News is doing rounds that Australiaâs largest online motorcycle¸ automotive and marine classifieds business, carsales.com Limited (ASX: CAR) is considering making an offer to purchase the auto trading business of Scout24 valuing 2.3 billion euros. Scout24 is a leading digital marketplaces operator for automobiles and real estate in Germany that has attracted significant interest from private equity firms. There is no certainty that carsales.com will bid for Scout24 or Scout24 will sell its business.

carsales continue to perform strongly, underpinned by its core Australian classifieds businesses and robust international portfolio. The strength of the companyâs Australian business is backed by depth and breadth of its offering to consumers and commercial customers and its market leadership position.

The company continues to deliver on its international growth strategy, with all its global businesses delivering considerable progress in FY19.

carsales Delivered Strong Financial Growth in FY19 in International Market

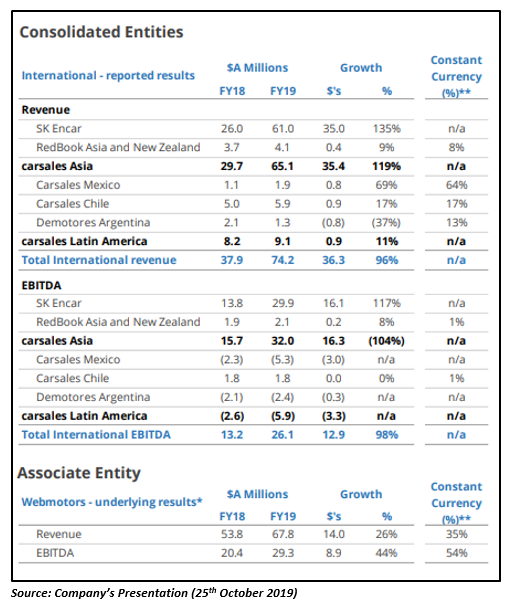

The global presence of carsales is growing significantly, with the company generating sizeable revenue in Korea, Latin America and Brazil. The company recorded a strong international growth in the financial year 2019, with 39 per cent and 29 per cent growth in revenue and EBITDA on the prior corresponding period (pcp). The company noted double digit underlying local currency revenue growth in all its international classifieds businesses.

Korea

The company witnessed good growth across all key revenue channels of SK Encar (South Koreaâs business acquired in January 2018) despite some softness in the South Korean economy during the second half of FY19.

carsalesâ Reported revenue and Reported EBITDA grew by 13 per cent each on pcp in FY19, driven by:

- Increased uptake of premium listing dealer products, particularly the SK Encar Guarantee vehicle inspection service, which has been fuelled by geographic expansion into new branches outside of the key major cities.

- Attaining additional share of media spend from key OEM, finance and insurance clients through a more targeted sales approach, as well as pleasing adoption of the new native display mobile advertising product.

Brazil

The company delivered outstanding financial performance in FY19 as Webmotors consolidated its position as the clear no.1 automotive vertical classified site in Brazil. The Underlying revenue and Underlying EBITDA were 35 per cent and 54 per cent up on pcp, respectively in FY19. Moreover, excellent growth was seen in key operational metrics, including inventory (38 per cent up) and dealer customer numbers (14 per cent up).

The dealer revenue grew by 25 per cent in FY19 as a result of a large increase in dealer numbers and improved yield per dealership. The new âCockpitâ platform for dealers was well received, fuelling dealer revenue.

In addition, there was a significant growth in finance and insurance revenue, particularly driven by the Santander bank integration, which permits seamless credit assessment, including approval into Cockpit. Besides good operating leverage, EBITDA margin also grew from 38 per cent to 43 per cent.

Chile

In Chile, the Reported revenue and Reported EBITDA increased by 17 per cent and 1 per cent, respectively. The revenue growth was majorly driven by dealer volume growth and yield expansion, while the EBITDA margin was impacted by investment in marketing, talent and product innovation.

Argentina and Mexico

The company observed resilient revenue result in Argentina in FY19, recording a 13 per cent growth in Reported revenue, reflecting good growth in dealer and display revenue.

Besides Argentina, the company saw a substantial growth of 64 per cent in Reported revenue in Mexico and pleasing growth in traffic and inventory metrics. The strong revenue growth was majorly driven by dealer acquisition and increased dealer yield. The growth reflected the companyâs marketing investment as well as upside from the continued deployment of its global platform.

Significant Growth Opportunities for carsales in Korea and Brazil

There are substantial growth opportunities for carsales in Korea and Brazil via SK Encar and Webmotors, the two international businesses that particularly recorded solid revenue and earnings growth in FY19.

Opportunities in Korea

- Economic/structural: South Korea is the 12th largest economy of the world having a strong automotive market, a high GDP per capita and good growth prospects over the next decade. carsales is well-positioned to benefit from anticipated migration of advertising expenditure towards online sources in next 2 to 3 years.

- Yield growth: There is significant potential for material yield growth over the next 2-3 years from a combination of price rises and volume growth in promote and inspection services.

- Volume growth: The business has good potential to grow listing volumes through regional expansion and a maturing online automotive sector.

- Display/OEM revenue: Significant medium to long term upside is available from a low base for SK Encar. New mobile and native product releases will drive this growth.

- Dealer and consumer services: There is considerable opportunity to grow the suite of dealer and consumer services (finance products, pricing analysis and appraisal tools and extended warranty services).

Opportunities in Brazil

- Economic/structural: Brazil is the 8th largest economy of the world with robust growth expected over the next decade. The growing purchasing power of an emerging middle class is likely to positively impact the automotive market.

- Competitive position: Webmotors is now the clear number 1 automotive vertical classified site in Brazil, having successfully transitioned to the lead charging model over the past 2 years.

- Dealer acquisition: There is significant scope to grow dealer numbers as Webmotors only has about 55 per cent dealer penetration, with a total addressable market of about 26k dealers in Brazil.

- Commercialising âCockpitâ: Cockpit is a recently deployed automotive CRM product in the early stage of monetisation, that has seen strong customer uptake and use to date.

- Diversifying revenue streams: There is considerable revenue opportunity in Private and OEM segments over the next 5 years, given coming from a relatively low base.

Way Ahead!

carsales has a long-term track record of delivering strong shareholder returns, backed by market leadership and diversification. Moreover, the company is well-placed to continue delivering long term shareholder value through exposure to international growth markets, world-class capability and investment in new products and services.

The company expects to deliver on the following goals in FY20:

- A steady recovery in Australian automotive market conditions across the year, fuelled by an improved lending environment, lower interest rates, recent tax changes and a recovering property sector.

- An improving trajectory is anticipated in the companyâs core Australian dealer and private businesses.

- Growth rates in Brazil and Korea are likely to be similar to FY19.

- Improving profitability is expected in Chilean business.

- Solid growth in Group Revenue, Adjusted EBITDA and Adjusted NPAT is anticipated for FY20.

Stock Performance: CAR is currently trading at $16.415 on the ASX, with a fall of 1.17 per cent (At 3:13 PM AEST on 12th December 2019). The stock has delivered a return of 54 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.