Copper prices are gaining momentum in the market over the supply shortage seeded by a strike at the BHP Group Limited (ASX: BHP)-operated Escondida Copper Mine in Chile along with an export ban from Indonesia. The ASX-listed copper stocks such as Independence Group NL (ASX:IGO), Castello Copper Limited (ASX: CCZ) and many others are now under the radar of commodity-linked equity investors over the industry anticipated rise in copper prices.

To Know More, Do Read: ASX Copper Stocks Gush Despite ICSG Forecasts For Tepid Copper Demand

Copper futures on COMEX (CME) soared from USD 2.494 per pound (low in September 2019) to USD 2.857 (high in December 2019) per pound, which underpinned a price appreciation of over 14.50 per cent. Apart from copper, gold witnessed a strong rally as well, which eventually elevated the copper exploration during the last quarter of 2019 amid co-existing gold and copper deposits.

The co-existing gold and copper deposits in Australia provided much grin to the miners, and while the gold prices are surging, the ASX copper miners rooted themselves strong to take advantage of the projected prices.

Read: Get Ready to Pay ~2.8k for 24k Gold; Gold Bulls Break the Gated Cage

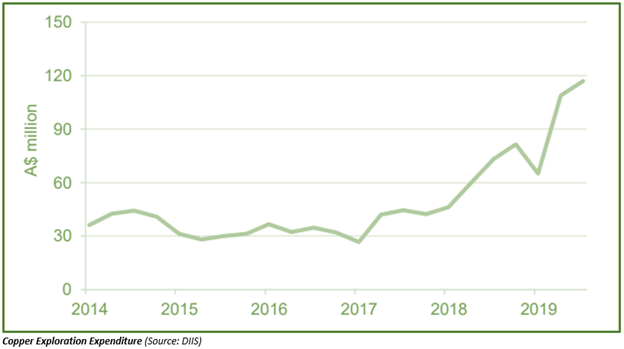

Surmounting Copper Exploration

Australia holds the number two spot when it comes to the export of copper ores and concentrates and the seventh-largest producer of copper across the globe, supported by its high expenditure in the copper exploration activities.

The copper exploration expenditure stood at $117 million in the September 2019 quarter, up by 60 per cent against the previous corresponding period. The golden hub- Western Australia witnessed the highest copper exploration in the recent quarter amid towering gold exploration activities.

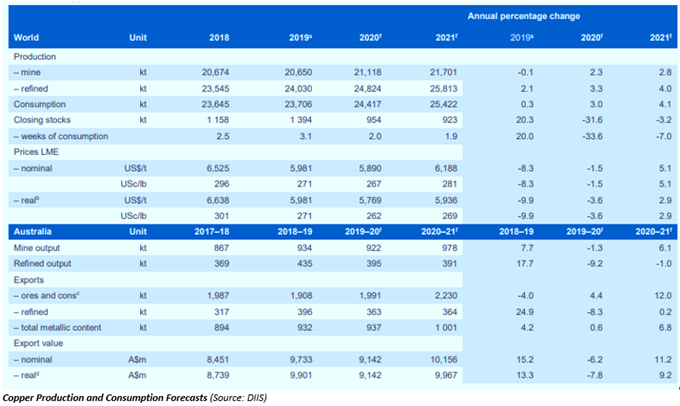

However, despite such high exploration, copper production is anticipated to slightly decline to 922,000 tonnes in 2019-20 over few suspended operations. 2020-21 is expected to witness higher production as few new projects come online to reach 978,000 tonnes.

The OZ Mineral’s (ASX: OZL) operated Carrapateena mine with an annual capacity of 65,000 tonnes in South Australia would contribute to the growth. In the recent events, the bilateral trade dispute between the United States and China had exerted tremendous pressure on copper prices, which further fuelled the closure of some copper projects such as of Metals X’s (ASX: MLX) operated Nifty Copper Mine in Western Australia.

The industry-projected surge in copper prices ahead could prompt the miners to revive the copper-operations again, which is further anticipated by the Department of Industry, Innovation and Science (or DIIS) to support the copper exports ahead.

Global Consumption and Production

Global copper consumption from January 2019 to September 2019 stood at 17 million tonnes, which remained 1.5 per cent lower against the previous corresponding period. The DIIS projects that 2019 copper consumption should be at 24 million tonnes, which remained steady as compared to 2018.

- DIIS Consumption Forecasts

DIIS forecasts the consumption to grow at an annual average rate of 3.6 per cent to stand over 25 million tonnes in 2021, depending upon the level of industrial activity in China. China’s copper consumption growth is expected by industry experts over the government’s stimulus to promote economic growth, which could further propel the copper consumption amid its high utilisation in infrastructure.

- DIIS Global Production Forecasts

The DIIS anticipates the global copper production to end at 21 million tonnes in 2019 and also projects the mine production to increase at an average rate of 2.5 per cent a year to stand at 22 million tonnes in 2021.

What Are Market Actions Suggesting?

HG Futures (Source: Thomson Reuters)

On following the futures contract price actions, it could be witnessed that copper prices are currently moving in contango post the October expiry, which further suggests that at present the storage cost for copper is higher than its convenience yield. However, overall the medium-term the market anticipates the convenience yields to be larger than the storage cost.

To Get Familiar With The Technical Terms Associated With Commodity Futures, Do Read: An Investors’ Guide For Commodity Valuation And Mining Stocks

The market expectations could be further confirmed by the future curve for COMEX copper, which is sharply turning up over the long-term, which suggests a lustrous outlook for copper ahead.

HG Future Curve (Source: Thomson Reuters)

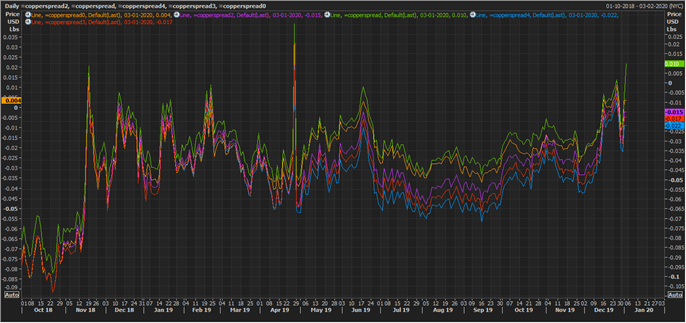

Copper Spread Supporting the Contango

Copper Spread Chart (Source: Thomson Reuters)

The above-presented chart is the futures spread between the current copper futures expiry on COMEX, i.e., Jan 2020 with relative expiry of April 2020 (copperspread0), July 2020 (copperspread), Oct 2020 (copperspread2), December 2020 (copperspread3), and January 2021 (copperspread 4).

It could be inferred from the above chart, that the near-term 3 months expiry is presently trading below the current Jan 2020 expiry, which suggests that copper prices could face short-term headwinds and market is factoring in the recent slowdown in the Caixin Manufacturing Index (China).

The Caixin Manufacturing Index for December 2019 stood at 51.5, which remained below both the market expectation of 51.7 and its previous value of 51.8, which suggested slower expansion in China against the market expectations.

While the current near-term 3-month expiry is showing a positive value, the latter expires are showing a negative value, which suggests that the longer-dated contracts are trading at higher prices, with decent open interest, which could be an indication that buyers are securing delivery at current rate over the anticipation of higher prices in the future ahead.

Key Takeaways

- Copper prices are gaining momentum in the market over the supply shortage.

- ASX-listed copper stocks are now under the radar of commodity-linked equity investors over the industry anticipated rise in copper prices.

- The copper exploration expenditure stood at $117 million in the September 2019 quarter, up by 60 per cent against the previous corresponding period.

- Australia’s copper production is anticipated to slightly decline at 922,000 tonnes in 2019-20 before later increasing 978,000 tonnes in 2021.

- The global copper consumption to grow at an annual average rate of 3.6 per cent to stand over 25 million tonnes in 2021.

- The DIIS projects the global mine production to increase at an average rate of 2.5 per cent a year to stand at 22 million tonnes in 2021.

- Market factors indicating decent medium-to-long-term outlook for copper; however, they are subjective to change with the geopolitical and economic factors.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.