pay interest annually, semi-annually or quarterly.

Maturity Date: Maturity date refers to the date on which the tenure of the bond is completed, and the principal amount gets due to the bondholders.

Secured Bonds: Secured bonds are issued by the company with underlying pledged collateral, and these bonds can push the company into bankruptcy when the obligations are not met by the company. Besides, in the liquidation of the company, these bondholders are paid in priority to every other holder.

Unsecured Bonds: These bonds are issued in the market with no underlying collateral. While the company is liquidated, these bonds are paid after the secured bondholders, and shareholders are paid at last.

Rating: The rating agencies issue bond ratings. These ratings provide an investor with the credibility of the company or any country in case of government bonds. Ratings are assigned to the bonds issued by the borrowers, which ranks the bonds in order of their issuer ratings.

Types of Bonds

Corporate Bonds: Corporate Bonds are issued by companies/corporation to finance their existing commitments. Corporate Bonds have now become one of the main sources of additional capital requirements of the companies.

Government Bonds: These bonds are issued by governments of the countries, and these are popularly known as sovereign debt. Besides, these bonds are generally considered as safe bonds due to the strong credibility of the countries. Governments issue range of bonds maturing from one month to thirty years.

Sub Government Bonds: At times, state governments issue debt to finance their respective projects, development, and these are also called municipal bonds.

Convertible Bonds: These bonds are generally issued by corporations, and unique feature of these type of bonds allows the holder to convert these bonds into the equity share capital of the company upon certain pre-defined terms.

Callable Bonds: Callable bonds provides an option to the company to repay the principal amount of the bond before the end of tenure. Hence, these bonds could be called up by the company after satisfying some pre-defined conditions.

Puttable Bonds: Puttable bonds allow the investors to acquire the principal on an issued bond through the sale of the bond to the borrower. It provides investors with greater flexibility and liquidity on the investments.

Zero-Coupon Bonds: These bonds are issued at a discount so that the investors can profit from the par payments at maturity, which would be at the par value.

Interest Rates & Bond Prices

Interest Rate & Price of the bonds are inversely correlated to each other. Simply speaking, when the interest rate is raised, the price of the bonds falls. Conversely, when there is an interest rate cut, the price of the bond rises.

For Example, if the government issued a 3% bond today, and two years later, the market interest rate is raised by 2%. Hence, the new bonds issued by the government would bear a 5% interest rate. Now the bondholders who bought the same bond two years ago have 3% interest while the newly issued bonds have 5%. In this case, the price of the previously issued bonds would fall to the extent to which it can cover the expected losses on interest variability through the maturity.

Bonds Yields

Bond Yields provides the investors with a realised return on the investment. It is empirical to say that the interest is the return on bonds. When the bond is issued, it carries the coupon rate, which is the bond yield at the time of issue. Sometimes the coupon rate and bond yield can be different, and this happens when the bonds are issued at discount or premium.

As the market prices of bonds keep fluctuating in the secondary market, there could be numerous reasons to the change in price, such as rating upgrade/downgrade, issuer facing liquidity challenges, and the interest rates.

The current yield of the bonds keeps fluctuating attributing to the change in the price of the bond. Similarly, the current yield of the bond can be calculated by dividing the Annual Coupon Payment to the Price of the Bond.

Australia 10-Year Government Bond (Source: Thompson Reuters)

On 02 September 2019, the Australian 10 Year Government Bond closed the session with a yield of 0.935. Besides, the bid for the bond was A$121.267 while ask was A$121.37.

Â

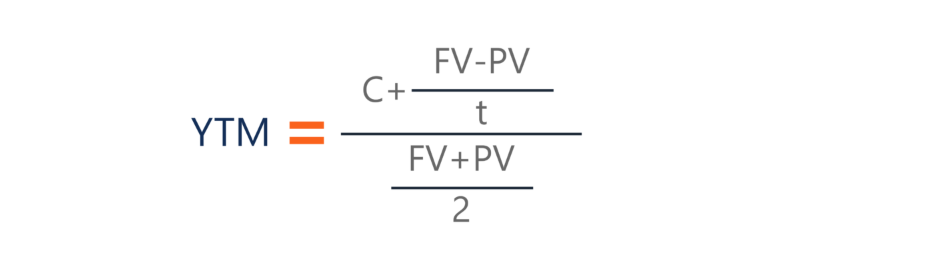

Yield-To-Maturity (YTM)

Yield to maturity provides an investor with the yield of the bond if it is being held till the maturity. So, it can be said that YTM provides the internal rate of return on bonds held till maturity.

The above figure gives the formula for YTM where:

C = Coupon Payment

FV = Face Value

PV = Present Value

T = Time to maturity

Negative Yields

At times, when the prevailing interest rates in the market are at a sub-zero level, and the uncertainty on returns of the other asset classes is very high. In such cases, market players tend to allocate a substantial portion of the portfolio into the safer assets, being safe bonds and precious metals.

With rising demand for government and investment grade credit which mostly trades at premium levels, and the prevailing sub-zero level interest rates result in high optimism around the safer bond markets i.e. government bond & investment grade credit, pushing the prices of these bonds to higher levels and yield on these bonds to negative levels.

Currently, the media has been reporting widely on the negative bond yield market, and it appears quite justified when a total of US$17 trillion was sitting in the negative-yielding bond market by the end of August 2019. Meanwhile, Ray Dalio â Founder, Bridgewater Associates, has pointed out to a probable bond blow off in his latest LinkedIn post. Currently, Germany, Denmark, France, Japan and Switzerland are a few countries with negative Government 10-year yields.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.