Mining Sector contributes around 10%1 in Australian GDP whereas its contribution in Countryâs Green House Gas (GHG) emission is around 16%2, which is expected to increase further in FY 2020 due to the upcoming projects and increase in export contributing significantly in Scope 3 emissions. Therefore, it is pertinent to mention that 60% of Australian export market is contributed by the mining sector only.

Climate Change Authority revised the Federal Government GHG reduction target from 26-28% to 45-46% below 2015 level by 2030 after the analysis of the working paper which concluded that the emission reduction target is not adequate to meet the objectives of Paris Agreement.

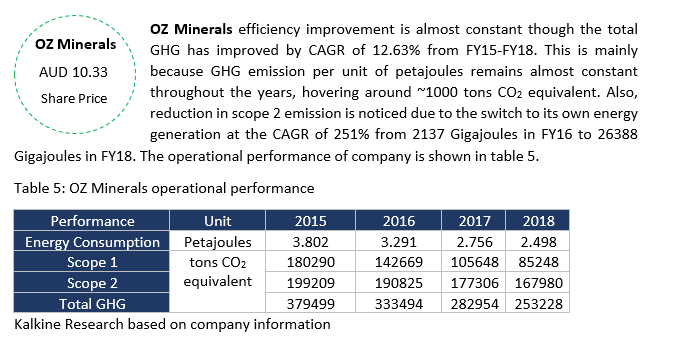

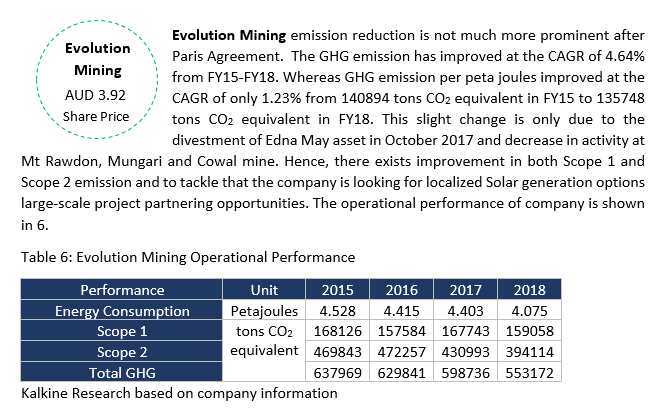

In milieu of this, it is quintessential to understand how the Australian Large Cap or Mid Cap companies are performing vis-Ã -vis their initiatives in Sustainable development.

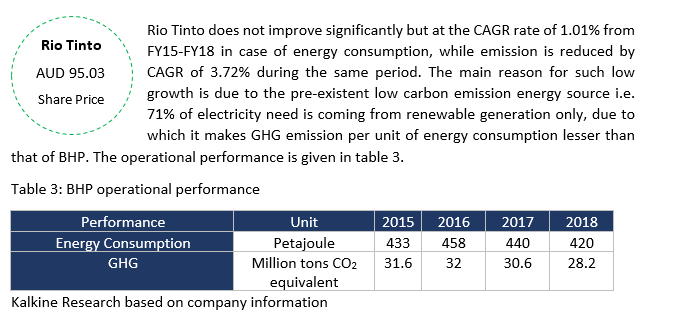

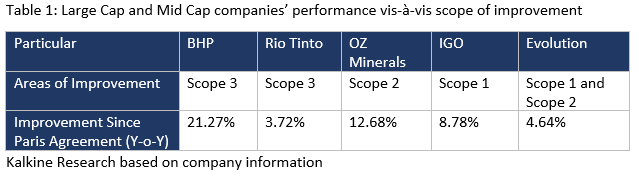

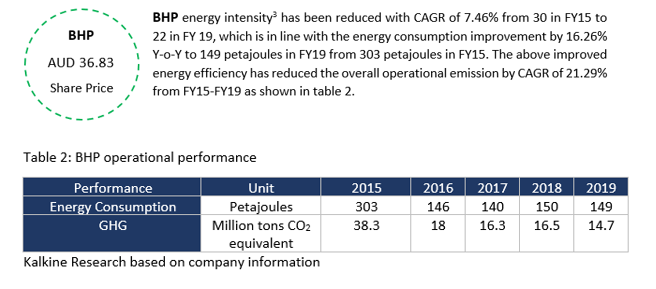

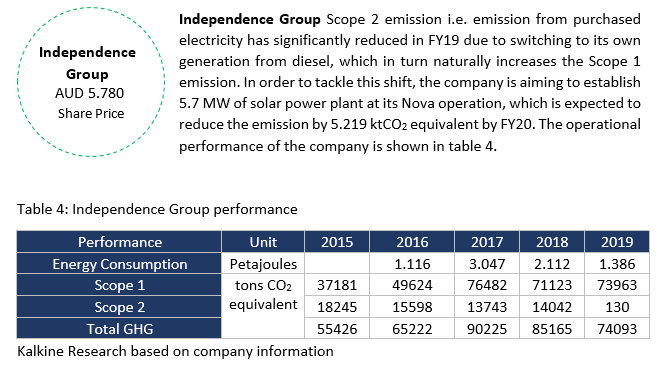

Post Paris Agreement, many companies have worked towards reducing the GHG emission which is quite visible in case of Large Cap or Blue-chip companies like BHP Group Limited (ASX:BHP) and Rio Tinto (ASX:RIO) where scope of improvement in Scope 1 and Scope 2 emission is quite less than the Scope 3 emission which is not directly related to the operational activities of the company. Whereas, Mid Cap companies still need to focus on Scope 1 and Scope 2 improvement.

This is the testimony to the financial strength of the companies. Stronger the financial strength more is the investment in low carbon emission technology. The details of each company are given in subsequent section: -

Currently, scope 3 emission are significantly high at 538 million tons of CO2 equivalent. For the same, the company has started the âSteward Strategyâ initiative in FY20 which will bring all the stakeholders of the company while intending to set the public goal for emission reduction to work towards the common goal.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 1Reserves Bank of Australia - Composition of the Australian Economy Snapshot 2Federal Government Projections 3Gigajoules per ton of copper equivalent production

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.