To promote economic development, a country needs more investments and production that, in turn, rely on the facilities for savings. These savings need to be channelised to productive resources in the form of investment which makes the role of financial services institutions highly imperative in an economy. Working in the financial sector are well-renowned Australian companies, Netwealth Group and IOOF Holdings that recently published impressive half-yearly results highlighting some notable figures.

Let us glance through the half-yearly performance of these two leading companies that are helping Australian citizens manage their respective finances and secure their future.

Netwealth Group Limited (ASX:NWL)

Netwealth is a technology company, superannuation fund, and an administration business that was established in 1999 to transform the traditional Australian financial services ecosystem. It is also one of the fastest-growing wealth management business in Australia.

The company’s offered financial products include:

- Superannuation, including accumulation and retirement income products.

- Investor directed portfolio services for self-managed super and non-super investments.

- Managed accounts and

- Managed funds.

Through Netwealth’s digital platform developed by its technology team, financial intermediaries and clients are able to invest and manage a wide array of domestic and international products.

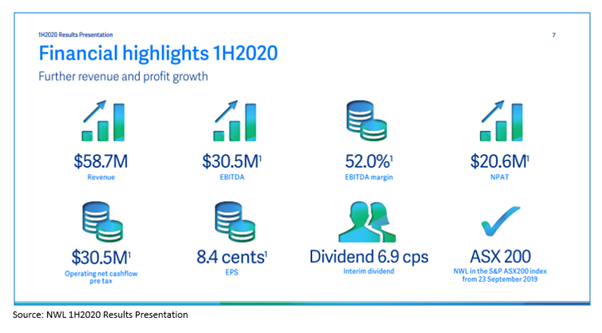

Financial Results 1H 2020: For the half-year ended 31 December 2019, Netwealth announced its results on 18 February 2020. The key Financial highlights are:

- Underlying EBITDA of $30.5 million, depicting an increase of 22.8% over the prior corresponding period (pcp) being 1H 2019.

- Underlying EBITDA margin was recorded at 52%.

- There was a 20.6% increase in the Underlying NPAT to $20.6 million over the pcp. The Underlying NPAT margin was recorded at 35%.

- NPAT was recorded at $20.5 million, up 26.3% on pcp.

- Operating expenses for the period amounted to $28.2 million, reflecting an increase of 20.5% over the pcp and previously advised strategic investment in IT infrastructure, people and software.

- The operating net cash flow (pre-tax) amounted to $30.5 million, and a 100% EBITDA cash conversion ratio for 1H2020 was recorded. It is noteworthy that Netwealth remains debt-free and continues to expense all of its internal IT development costs.

- A fully franked interim dividend of 6.9 cents per share, totalling $16.4 million was also declared by the Board of the Company on 18 February 2020. The dividend is payable on 26 March 2020, and the ex-dividend date is 25 February 2020.

The Business Highlights from the half-year announcement include:

- Funds Under Administration (FUA) of $28.5 million as at 31 December 2019 depicting an increase of $9.5 million (50.2%) over the pcp.

- The FUA net inflows for 1H2020 totalled $4.4 billion, marking an increase of $2.4 billion (124.9% increase) as compared to 1H2019 and $2 billion (81.6% increase) over 2H2019.

- As at 31 December 2019, the Funds Under Management (FUMs) stood at $5.7 billion including Managed Account FUM of $4.4 billion as at 31 December 2020.

- Average Pool Cash as a percentage of FUA of 8.4% for 1H2020, marked a decrease of 7% by the end of half-year, demonstrating higher flows into the Wrap service and Managed Account which typically had lower cash balances, in addition to a positive market movement which increased non-cash asset value.

- A 15% increase in Member Accounts to 75,512; a 13.3% increase in the Financial Intermediaries using the platform to 2,711.

- Member account size also increased to $376,000 (Wrap: $878,000; Super: $201,000) for December 2019.

- A 7% increase in Annualised Platform Revenue per member to $1,564, reflecting continued diversification of revenue streams and utilisation of ancillary services.

Netwealth has accelerated its investment in technology and distribution teams to maintain its scalability and efficiency as growth accelerates in the time to come.

Stock Performance: On 21 February 2020, the NWL stock closed at $8.540, in line with previous day’s close. Netwealth had a market capitalisation of ~$2.03 billion with ~237.69 million shares outstanding. The stock has delivered positive returns of 8.51% YTD and 11.49% in the last six months.

IOOF Holdings Limited (ASX:IFL)

IOOF, established in 1846, is one of the largest groups in the financial services industry, helping Australians to secure their financial future ever since. The company offers advisors and their clients with various services including:

- Provision of Financial Advice services through an extensive network of financial advisers.

- Administration of Portfolio & Estate for advisers and their respective clients along with a significant number of employers across Australia.

- Trustee Services, including estate planning and compensation trust services.

Financial Results 1H2020: Commenting on the half-year gone-by, IOOF CEO, Renato Mota quoted:

The Group’s Funds Under Management, Advice & Administration (FUMA) were up 5.2% at $145.7 billion. The statutory NPAT was recorded at $115.0 million while the underlying NPAT from continuing operations of $56.6 million was in line with guidance.

The CEO also added that the earnings for the period had been impacted by divestments, and there was a reduced economic interest from the ANZ P&I coupon. There was also a boost in associated costs concerning the governance and constant competitive pricing burden.

The total net inflows were recorded at $1.4 billion reflecting continued organic growth, while the cost to income ratio of 57.8 was up 12.1% on 1H2019, demonstrating increased governance costs and the effects of legislative changes. The Portfolio & Estate Administration recorded net inflows of $756 million and Advice $985 million for the half, contrary to the retail industry trend of continued and significant outflows, but a testimony to the competitiveness and appeal of IOOF’s proposition in the market.

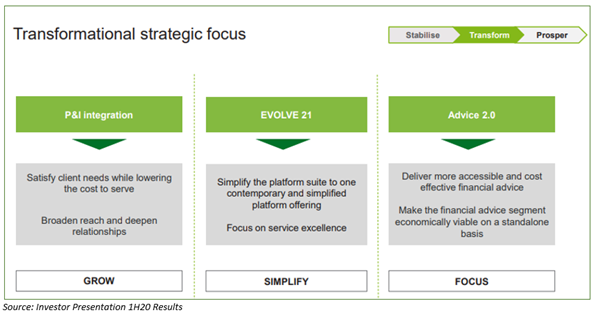

The Group also closed the acquisition of ANZ Pensions & Investments for the revised sale price of $825 million, which was a reduction of $125 million.

An interim dividend of 16 cents per share (fully franked) was declared by the Board for the shareholders.

One of the key Business Highlights from the period was addition of 11 new advice practices to the Advice business in FY20’s second quarter, which witnessed the Advice channel increase FUMA at $76.6 billion, an increase on $985 million, expanding IOOF’s extended scale and reach.

With 1,443 advisers, IOOF is the second-biggest advice business as well as fifth biggest platform provider.

Also, the company got on a transformation program to prioritise, streamline and develop the new IOOF.

Stock Performance: With a market capitalisation of ~$2.49 billion and ~351.08 million shares outstanding as on 21 February 2020, the IFL stock settled the day’s trade at $6.850, a decline of 3.385% compared to the previous day’s close. IFL has delivered an impressive positive return of 38.77% in the last six months.