Australian companies - The Citadel Group Limited, CSG Limited and iSelect Limited have released their full-year results (FY19), while Reckon Limited has released its half-yearly results (H119). Letâs take a detailed look at these companiesâ performance during the reported periods.

The Citadel Group Limited

The Citadel Group Limited (ASX:CGL), a software and technology company that specialises in managing enterprise information in complex environments, released its FY2019 full-year results for the period ended 30 June 2019, on 20 August 2019.

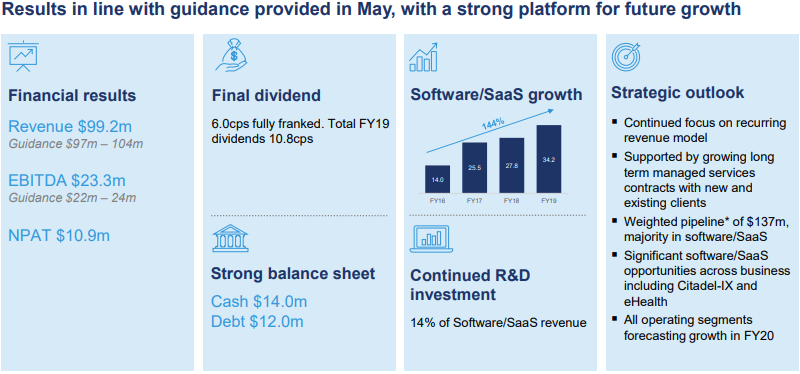

In line with the guidance provided by the company in May 2019 for revenue and EBITDA in the range of $ 97 million to $104 million and $22 million to $24 million, respectively, CGLâs FY19 revenue and EBITDA stood at $ 99.2 million and $ 23.3 million, respectively. The revenue of the company declined by 6.9% year-on-year, while EBITDA fell by 31.7% and NPAT declined by 43.8% to $ 10.9 million. As a result, the companyâs final dividend for the financial year 2019 reported a decline of 33.3% to 6 cents per share. According to the company, financial performance during FY19 was impacted by a delay in extensions for customer-controlled projects in addition to a lower customer spending in the last quarter.

Source: Companyâs Report

Activities:

During the period, the company won contracts across its core verticals which comprise of Knowledge, Health and Technology. The company also released new products which supported the Software/SaaS revenue growth by 23% year-on-year to $ 34.2 million in FY19.

Balance Sheet and Cash Flow Statement:

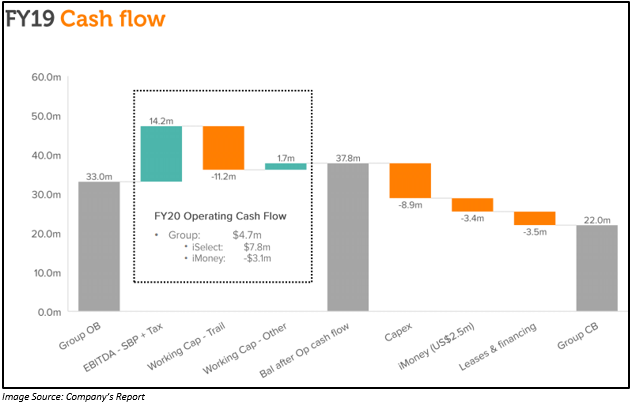

The balance sheet witnessed a slight increase in net assets. The total shareholdersâ equity for the period was $ 86.345 million. The net cash inflow from operating activities declined from $ 20.356 million to $ 14.738 million, while net cash outflow from investing and financing activities was $ 8.698 million and $ 15.853 million, respectively. The net cash available by the end of FY2019 was $ 14.021 million.

Stock Performance:

The shares of CGL have given a negative YTD return of 44.57%. On 21 August 2019 (AEST 03:23 PM), the stock was trading at A$ 3.695, down by 7.161% as compared to its previous closing price. CGL has a market capitalisation of A$ 196.05 million with approximately 49.26 million outstanding shares, an annual dividend yield of 2.17% and a PE ratio of 24.88x.

CSG Limited

CSG Limited (ASX:CSV), a provider of technology and print managed services, on 20 August 2019, released its full-year results for the period ended 30 June 2019. The company reported an increase of 71% year-on-year in underlying EBITDA to $ 17.1 million. However, revenue of the company declined by 3% to $ 217.6 million. Its underlying NPAT for the reported period grew by 148% to $ 5.7 million.

FY2019 Activities:

The company launched the CSG 2021 Program during FY19, which includes new vision, mission, strategy and values. The companyâs is technology momentum is continuing to build, with a 17% increase in subscription revenue as compared to the previous corresponding year. It exited the financial year 2019 with an increase of 17% in monthly recurring revenue to $ 2.5 million.

CSG Limited made some changes in the board as well. Gavin Gomes, who was earlier the Executive General Manager, Canon Australia, as appointed as the companyâs Executive General Manager, Australia. He would be taking care of the operations related to the print and technology in Australia. Meanwhile, the company appointed Harold Melnick as the General Manager, Marketing and Rajarshi Ray as a board member, who would join the board in the first quarter of FY2020.

Balance Sheet and Cash Flow Statement:

The balance sheet registered an improvement in total equity of the company from $ 82.4 million in FY2018 to $ 100.8 million in FY2019. Its operating cash inflows stood at $ 10.4 million in FY2019, while net cash outflow in investing activities was $ 7.8 million and net cash inflow through financing activities was $ 9.7 million. Its net cash and cash equivalents by the end of FY2019 were $ 26.6 million.

Stock Performance:

The shares of CSV have given a YTD return of 12.50%. On 21 August 2019 (AEST 03:25 PM), the stock was trading at A$ 0.185, up 2.778% from its previous closing price. CSV has a market capitalisation of A$ 80.87 million with approximately 449.26 million outstanding shares.

iSelect Limited

iSelect Limited (ASX:ISU) is a provider of online comparison services across insurance, utilities and personal finance products in Australia. On 20 August 2019, the company released its full-year results for the period ended 30 June 2019.

The company during the period made significant improvements to its operational performance as well as position the business towards sustainable growth. The companyâs reported EBIT (including iMoney) reached -$ 2.3 million in FY19, compared with -$ 15.3 million in the same period a year ago. There was a decline of 16% year-on-year in underlying revenue to $ 150.7 million; however, underlying EBITDA grew by 45% to $ 22.9 million in the financial year 2019. Underlying EBIT increased by 77% to $ 15.2 million and underlying NPAT grew by 64% to $ 11.1 million.

The balance sheet of the company remained strong during FY19 with a net cash balance of $ 22 million and zero debt. The company has decided not to pay a final dividend for FY19.

Outlook:

In FY2020, the company would make more investments in technology and marketing, as well as reinvest in its brand. The investments in technology and brand along with the energy reforms and AASB15 would materially impact the companyâs performance in 1H FY2020 vs 1H FY2019.

Stock Performance:

The shares of ISU have given a negative YTD return of 22.37%. On 21 August 2019 (AEST 03:28 PM), the stock was trading at A$ 0.535, down 9.322% from its previous closing price. ISU has a market capitalisation of A$ 130.99 million with approximately 222.01 million outstanding shares.

Reckon Limited

Reckon Limited (ASX: RKN) is a provider of online and desktop accounting software for business of all sizes, accountants, bookkeepers and professionals. On 20 August 2019, the company released its half-yearly results for the period ended 30 June 2019.

The company reported a 4.3% growth in EBITDA despite re-investment in sales and marketing, designed towards opportunities in the respective segments. As a result of strong cash flow during the period, the company was able to reduce its net debt by $ 7 million. The bank facilities also extended for another 3 years. The board declared an interim dividend of 3 cents per share, whose payment would be made on 18 September 2019.

Activities:

The number of cloud users increased during the period by 21% to 62,000. The cloud division is still working on the transitioning of desktop users to the cloud. As a result, it is still be influenced adversely due to the mix impact of a lower ARPU on the cloud products. 46% of the revenue of the company is through the cloud segment. Also, 19,000 users have adopted the new payroll app of the company, which was launched in May 2019.

For Practice Management â Accountants Group, the company reported stabilization following the aborted sale in 2018. Large accounting firms prefer Reckon APS as the product of choice. For this segment, the focus of the company in the second half of 2019 would be to re-establish the growth trends of historical revenues. It reported substantial progress on the development of the new cloud suite.

The legal segment performed strongly during the period and the revenue for this segment grew by 11%, while EBITDA was up by 105%. The scan product continued to demonstrate good potential while driving new sales opportunities.

Stock Performance:

The shares of RKN have given a negative YTD return of 7.46%. On 21 August 2019 (AEST 03:30 PM), the stock was trading at A$ 0.770, up 6.944% from its previous closing price. RKN has a market capitalisation of A$ 81.57 million with approximately 113.29 million outstanding shares and a PE ratio of 10.59.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.