3 Scenarios for making good returns

Qantas Airways Limited (ASX:QAN)

- Proposal to authorise BP, Qantas loyalty scheme

- Address to Shareholders

- Leading into the last GFC

- What to Expect

- Stock Performance

A stock which trades at a lower price in comparison to its fundamental or âfairâ value is said to be a value stock. These stocks may be undervalued for several reasons such as recent modified government regulations which may not be in favour of the company or there might be some transitory problems in the company like that of a succession issue, etc.

Investors grab the opportunity to enter the market with these stocks in order to earn potential capital gains in the future. Growth stocks, no wonder have performed well, but returns have reversed trend in the past year in favour of Value stocks. When investing for long term, it is important to diversify the portfolio in order to realise more stable returns over time. This can be done by combining growth and value stocks, which can create a possibility to earn higher returns with lesser volatility. We know that economies tend to work in cycles, which may favour one set of stocks in a downturn and may benefit others during the boom. This will go some distance in hedging the risk of the portfolio.

Some of the common characteristics for value stocks include low P/E ratio, lower price multiples than the industry median, lesser volatility in the broader market and is more likely to pay dividends to their shareholders. No wonder people want to make money, regardless of their experience in the market and keep trying different strategies in order to create alpha. Investing in stock market is simple but having a surety for returns is definitely not easy. For earning returns and staying in market for a longer period, one needs to have a sensible understanding of the market and capability to do a bit of research.

The returns depend upon the risk-taking capacity of an investor and /her knowledge of fundamental analysis. Making consistent returns is only possible if an investor has sufficient knowledge of estimating the fair value of stocks.

There are some broad guidelines which can be followed and may help the chances of making a decent profit:

- Research: It is always good and important to do a detailed research of the stock while investing. One should always invest in the security he/she knows about, rather than playing the hearing and herding game.

- Understand the Business: Investors usually invest in a stock focusing on its price movements. An ideal strategy is to understand the nuances of the business and the companyâs revenue model, running the idea through an investment frame work and then look at the market prices.

- Realistic Expectations with disciplined approach: It is essential for an investor to have patience at all times as the stock market is volatile. Investor should have the capacity to absorb the inherent risks of investing in stocks and it is important to understand that no single asset class provides unusually high returns for a long period of time.

- Diversification: Keeping all your eggs in the same basket is very risky. As mentioned earlier, it is very important to diversify the portfolio, which will help optimise the risk.

Below mentioned are some scenarios where an investor can make good returns:

Earning it steadily and safely: The most tried and tested way to make the money grow is to invest in a stable portfolio with high investment grade bonds along with stocks of companies with large market capitalisation. This will not provide an immediate high alpha because of low risks but will surely provide consistent returns. If an investor prefers a safe investment with regular returns, bonds can be less risky and suitable.

The World of Derivatives: Investors with high risk appetite might find the first alternative a little unexciting and instead want significant returns when there are fluctuations in the market. For them, the faster way to earning higher returns would be to use options or invest in well-researched penny stocks. But as indicated before, it is important to do the homework and thorough research about call and put options before speculating on any stock.

The contrarian Way: There comes a time when everyone in the market either rushes to buy the stock because of some positive news, resulting in the stock price to skyrocket or sell a particular stock at the same time because everyone wants to cash out. It is crucial to stay disciplined without panicking in the market. It is not recommended to buy junk stocks just because everyone is selling, but to take a rational decision and buy a value stock whose price has declined, because there is over pessimism in the market.

In order to make money from stocks, it is advised to stay invested in the market for longer periods. Good companies tend to grow over time and increase profit growth and hence investors get rewarded with higher returns and capital gains from the resulting higher prices. Staying longer in the market also offers you with an opportunity to collect dividends without selling the underlying assets.

Let us have a look at a stock which is offering consistent returns:

Qantas Airways Limited (ASX: QAN)

Qantas Airways Limited (ASX: QAN) is engaged in air transportation services, the sale of worldwide and domestic holiday tours and associated support activities including catering, information technology, ground handling and engineering and maintenance.

Scheme of loyalty for BP, Qantas: The ACCC has proposed to allow Qantas, BP Australia and BP petrol stations operating independently to take part in the BP Rewards, Qantas Frequent Flyer and Qantas Business Reward programs for a period of five years.

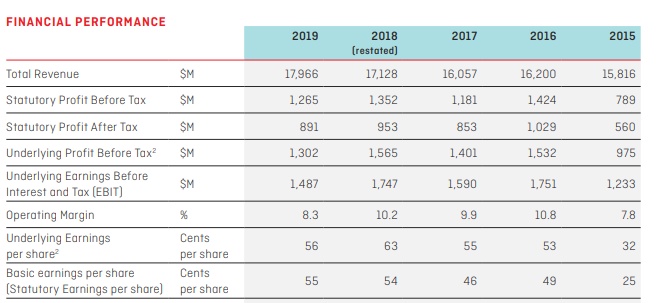

Address to Shareholders: In the recently held annual general meeting of Qantas Airways Limited, the top management of the company stated Jetstar Group will provide on its core promise of low, everyday fares, with nearly two thirds of tickets sold for under $100. In early FY2019, the company launched a $5 million regional grants program to support groups that give much needed assistance to people outside the capital cities and raised $3 million with its customers for drought relief. During the year, the company gave a strong performance with underlying profit before tax of $1.3 billion, despite of higher oil prices. In Financial Year 2019, the company repaid the shareholders another $1 billion through dividends and buybacks.

Financial Performance (Source: Company Reports)

Leading into the last GFC: The company is in a leading domestic position with 2.5x larger Jetstar. The Loyalty business has more than doubled in size and Qantas International and Jetstar International poised to benefit from new aircraft â 787 and A321LR. During the year, Operating cash flow of the company was $700m higher with margin advantage to key competitors. The company also portrayed a strong balance sheet a lower leverage of 2.2x as compared to 2.5x in FY08. The market capitalisation of the company is $10.48 billion, up by $2 billion in FY08. Virgin Group has announced a target 2H20 capacity reduction of approximately 2% vly and Qantas Group continues to refine a profiled position for 2H20, excluding deliberate growth in Western Australia.

What to Expect: The company will focus on operational efficiency, revenue optimisation, customer experience and empowering employees in FY20. The company also gave its long-term outlook for FY24 and is Targeting EBIT margin ~18% in Qantas Domestic, EBIT margin ~22% in Jetstar Domestic and ROIC of over 10% in Qantas International. The company is also investing $50m in Sustainable Aviation Fuels and is expecting Net zero emissions by 2050. It also plans to reduce 100m single-use plastics by the end of 2020 and Reduce waste to landfill by 75% by the end of 2021.

Stock Performance: As per ASX, the stock of Qantas Airways Limited gave a return of over 25.7% in the past one year and a return of 21.84% in the past 3 months. The stock closed at $7.140 as on 22 November 2019 with a market capitalisation at $10.48 billion. In terms of valuation, it is trading at a P/E multiple of 13.08x and is earning a dividend yield of 3.5% annually.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.