The S&P/ASX 200 Financials (Sector) (ASX:XFJ), increased by 9.2 points (0.15%) during the day’s trade reaching $6,149.8 on 15 January 2019 (AEDT: 01:21 pm).

In the past one year (till January 15, 2020), the XFJ has increased from around 5681 to around 6149, an increase of roughly 8.24%.

The emergence of fintech companies is currently shaping the financial sector in Australia with its unique offerings to the customers. In less than a decade’s time, we have seen several Australia based fintech companies expanding its services and operations to multiple countries.

The primary factor of technology has propelled the robust growth of these companies in such a short period of time with the special emphasis on customer convenience for payments and purchases

Here we shall discuss three ASX-listed companies and their performance during recent time.

$37 million in Performance Fees for VGI Partners

Being a global equity manager, VGI Partners Limited (ASX:VGI) engages in the management of capital for high net worth individuals, family offices, VGI Partners Global Investments Limited and VGI Partners Asian Investments Limited through its team of 28 investment and operations professionals based in Sydney, New York and Tokyo.

As at 31 December 2019, VGI has $3.1 billion worth of funds under management (FUM) which grew from $2.6 billion at 30 September 2019. VGI believes that the increase in its FUM is influenced by the IPO from VGI Partners Asian Investments Limited (ASX:VG8) that raised around $557 million in mid-November 2019.

Fast forward to 10 January 2020, FUM for VGI had further increased to approximately $3.2 billion as an effect of fund performance. VGI is of the strong view that its global strategy funds are currently above the high watermark.

The performance fee revenue (pre-tax) for performance calculation periods that ended on 31 December 2019 is estimated to be crystallised approximately $4 million and recognised in VGI Partners’ financial report for the six months to 31 December 2019 viz. 2H19.

Net performance fees of $32.8 million reported in 1H19 when combined with the above shall take net performance fees to around $37 million for calendar 2019 (expected fluctuate significantly from period to period).

The performance fee is the fee paid to an asset manager or other investment advisers whose investment decisions help to generate positive returns.

For VGI, Performance fees are recognised in the accounts of VGI Partners Limited on a crystallised basis (typically crystallised at 30 June each year, with a smaller proportion crystallised at 31 December each year); i.e., as and when they become due and payable.

36% Growth in Quarterly Loan Origination for WZR

ASX Listed Fintech company, Wisr Limited (ASX:WZR) is Australia’s first neo-lender which engages in delivering a smarter, fairer and wiser collection of financial products and services with a commitment to the financial wellness of all Australians.

WZR’s reached a milestone of originating $31.6 million of new loans in Q2FY20 (a 36% increase as compared to Q1FY20) with total originations reaching $163.8 million till 31 December 2019.

Source: ASX

The originations for H1FY20 totalled to $54.9 million which represents a 90% increase when compared to H1FY19, and a 35% increase when compared to H2FY19. During the quarter, new funding facility became operational for WZR which approximately triples the average margin when compared to previous loan unit economics.

Wisr CEO, Mr Anthony Nantes commented:

Z1P’s Revenue Up By 24%

One of the prominent industry performer in the digital retail finance and payments, Zip Co Limited (ASX:Z1P) offers POS (point of sale) credit and digital payment services to industries such as retail, education, health and travel. Z1P through its brands namely, Zip Pay, Zip Money and Pocketbook is focused on offering consumer products which are fairly priced.

The company follows a dual revenue model dependent on both retailers and customers, wherein each of them is responsible to bring the other along. This helps Z1P for countering the risk of customer falling into arrears. Z1P generates revenue in the form of interest, monthly fee, or establishment fee though customers and merchant service fee through retailers.

For the quarter ended 31 December 2019 (Q2 FY20), Z1P reported a record 24% increase in its revenues on Q1 FY20 and an increase of 101% on YOY basis. The Company’s quarterly revenue amounted to $38.5 million.

Acquisitions and Strategic Relationships

- Completed the acquisition of global instalment technology platform, PartPay Limited, providing exposure to New Zealand, United Kingdom, United States and South Africa;

- Recently acquired SME lending provider Spotcap ANZ performing well – Zip Biz, now in beta, leveraging its market-leading credit decision making capability;

- Zip struck a strategic relationship with Amazon Australia and successfully launched in November 2019 to become Amazon Australia’s first instalment payment option;

- Ola, Optus, Seafolly, Jax Tyres, Sigma and a number of other household names went live or joined the platform in the quarter;

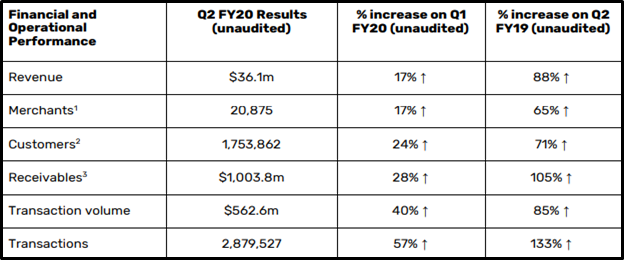

The following table represents continued rapid growth delivered in their underlying operations in key operating metrics, which now incorporates operations in New Zealand and the UK, following the recent PartPay transaction (to acquire PartPay, now Zip NZ), which was approved on 30 October 2019.

Source: ASX

Zip NZ’s Two Months of Operations

Post-acquisition, rebranding to Zip and successfully integrated into the core business, Zip NZ:

- Generated revenue of $0.6 million on the transaction volume of $18.7m from 117k transactions;

- Customer numbers increased to over 165k (with 32k added in the quarter) and merchant numbers grew to 1,100;

- Leading retail brands on the platform include: The Warehouse Group, TheMarket, Spark, Rockshop, Saben and Lighting Plus;

Zip’s merchant base continual expansion to include 20,875 partners who are now accepting Zip across 51,000 points of presence both online and in-store across Australia and New Zealand. The new partners that went live on the platform in the quarter or are currently in integration include Amazon, Optus, Ola, Seafolly, City Chic, Nutrimetics, My House, Sigma, Freddy’s, Jax Tyres, Beginning Boutique, Betta Home Living, Budget Pet Products, mycar (Kmart Tyre & Auto), and Bridgeclimb Sydney.

Zip believes that the company is on track to achieve its financial targets set for FY20 and is:

- Currently annualising at transaction volumes of $2.3 billion for Q2, against a target for EOFY 2020 of $2.2 billion;

- Presently has 1.8 million customers with an active Zip account against an EOFY 2020 global target of 2.5 million;

All Eyes on the Stock Performance (AEDT: 03:51pm)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.