Amidst global trade worries and lower bond returns, investors are flocking to equity market. One such sector gaining interests of market players is Healthcare sector comprising. The sector represents ample lucrative stocks with strong growth prospects.

Factors contributing to the growing investorsâ interest for the healthcare stocks include demographic trends of ageing population, advancement in medical technology, development of precision medicine, competition among health care providers and drug developers & researchers to cater to huge market opportunity to meet unmet medical needs and growing popularity of medicinal cannabis.

Some investors eye popular blue-chip players with successful commercialization in the market. While others intend to tap the potential growth prospects of pharma players engaged in clinical trials, research and development. Investment in healthcare stocks provide a great diversification support to market enthusiasts, while associated risks must be kept in mind. Investors can invest in healthcare service providers, biotechnology players as well as medical device companies.

Let us look at some of the key developments in the Australian healthcare space:

Canadaâs CDPQ co-invests in Healthscope

Caisse de dépôt et placement du Québec (âCDPQâ), Canadaâs leading institutional fund managing company, with net assets worth CAD 326.7 billion (as at 30 June 2019), invests globally in private equity, major financial markets, infrastructure, real estate & private debt. In short, it governs funding mainly for public and parapublic pension as well as insurance plans.

It was recently announced that CDPQ has co-invested $300 mn in Healthscope, supporting Brookfield Business Partners L.P. and its institutional partners. This Canadian Pension fund manager now owns significant minority stake in Healthscope.

Healthscope Limited (ASX: HSO), second largest private Hospital operator in AU, is a multidisciplinary healthcare provider that operates and manages a diverse network of clinics, hospitals, and physicians, dealing in acute care services. Earlier in June 2019, Brookfield took over Healthscope in a $4.4 billion deal.

Executive vice-president & head of private equity at CDPQ, Stephane Etroy stated âthat the Company is extremely happy regarding this unique opportunity to offer support to a world-class healthcare provider, Healthscope, in further extending its acute clinical care offeringsâ.

Existence of CDPQ in Australian Market

CDPQ marked its presence in Australian market by managing and acquiring shares of different groups. Since 2012, CDPQ has been a stockholder of its long-term partner Plenary group and has been investing in various Australian projects operated by this group. In 2016, CDPQ collaborated with a leading Australian insurance distributor Greensone and acquired 44% of its shares. In addition, CDPQ governs 25% and owns 30% shares of the electricity transmission network of NSW; Transgrid and Port of Brisbane, respectively.

Let us know look at two healthcare related stocks trading on the ASX:

Nuheara Limited (ASX:NUH)

First consumer wearable technology company listed on ASX, Nuheara based in Perth, Australia believes in revolutionizing the way of peopleâs hearing. The Company develops life changing, proprietary and multi-functional intelligent hearing aid devices for enhancing peopleâs hearing power as per their personal preferences and facilitating wireless connections to smart devices. Its novel products, IQbudsTM BOOST & IQbudsTM were released in the market in 2016 and are now being sold globally in professional hearing clinics and optical chains & major consumer electronics retailers.

A glimpse at Nuhearaâs FY19 Preliminary Final Report:

- The total revenue generated from ordinary activities dipped by 14% to $4,481,405 compared to previous fiscal year (FY2018: $5,251,960).

- Net loss after tax was recorded $10,027,238, increased by 35% pcp (FY2018: $7,416,412).

- A loss of 1.09 cents per share, compared to a loss of 0.92 cents per share in 2019.

- Cash Reserves as on 30 June 2019 stood at $3,220,079, that excludes $4 million capital raise or acquired from the NUHâs Southern Peru mining assets sale for circa $371,615.

- Zero outstanding debt.

- Increased investment in the evaluation and development of proper sales channel to the healthcare market following the strategic realignment of Nuhearaâs product range with the hearing health care market.

- In FY19, new targeted sales trials were conducted under optical, specialized electronic providers, and an increase in number of independent audiologists.

- Launch of its own Direct-To-Customer sales platform (Nuhearaâs fastest growing sales channel).

- Increased Average Selling Price (ASP) of IQbuds products to $362 for FY19 compared to ASP $242 for FY18)

As per Justin Miller, CEO of Nuheara, the Companyâs growing focus is on its way to reach out to the market. Nuhearaâs longer term objective includes sustainable mass sales.

Stock Performance: Nuhearaâs shares are trading at $0.024, down by 4% (1:11 PM AEST, 3 September 2019) with the market cap of $2 million and nearly 1.06 billion outstanding shares. The company generated a negative return of 64.8% on YTD basis.

CSL Limited (ASX:CSL)

A leading global biopharmaceutical company with one of the largest & fastest-growing protein-based biotechnology businesses, CSL Limited (ASX:CSL) is focused on R&D as well as manufacturing, marketing and distribution of innovative biotherapies and influenza vaccines. It has two main businesses; namely CSL Behring, a leading company dealing in biotherapeutic business with a wide range of quality products and Seqirus, a leading influenza virus company.

FY19 Performance:

The Financial year 2019 has been a great year for CSL limited. Some key highlights are as follows:

- Revenues increased by 11% and profit after tax increased by 17%.

- A strong growth in its core albumin and immunoglobulin and albumin therapies.

- High patients demand for Haegarda and Kcentra products.

- Final dividend of US$1.00 per ordinary share (unfranked), totaling the dividend to US$1.85 per share for 2019.

- Operational cashflow of US$1.6 billion, down 14% on pcp.

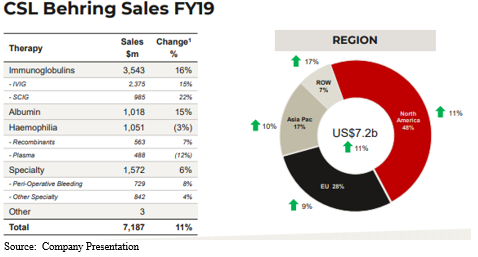

FY19 Performance of CSL Behring:

- Immunoglobulin sales increased by 16% to US$3,543 million.

- Albumin sales grew by 15% to US $1,018.

- Total sales showed a growth of 11% reaching to US$7,187 million

- Regions wise, North America contributed significantly ~ 48% to total sales, an increase by 11 % over last year.

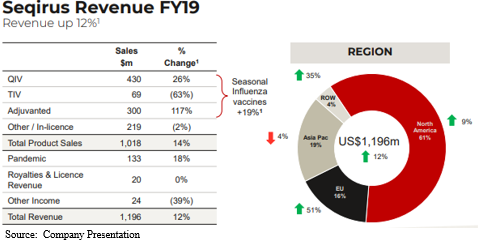

FY19 Performance of Seqirus:

- Total Revenue growth of 12% to US$ 1196.

- Total Product Sales growth of 14%.

CSLâs Outlook for FY2020:

In future, CSL plans for continued development of differentiated plasma-derived & recombinant products on a medium-term basis and novel high margin human health medicines/product development protected by its own IPR.

Stock Performance: CSLâs shares are trading at $240.170, up by 0.133% (as at 1:11 PM AEST, 3 September 2019) with the market cap of $108.71 billion and nearly 453.26 million outstanding shares. The company has generated a 29.38% return on YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.