Based in Melbourne, Village Roadshow Limited (ASX: VRL) is a leading entertainment company, boasting a diversified portfolio of assets. Its core businesses include Film Distribution, THEME Parks, Cinema Exhibition, and Marketing Solutions, engaged in providing significant cross-promotional opportunities while targeting a similar customer demographic.

In 1954, Village Roadshow was founded by late Mr. Roc Kirby in Melbourne and the Company got listed on ASX in the year 1988.

VRL is the owner as well as operator of popular theme parks on Queensland's Gold Coast which includes Warner Bros Movie World, Wet'n'Wild Gold Coast, Sea World, Australian Outback Spectacular & Paradise Country, as well as Sea World Resort & Water Park and Village Roadshow Studios. The Company opened the country’s first Topgolf site in June 2018. The Company also has the maximum ownership in Wet'n'Wild Las Vegas.

Let us discuss how the Company performed during the six months to December 2019.

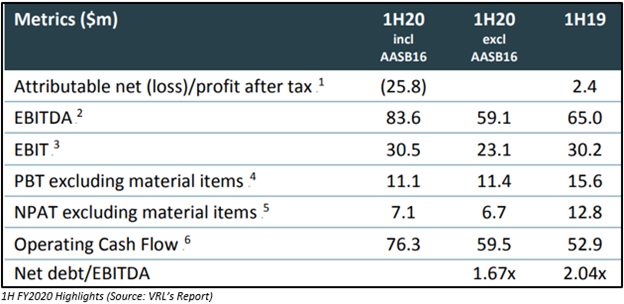

On 21 February 2020, Village Roadshow published its first half performance for the period ended 31 December 2019. VRL highlighted that it adopted the new lease accounting standard from 1 July 2019 and provided the results including and excluding the AASB16 impact.

Revenue for the Company from continuing operations stood at $491.2 million for the current period compared to $530.1 million for the previous corresponding period. VRL reported attributable net profit after tax, excluding material items of income and expense of $7.1 million for the six months to December 2019, compared with $12.8 million in the same period a year ago.

Net cash flows from operating activities was noted at $76.3 million (1H FY2019- $52.9 million), while net cash flows used in investing activities totalled $28.1 million ($22.5 million in pcp) and net cash flows used in financing activities stood at $37.1 million ($39.9 million on pcp).

Cash and cash equivalents at the end of the period (December 2019) reached $73.09 million, compared with $61.65 million at end-June 2019.

Operational Highlights:

- Gold Coast Theme Parks profitability continues to enhance. Ticket sales, ticket yield and attendance registered growth during the six-month period.

- Cinema division was mostly aligned with the previous year.

- The Company maintained a solid balance sheet, with net debt lowered from $219.6 mn to $198.4 mn.

- Leverage improved from 1.76x at 30 June 2019 to 1.67x at 31 December 2019.

- VRL completed the sale of Edge Loyalty Systems to Blackhawk Network (Australia) on 31 October 2019.

- Remained dedicated to wise capital expenditure.

Let us zoom our lens through Divisional performance during the first half along with the outlook.

Theme Parks: 1H EBITDA Up 7%; Robust Attendance Growth

Theme Parks division delivered a solid 1H FY2020 result, with more than 7% growth in EBITDA to $42.5 mn as compared to the previous corresponding year. The growth in EBITDA was registered despite the lower than expected revenue recognition on ticket sales which resulted in improved deferred revenue. Additionally, 12% growth in attendance on pcp and 6% increase in ticket yield aided the EBITDA growth.

Gold Coast theme parks continued to derive the rewards of the successful application of a high-yield and value differentiating ticket sales strategy, with solid 1H FY2020 ticket sales & increased ticket revenue.

Outlook of Theme Parks:

Theme Parks division is focused on providing the best guest experience possible. The segment intends to use technology like its Accesso platform to boost the guest experience as well as revenue. Village Roadshow Theme Parks is continuing to work closely with the government to ensure a rigid approach to safety, standardised against the top global industry guidelines.

- In 2H FY2020, the division expects to benefit from the recognition of a large percentage of deferred revenue from higher annual pass sales in November and December 2019 prior to the price increase.

- The extreme weather along with the coronavirus eruption is projected to have an adverse impact of ~ $3 mn on 2H FY2020 results.

- Easter school holidays scheduling across the states would give an increased holiday visit window in April while the opening of The Vortex in March at Sea World would also support the earnings in the second half.

Cinema Exhibition: Focusing on Refashioning

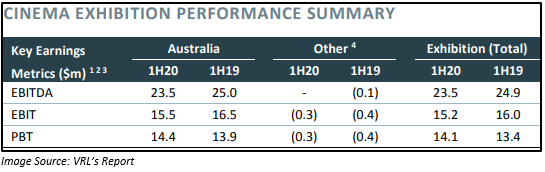

Cinema Exhibition division operates mainly in Australia via a joint venture with Event Hospitality & Entertainment Limited. Box office revenues were in line with prior year, while Rewards loyalty program continues to aid admissions growth and supports steady uplift in Concessions revenue in the Village managed circuit.

Village Cinemas is focused on ‘refashioning for the 2020s’, targeted towards ensuring its cinemas remain a destination of choice.

Cinema Exhibition Outlook:

- FY2020 Australian Box Office is projected to remain in line with FY2019.

- The Company plans an exciting new bar and entertainment concept in the Knox cinema foyer in the second half.

- M-City Clayton, featuring a ‘taphouse’ style bar, a high-quality craft food and beverage menu, innovative ordering technology and premium seating, and Edmondson Park are due to open in mid-2020 and likely to contribute to earnings in FY2021.

- Multiple Event-managed sites have renovations lined up with lease renewals in upcoming years.

Film Distribution: EBITDA Down to $0.4 mn

This division is engaged in the distribution of theatrical film content to cinemas. In 1H FY2020, the division delivered an EBITDA of $0.4 mn, compared with $8.2 mn in the first half of FY2019. EBIT declined from a profit of $6.5 mn to a loss of $1.5 mn, while PBT declined from $4.7 mn to a loss of $2.9 mn.

Film Distribution – Outlook

In 2H FY2020, the company expects an improvement in results for this division as compared to 1H FY2020. However, the overall FY2020 earnings results would be less than what it was in FY2019.

In the Pay TV window, recently, Roadshow renewed its two-year agreement with Foxtel and has content slates sealed in for 2H FY2020 with its main Television partners.

Marketing Solutions – EBITDA Grows to $4.1 mn

With offices in the UK and the US, the Marketing solutions division is a world leader in sales promotions, focused on handling overall campaigns and rewards. The division also works with some of the biggest brands in the world.

The division registered growth in EBITDA from $1.9 mn in 1H FY2019 to $4.1 mn in 1H FY2020. EBIT improved from $1 mn in 1H FY2019 to $3.4 mn in 1H FY2020, while profit before tax from this division was $2.3 mn.

On 31 October 2019, the company completed the sale of Edge to Blackhawk Network. The earnings from this division include only four months of Edge earnings. From this division, Opia achieved a solid performance in 1H FY2020 with EBITDA boosted by $2.9 mn on the prior year, primarily driven by revenue contribution from new regions like the US and South Africa along with the growing access across various industry divisions.

Marketing Solutions – Outlook

Opia is well placed for expansion after a complete analysis of the business & investments in personnel to boost the business.

Opia is looking for an opportunity to expand its active customer base in the UK and Europe. At the same time, it is also continuing to expand in South Africa and the US.

On 24 February 2020 (AEDT 02:11 PM), the VRL stock was trading at $3.750, with a market capitalisation of $753.38 million. The stock has delivered a 60.17% return in the last six months.