Airline industry is probably the most impacted sector, experiencing significant financial losses, due to travel restrictions imposed by the Government to stop the spread of infectious disease, Covid-19, and save the lives.

Interesting Read: Coronavirus outbreak: Can the Airline Industry regain the vigour?

Not just the industry, humans are suffering too, since they have also been placed under a lockdown. As per the latest update by the Australian Government, all overseas travel is banned; however, there are few exceptions. For citizens who are presently outside the country and want to come back, the Government has requested them to return when commercial flights are made available. The Government assured that it is working to make flights available for such people.

In order to get Australians home, the Government is working with Qantas and Virgin, and has set up a network of regular flights from major cities like Los Angeles, London, Hong Kong and Auckland.

Many travellers are experiencing challenges because of flights getting cancelled or movement being restricted. In the countries where airlines have suspended their operations, the Australian Government is working with the airline industry and other governments to help Aussies look for ways to return home.

Do Read: Aviation doom deepens as investors embrace realistic facts

In this backdrop, let us discuss few stocks from the airline industry that are listed on ASX.

Virgin Australia Holdings Limited (ASX: VAH)

Virgin Australia Holdings Limited, on 21 April 2020, announced to have entered voluntary administration, targeted towards business recapitalisation and ensuring the Company emerges in a stronger financial position on the other side of the COVID-19 crisis. The move follows continued efforts by the Company towards securing financial assistance from federal and state governments and other number of parties; however, it is yet to obtain the required support.

On 20 April 2020, the Company was under discussion, as its ratings were downgraded by Moody’s and Fitch.

Moody’s Ratings Update: Moody's Investors Service downgraded Virgin Australia Holdings Limited's Corporate Family Rating from B3 to Caa1 and its backed senior unsecured MTN program from Caa1 to Caa2.

The downgraded ratings were influenced by the rapid and broadening spread of the COVID-19 eruption, worsening global economic outlook, declining oil prices, and asset price deteriorations, which are resulting in an extreme and extensive credit shock across various sectors, regions as well as markets. The passenger airline sector is one of the most significantly impacted sectors because of the travel ban imposed by the Australian Government. The collective credit impacts of these developments are unprecedented, and the downgraded ratings of VAH highlight all these.

As per Moody’s estimation, Virgin Australia has ~$900 million worth of unrestricted cash on its balance sheet in the mid of March 2020 and negligible availability under its credit facilities. Further, the airline has no new aircraft deliveries and no significant debt maturities until July 2021 and October 2021, respectively. It also highlighted that because of the considerably low number of bookings, there would be a material cash burn in the short term.

Fitch Ratings Update: Fitch Ratings has also lowered VAH’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from B- to CCC-. The decision was based on growing uncertainties around whether the airline would be able to secure additional funding to ensure that it has enough liquidity while the COVID-19 associated travel bans are in place.

Fitch Ratings highlighted that cancellations and minimal bookings, in addition to outflows at the Company’s loyalty program due to the members exchange points for non-flight benefits, have severely hit Virgin Australia’s working capital. Further, VAH has grounded majority of its fleet to reduce cash burns and simultaneously to look for options to increase liquidity.

Stock Information: The VAH stock last traded at $ 0.086 on 9 April 2020.

Sydney Airport (ASX: SYD)

Sydney Airport, on 20 April 2020, provided an update on its half-year distribution, traffic and liquidity.

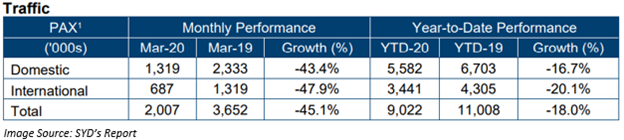

Traffic Update: Total traffic during March 2020 dropped by 45.1% to 2 million passengers as compared to the previous corresponding period. International traffic plunged by 47.9% to 0.7 million while domestic traffic went down by 43.4% to 1.3 million.

Interim 2020 Distribution Update: Considering the present impact of coronavirus along with the ambiguous near-term trading outlook, the board of the Sydney Airport as well as Sydney Airport Trust 1 have decided not to declare a dividend for the six-month period ending 30 June 2020.

Balance sheet & Liquidity Update: The Company has secured $850 million of additional bank debt facilities and has $1.75 billion of undrawn bank facilities, $430 million in available cash, and ~ $600 million of new USPP bond market debt.

Capital Investment Program: Sydney Airport is targeting $150 million to $200 million for the next 12 months from 1 April 2020, under its capital investment program. The focus would be on essential projects that target safety, maintenance as well as asset resilience. Other than this, the Company is likely to take advantage of the terminals, facilities and airfield being mostly dormant, for a range of non-critical projects.

Operating Expenditure Reductions:

- Sydney Airport has implemented various operating cost initiatives, targeting to reduce a minimum of 35 percent in operating costs for the next 12 months from 1 April 2020;

- Directors of Sydney Airport Limited and The Trust Company (Sydney Airport) Limited (TTCSAL) have agreed to decrease their fees by 20 percent for 3 months starting 1 April 2020 up to 30 June 2020;

- Fixed remuneration of the CEO would be trimmed down by 20 percent.

Stock Information: On 21 April 2020 (AEST 02:53 PM), SYD stock was trading at $5.800, down 4.918% from its previous close. SYD has a market cap of $13.78 billion and 2.26 billion outstanding shares.

Qantas Airways Limited (ASX: QAN)

Qantas Airways Limited is engaged in the operation of international & domestic air transportation services, sale of international as well as domestic holiday tours & related support activities.

Minimum Domestic Network: Recently on 16 April 2020, the Company announced that QAN and Jetstar are pleased to help form part of the minimum domestic & regional network backed by the Federal Government, directed towards ensuring communities stay connected and assisting with the movement of critical freight.

Since there is a need to provide essential travel, the flights would offer critical freight capacity, with most of the bellyspace to be used for mail and other critical shipments which include medical equipment.

The number of passenger flights will increase on a weekly basis from 105 to 164. Services will be catered towards capital cities in addition to 36 destinations (regional) with temporary regional network focusing on those towns that are more than two hours’ drive from the main transport hub.

Stock Information: At AEST: 3:00 PM on 21 April 2020, QAN stock was trading at $3.600, up 0.279% from its previous close. QAN has a market cap of $5.35 billion and ~1.49 billion outstanding shares.