Australia, having a multi-faceted digital economy, is not leaving any bit to further grow itself in the information technology sector. Cashing on the transitional economic conditions and achieving efficiency gains are driving demand for creating opportunities across sectors such as financial services, digital health, agriculture etc.

As per a report by Australian Trade and Investment Commission, “the contribution of digital technologies to the economy of Australia is probable to grow by 75 percent to $139 billion, between 2014 and 2020.”

S&P/ASX 200 Information Technology is treated as a benchmark index for companies in IT space.

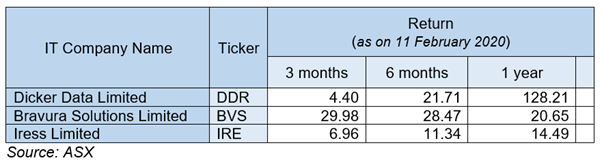

Let’s view three such IT stocks: DDR, BVS and IRE

DDR with skyrocketing dividend growth

Information technology company, Dicker Data Limited (ASX: DDR), has been trading on ASX since 24 January 2011. DDR provides technology software, hardware, IoT and cloud solutions to the clients. The Company has more than 5,000 reseller partners and include major brands such as Cisco, HP etc as its vendors.

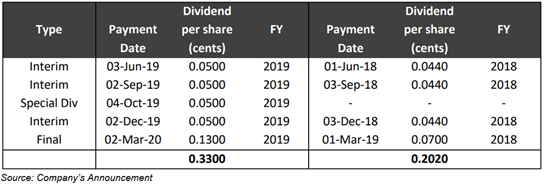

Exponential increase in dividend distribution:

On 10 February 2020, DDR announced dividend distribution for the last quarter of FY 2019 ended on 31 December 2019.

- In FY 2019, the final dividend declared amounts to 13 cents per share which is fully franked.

- Record date and payment date will be 14 February 2020 and 2 March 2020, respectively.

- With the payment of four interim dividends and a special dividend during FY 2019, the total dividend paid for the year amounts to 33 cents per share, which is an increase of 63.4 percent or 12.8 cents per share from the total dividend paid in FY 2018.

DDR becomes a distributor to Cloud Data Management Company:

- On 21 January 2020, Dicker Data announced that it had been appointed by Veeam as a distributor in the Australian market. Veeam business includes providing the backup solutions to deliver Cloud Data Management.

- As an outcome of this agreement, DDR has access to the product portfolio of Veeam. Moreover, DDR can offer new solutions built on existing and new vendor partners in the mid-market customer segments and SMBs.

Stock performance on dividend release date and distributor appointment date:

- On 10 February 2020, the stock of DDR traded at $ 7.16, moving upwards by 8 percent, as compared to its previous closing price.

- On 21 January 2020, the stock of Dicker Data traded at $ 6.96 with no change as compared to its previous closing price. However, a positive return of 2 percent is witnessed on the very next day.

Stock information:

On 12 February 2020, DDR closed at $7.260, having a market capitalisation of nearly $ 1.15 billion. While the 52 weeks low and high price of the stock was noted at $ 3.040 and $ 8.090, respectively.

BVS to release its H1 FY 2020 results:

Bravura Solutions Limited (ASX: BVS) is a software solutions provider, mainly to life insurance, wealth management and funds administration industries. BVS has a team of nearly 1,300 people serving in 12 offices around the globe, including, Africa, Asia, Australia, Europe, New Zealand, United Kingdom

- On 23 August 2019, BVS agreed to acquire Midwinter Financial Services (provider of cloud-based SaaS). The total consideration of the deal was $50 million.

- On 29 October 2019, Bravura Solutions Limited has entered into an agreement to acquire FinoComp for $25 million. Following the acquisition, FinoComp’s software will add additional functionality to BVS and will also create opportunities such as cross- selling, new Wealth Management clients etc.

- On the date of announcement, the stock of BVS delivered a positive return of 5 percent as compared to its previous closing price.

Financial performance for FY 2019, for the period ended 30 June 2019:

- Revenue was $257.7 million, a growth of 16 percent over FY 2018.

- Similarly, EBITDA and NPAT grew by 27 percent to $49.1 million pcp and 21 percent to $32.8 million pcp, respectively.

- Full-year dividend pay-out ratio of 70 percent of Net Profit After Tax.

- Net cash positioned at $194.8 million supports the Company in availing opportunities for inorganic and organic investments.

Stock performance:

On 12 February 2020, the stock of BVS closed at $ 5.40, having a market capitalisation of nearly $ 1.35 billion. While the 52 weeks low and high price of the stock was noted at $ 3.730 and $ 6.27, respectively.

IRE positive attributes:

Technology company, Iress Limited (ASX: IRE) provides software to the financial services industry for trading & market data, investment management, superannuation, mortgages, pensions & life and data intelligence.

New Appointments:

On 23 January 2020, IRE notified the market that they have appointed two non-executive directors, namely Ms Trudy Vonhoff and Mr Michael Dwyer which was effective from 1 February 2020.

Profile of Ms Vonhoff:

- Currently a director of Credit Corp Group (ASX:CCP) and Cuscal Limited.

- She has expertise in retail banking, financial markets and investment for over 20 years, working in companies such as AMP Bank, Ruralco Holdings Limited (RHL.ASX), Tennis NSW and the Westpac Staff Superannuation Fund.

Mr Dwyer’s Profile:

- Currently a director of TCorp (New South Wales Treasury Corporation), the Global Advisory Council of Tobacco Free Portfolios, WSC Group and the Sydney Financial Forum.

- He has expertise in superannuation and investment for more than 35 years, comprising 14 years as CEO of First State Super.

On 6 January 2020, Iress Limited acquired BC Gateways, provider of blockchain communication platform. BC Gateways’ platform provides cost-effective, compliant and automated technology to financial institutions.

Stock performance:

On 12 February 2020, the stock of IRE closed at $ 14.060, having a market capitalisation of nearly $ 2.47 billion. While the 52 weeks low and high price of the stock was noted at $ 11.010 and $ 14.770, respectively.