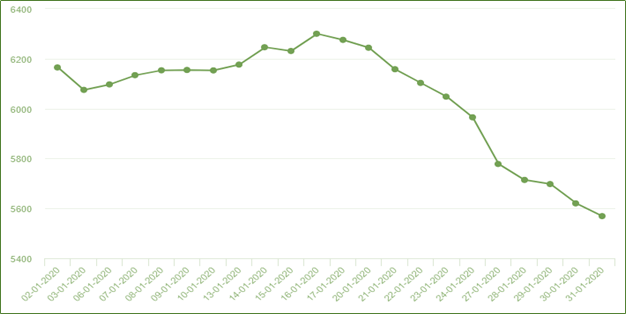

The metal market is witnessing turmoil over the outbreak of Coronavirus in China. The best economic indicator, LME copper price has fallen by ~11.6% from US$ 6,300 per tonne on 16 Jan 2020 to US$ 5,569 per tonne on 31 Jan 2020. The falling copper prices are the testimony to the impact of coronavirus on the global economy since China being the world largest resources trader and houses most of the smelters and refineries.

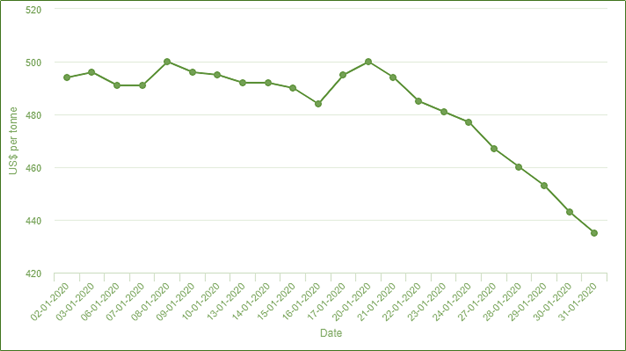

China is the world largest crude steel producer too which also witnessed the dramatic fall. LME Steel HRC FOB China (Argus) price fell by 13% from US$ 500 per tonne on 20 Jan 2020 to US$ 435 per tonne on 31 Jan 2020. The worldwide steel market along with ferrous metal is on halt as the market stakeholder is awaiting the closure of extended lunar new year holiday in China owing to the Coronavirus epidemic.

Coronavirus originated in the city of Wuhan, Hubei province delayed the resumption of metal production post new year as the 24-30 Jan 2020 lunar holiday is extended to 2 Feb and in some region namely Shanghai, Jiangsu and Zhejiang, holidays to prolonged further till 9 Feb 2020. The logistics bottleneck, travel restrictions on workers returning from their hometowns are likely to continue further the lunar holiday leading to the broader effect of the catastrophe on worldwide growth.

Interesting Read: Market Pessimism Grows Stronger Over Coronavirus; Risky Assets Under Pressure, Gold Near Record Peak

Steel: The government has adopted the quarantine program and movement control to prevent the virus from spreading. For the same long-distance public transport and taxis are suspended across many cities. Example, 37 bus lines in the province of Hebei are suspended, including transportation services to major steel-producing cities like Tangshan are halted impacting movement of the labour force to the worksite. Not only roadways but the railway also suspended from operation in many cities of the country.

LME Steel HRC FOB China (ARGUS) Price:

Source: London Metal Exchange

Is the Virus only reason for falling prices?

If we talk about the general scenario during December and January, then most of the construction projects usually remain idle amid the period of winter and worker are often given a month holiday. East China, the hub of significant steel producer, is expected to resume operation post the holiday. Blast furnace operator maintained the crude steel production during the holiday period to keep the output from falling significantly, which might raise the inventories at the end of February or starting March.

Electric Arc Furnace (EAF) maker from scrap material which was closed during the period of holiday and the halt is expected to remain due to the outages, contributes about 10pc in total crude steel production.

And most importantly, Shanghai Futures Exchange (SHFE) is planned to resume trading post-holiday, i.e. after 2 Feb 2020 despite the extension of the holiday.

Good Read: Coronavirus Could Be More Dangerous Than Thought Initially; Outbreak Impacts Global Markets

Therefore, the activities remained, as usual, any calendar year. Then why are the prices falling? Maybe because of the sentiments? What will happen when the market opens post-holiday?

Though the operation is, as usual, the traders are anticipating the primary effect on the prices because of the severe impact on steel demand post-holiday due to the following reasons: -

- Shortage of workers at the plant because of traffic controls and postponement of holidays.

- Construction may not be allowed to resume until further notice by the government in many cities.

- Demand for coil and rebar are expected to fall and the burden to downstream market likely to reflect on steel production.

- Traders are offloading cargoes with coil and rebar due to the falling prices and lower bookings.

- The falling prices remain for iron ore prices are affecting sentiments and may reflect in blast furnace operations if sustained for a few months.

- Not only this but closure of ports such as Caofeidian and Jingtang are also affecting the import and export of iron ores or coking coal and steel respectively. However, restocked ore ahead of the holiday but the resumption of domestic coal mines may delay impacting the sentiments of the people and so do the prices.

Copper: The most sensitive metal to the economy has tumbled by 11.6pc in past 15 days. However, a sight of hope exists as the hub of the copper fabricator, and aluminium downstream factory is present in Guangdong province and not at the Hubei province, an epidemic centered. The investors and traders are eyeing on the region whether the activities resume after a holiday or not.

LME Copper price:

Source: London Metal Exchange

The fear is not limited to metal but the global oil benchmark, Brent crude plunged to US$58.16 on 31 Jan 2020 from US$64.85 on 17 Jan 2020. The falling crude oil prices are the testimony to the Chinese market downturn rippling the effect on the global economy.

The drop in commodity prices has hurt shares in companies that produce oil and mine metal. Shares of BHP Group Limited (ASX: BHP) has fallen by ~7.3% from 20 Jan to 3 Feb 2020, while Fortescue Metals Group Limited (ASX: FMG) has declined by 13.3% between 22 Jan to 3 Feb 2020 and Origin Energy Limited (ASX: ORG) is down 9.3% amid 22 Jan to 3 Feb 2020

Good to know: Australian Shares Shed Wealth Amid Coronavirus Pandemic

Many countries, such as the Middle East and North Africa (MENA) and Europe has halted trading activities. The market is waiting for the evaluation of coronavirus as the cases are visible worldwide. All other instances of the virus have depicted the individual either travelling or staying and studying in China. Few countries reported a fall in the grip of a global epidemic is: -

- England validates two cases of coronavirus in the UK.

- Thailand validates the first case of the spread of the virus through human-to-human.

- Australia confirmed nine cases of the virus.

- The country like Cambodia, France, Finland, Germany, Toronto, Vietnam, UAE and India has validated case of coronavirus.

In the milieu of which countries are banning travelling to China to curb the global outbreak of Coronavirus. For a few examples: -

- Hong Kong announced a 91% reduction in the number of Chinese entering the country.

- Turkish Airlines halt flights back and forth to mainland China till 9 Feb 2020.

- Mongolia is closing all the entry ports from China until 2 March 2020.

- Vietnam introduces a provisional ban on releasing travel visas to Chinese tourists.

Therefore, the anticipated falling demand or prices in steel and copper by the investors and traders are subject to the severity of the coronavirus epidemic.