Geo-political tensions due to ongoing trade war is expected to slow the global growth. Low demand and consumption have started taking a toll on various commodity prices, especially Copper, which finds huge applications in the economic activity of any country. Few important copper stocks on ASX are KGL Resources Limited (ASX:KGL), Aeon Metals Limited (ASX:AML), Aeris Resources Limited (ASX:AIS) and MOD Resources Limited (ASX:MOD).

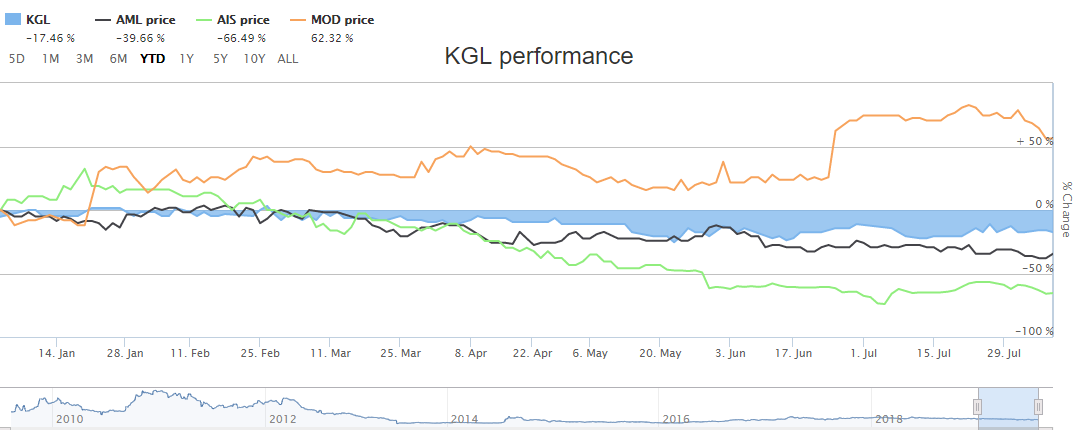

YTD Returns Comparative Performance chart (Source: ASX)

KGL Resources Limited (ASX:KGL)

KGL Resources Limited (ASX:KGL) is involved in the exploration and development of the Jervois multi-metal project in the Northern Territory. The company recently published its June quarterly activities report, wherein it highlighted that the infill drilling at Reward and Rockface delivered some excellent results. The bulk of the intercepted mineralisation is similar to that of the surrounding high-grade holes. This program was designed to increase the Indicated Resource category for copper as the company moves towards eventually establishing a JORC Ore Reserve essential for final project approval. A high-grade intercept just below the proposed open pit floor at Reward adds significant potential value in mine planning.

Drilling of a new conductor at Reward East produced encouraging results. All holes drilled at Reward East and Reward North encountered significant mineralisation and point to a continuity towards the north and east. New areas were explored along the Jervois J-fold, with all holes drilled at Amigo, Krak Ridge, Bellbird and Maâa Salama intercepting mineralisation. Drilling completed during the quarter has sourced sufficient bore water required for the project, overcoming a major potential hurdle in progress towards development.

The focus was on detailed technical studies to support responses to stakeholdersâ queries and preparation of the EIS supplementary report which was lodged last Friday. The Northern Territory Environmental Protection Authority (NTEPA) will now review the supplementary report and, subject to no further queries, provide an Assessment Report to the appropriate government department.

The company spent A$3.47 million on exploration and evaluation during the June quarter with A$3.7 million operating cash outflow. The cash and cash equivalents at the end of the quarter stood at A$11.48 million.

On 9th August, KGL settled the dayâs trade at $0.260, with the market cap of ~$74.35 Mn. It reported 52-week high and low of $0.350 and $0.220, respectively, with an annual average volume of 68,617 (as per ASX). It has generated negative returns of 21.21% for the last one year and 7.14% for the last three months.

Aeon Metals Limited (ASX:AML)

Aeon Metals Limited (ASX:AML) is involved in the exploration and development of the advanced Walford Creek project. The company recently updated regarding substantial base metals mineralisation in the recent drilling undertaken within the Vardy Resource area. Assays and sections detailed in this ASX release encompass ten drill holes: WFDH425, WFDH426, WFDH430, WFDH431, WFDH432, WFDH433, WFDH440, WFDH441, WFDH442 and WFDH445. They were drilled to test for possible mineralisation on the eastern end of the pit area.

Hamish Collins, Managing Director of Aeon stated that the exploratory drilling shows that the FRF structure and hydrothermal mineral fluids are likely to continue east. The company intends to conduct additional drilling to better define the stratigraphy depths.

The 2019 Walford Creek drilling program commenced on 3 May 2019 with a single drill rig undertaking RC pre-collars. A second rig arrived on site and commenced diamond drilling of those RC pre-collars on 13 May 2019.

Highlights of drilling to-date include:

- 6 RC step-out holes now completed west of Amy Resource boundary with all holes intersecting the PY3 mineralisation.

- Mineralised PY3 now identified over a total distance of approx. 12.5km from eastern end of the currently planned Vardy pit design.

- High-grade intersections within infill resource drilling at Vardy expected to increase Resource volume, grade and confidence levels and potentially extend preliminary open pit dimensions. Best intercept of 37m at 1.27% Cu, 0.17% Co and 41g/t Ag from 285m, including 24m at 1.69% Cu, 0.20% Co and 41g/t Ag from 288m (hole WFDH419 as announced on 26 July 2019).

On August 9, AML settled the dayâs trade at $0.155, down 11.43% with the market cap of ~$673 Mn. Its 52 weeks high low has been noted at $0.385 and $0.155, respectively, with an annual average volume of 182,686 (as per ASX). It has generated negative returns of 46.97% for the last one year and 27.08% for the last three months.

Aeris Resources Limited (ASX:AIS)

Aeris Resources Limited (ASX:AIS) is involved in the production and sale of copper, gold and silver and the exploration for copper. The company recently published diggers and dealers presentation, where it highlighted about Tritton Copper Operations. The FY19 copper production stood at 26,852t, where the initial guidance was of 24,500t. The FY20 copper production guidance is expected to be 24,500t. The existing copper metal inventory includes Ore Reserves of 8.4Mt @1.5% Cu and Mineral Resources of 20.7Mt @ 1.5% Cu.

In the June â19 Quarter report, AIS highlighted that its Cash and receivables stood at $26.6M at quarter end. Production detail from Tritton underground mine and Murrawombie underground mine are as follows:

Tritton Underground Mine (Tritton):

Tritton mine ore production of 307kt was slightly lower compared with the previous quarter (323kt). Copper grades achieved of 1.73%, improved compared to the previous quarter (1.58%).

Murrawombie Underground Mine (Murrawombie):

Murrawombie ore production of 114 kilo tonnes was higher compared to the previous quarter (106 kilo tonnes). Mine grades of 1.98% also improved compared with the previous quarter (1.53%) due to sequencing of the mine plan. A major review of stoping sequence and cut-off grade undertaken this financial year improved the geological understanding and the ability to mine more selectively.

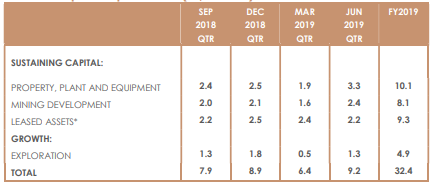

Tritton Capital Expenditure Data (Source: Companyâs Report)

On August 9, RMS settled the dayâs trade at $1.370, down 1.08%, with the market cap of ~$911.15 Mn. Its 52 weeks high and low stand at $1.440 and $0.380, respectively, with an annual average volume of 4,375,741 as per ASX. It has generated an absolute return of 179.80 for the last one year, and 68.90% for the last three months.

MOD Resources Limited (ASX:MOD)

MOD Resources Limited (ASX:MOD) is involved in the exploration of copper and silver in Botswana. In its June Quarterly report, MOD highlighted that it completed the 66-hole resource infill drilling program at T3. Assays continue to deliver impressive results as drilling intersected further high-grade, vein-hosted mineralisation while providing clarity around the up-dip extent of mineralisation within the first two stages of the proposed open pit mine.

On 7 May 2019, the Company announced its growth strategy with the two main objectives being to build additional high-grade mineral resources in the T3 Expansion Project and demonstrate the unique copper-belt scale opportunity of MODâs extensive licence holdings through new discoveries. As part of the growth strategy, drilling re-commenced at T23 Dome, which forms part of a structural zone with several exciting exploration targets, 100km west of T3. Drilling intersected further zones of disseminated copper mineralisation interpreted from shallow depth.

The next phase of drilling at T23 Dome is expected to focus on structural targets which could host high grade vein-hosted mineralisation. Further progress was reported by Botswana Power Corporation on the North West Transmission Grid Connection project, to bring power within 14km of the T3 Copper Project, targeted in early 2020 and should result in significant cost benefits for T3.

The company spent A$2.44 million during the June quarter on exploration and evaluation activities, with operating cash outflow of A$4.57 million. The cash and cash equivalents at the end of the year stood at A$8.3 million.

On August 9, MOD settled the dayâs trade at $0.410, up 2.5%, with the market cap of ~$121.7 Mn. Its 52 weeks high and low stand at $0.522 and $0.207, respectively, with an annual average volume of 2,431,135 (as per ASX). It has generated a return of -16.33% for the last one year and 31.15% for the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.