With the increasing uncertainties in the international as well as domestic markets, the investors are seeking to diversify their investment portfolios to maintain high yields from domestic market as well as abroad. The below mentioned ASX listed stocks have come up with significant updates recently. Letâs dig deeper into what is new with these stocks.

The below mentioned stocks have come up with significant updates recently. Letâs dig deeper into what is new with these stocks.

Orora Limited (ASX: ORA)

$225 million net gain on sale for ORA

Orora Limited (ASX: ORA) works actively with its customers, spanning over seven countries worldwide, to provide a diverse range of personalised packaging solutions and displays. The company operates under the materials sector and has developed groundbreaking packaging solutions. Ororaâs product range includes glass bottles, aluminium cans, closure and caps, boxes and cartons, point of purchase displays, and many more packaging products.

ORA recently released updates of Annual General Meeting held on 15th October 2019. It also highlighted its financial performance for FY19. Notable highlights from the FY19 are:

- Increase of 4% in the underlying Net Profit After Tax (NPAT) $217 million;

- Increase of 3.7% in the underlying EBIT of $335.2 million;

- Underlying earnings per share 18.0 cents, up 3.7%;

- Sales revenue up 12.1% to $4,761 million;

Taking a step closer to its commitment to be the industry leader, ORA announced the sale of its Australasian Fibre business to Nippon Paper Industries Co., Limited for a consideration $1,720 million with a projected net gain on sale (after tax and transaction related costs) of approximately $225 million.

Orora intends to return most of the net proceeds of $1,200 million to shareholders and expects the completion in early calendar 2020, which is subject to customary conditions for a transaction of this nature comprising of regulatory approvals.

On 17th October 2019, the company's stock was trading at a price of $3.020, with a daily volume of ~2,840,967 and a market capitalisation of approximately $3.63 billion. The stock has a 52 weeks high price of $3.470 and a 52 weeks low price of $2.600 with an average volume (yearly) of ~6,078,913. In the past six months, the companyâs stock has provided 2.03% return.

IMF Bentham Limited (ASX: IMF)

$141 million binding share purchase agreement for IMF

Headquartered in Australia, IMF Bentham Limited (ASX:IMF) is among the leading litigation funders with offices in multiple countries across the globe. The company actively engages in delivering innovative litigation funding solutions and has developed a growing diverse portfolio of litigation funding assets.

The company recently on 15 October announced a trading halt in its stock trading. According to the company report, the stocks shall be at a trading halt until the commencement of normal trading on 17th October 2019 or unless ASX decides otherwise.

On 17 October 2019, IMF Bentham notified the market on the conclusion of the institutional placement along with the institutional component of pro rata accelerated non-renounceable entitlement offer. Both of them obtained a solid support of shareholders, which was followed by an aggregate raising of around $100 million. Further, there would be a launch of fully underwritten retail component of entitlement offer, later this month on 22 October.

IMF also released the Chairmanâs letter wherein he notified that the company is all set to acquire Omni Bridge Holding BV, one among the leading dispute finance businesses of continental Europe. In accordance to it, he extended an offer to the stakeholders to take part in a 1 for 5.8 accelerated non-renounceable pro-rata entitlement offer of New Shares at an offer price of $3.40/New Share in order to raise gross proceeds of $120 million.

The company secretary, Jeremy Sambrook in an Entitlement offer- notification to ineligible stakeholders updated on a fully underwritten institutional placement and an accelerated non-renounceable entitlement offer to raise around $139 million.

In addition to this, the company announced that it has entered into a binding share purchase agreement of up to $141 million in total consideration to acquire Omni Bridgeway, which engages in civil law jurisdictions principally in Continental Europe and Central Asia.

Omni Bridgeway is a leading funder of litigation, arbitration and enforcement proceedings with $55 million of capitalised investments and over $4 billion of claim value under management as of FY18.

The company shall purchase 100% of the issued capital of Omni Bridgeway from six individual shareholders for approximately $141 million in total consideration to be paid as:

- $57 million cash payable upon closing;

- $32 million deferred consideration to be paid or issued in 2 equal instalments over three years;

- $52 million deferred & contingent consideration, to be paid or issued in 5 annual instalments based on Omni Bridgewayâs Performance Milestones.

In the past six months, the companyâs stock has provided 43.18% return. On 17 October 2019, IMF stock is trading at $3.5, slipping by 7.407 percent (at AEST 3:41 PM).

Adelaide Brighton Limited (ASX: ABC)

ABC outperforms the ASX200

As a major producer in the Australian integrated construction materials and lime, Adelaide Brighton Limited (ASX: ABC) produces and supplies a variety of products to the building, construction, infrastructure and mineral processing markets throughout Australia.

The company published its ASX CEO Connect Conference presentation on 15th October 2019 emphasising on key areas of the company and highlighting its performance.

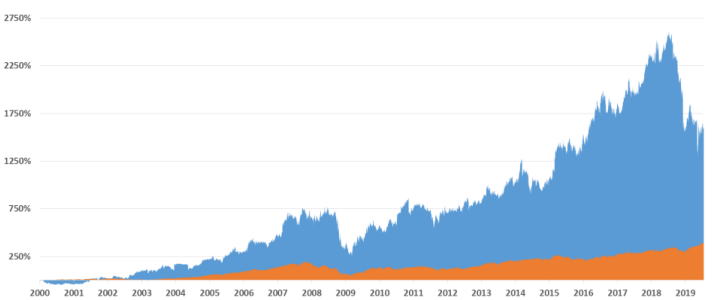

Figure 1 Total Returns from an investment in ABC vs S&P/ASX200 Accum. Index (Source: Companyâs Report)

According to the company, ASX200 has been outperformed by ABC on the grounds of total shareholder return. The graph clearly depicts high growth returns from ABC.

2019 Outlook

- Robust and sustainable business with quality asset base delivering superior returns to shareholders and low-cost production with market-leading position;

- Demand outlook for construction continued softening in residential construction market with an expected inflection point in 2021;

- Demand outlook for mining iron ore and gold expansion to increase demand for cement and lime in WA in the near term and alumina demand for lime to remain stable over the medium term with the potential to increase in the long term;

- Earnings guidance underlying NPAT estimated to be between $120 â $130 million, targeting net cost savings of $10 million for 2020;

On 17th October 2019, the company's stock last traded at a price of $3.09, up by 0.98 percent from tis prior close, with a daily volume of ~ 1,223,216 and a market capitalisation of approximately $1.99 billion. The stock has a 52 weeks high price of $ 5.813 and a 52 weeks low price of $ 2.845 with an (year) average volume of ~2,743,435.

Evolution Mining Limited (ASX: EVN)

Record Group free cash flow for EVN

As a gold mining business, Evolution Mining Limited (ASX: EVN) is an Australian mining company that owns and operates five gold operations in different parts of Australia.

The company recently announced its quarterly report for the period ending 30th September 2019. The highlights for the companyâs quarterly performance are:

- Gold production of 191,967 ounces including record production at Cowal under Evolution ownership of 75,807 ounces;

- Record Group free cash flow of $158.6 million reflecting a 45% increase on prior quarter;

- Net cash position increased to $91.7 million as compared to $35.2 million, as on 30 Jun 2019;

- $102.1 million paid to shareholders as fully franked FY19 final dividend.

According to company reports, the EVNâs FY20 guidance update are as follows:

- Unaffected FY20 gold production guidance at 725,000 â 775,000 ounces;

- AISC guidance increased by $50/oz to $940 â $990/oz which includes $20/oz increase from the impact of revised metal price assumptions on royalties & by-product credits and $30/oz increase due to stability issues in Mt Rawdon pit west wall requiring a revised mine plan.

At the market close on 17th October 2019, the company's stock was at a price of $ 4.175 with a daily volume of ~9,739,671 and a market capitalisation of approximately $ 7.26 billion. The stock has a 52 weeks high price of $ 5.585 and a 52 weeks low price of $ 2.905 with an average volume (year) of ~9,877,971. In the past six months, the companyâs stock has provided 24.85% return.

Newcrest Mining Limited (ASX: NCM)

Approval of 2 stages of Cadia Expansion Project for NCM

Being one of the worldâs largest gold mining company, Newcrest Mining Limited (ASX: NCM) explores, develops and operates gold and copper mines and ensures the safe delivery of greater returns to its stakeholders.

The company lately announced the approval of the execution phase of the first two stages in the Cadia Expansion Project by the company board. With a projected total capital cost of $ 865 million, the two stages of the companyâs project area:

- Stage 1, approved from feasibility study to execution, with a projected capital cost of $685 million includes PC2-3 mine development, materials handling system upgrades, associated infrastructure and the initial works with an aimed increase in plant capacity to 33mtpa;

- Stage 2, in a feasibility study with an estimated capital cost of $180 million includes further plant expansion to 35mtpa and recovery improvements targeting completion in late FY22;

In addition to this, the expected real net present value (NPV) of $1,170 million with an internal rate of return (IRR) of 21.5% and a payback 7.6 years is estimated from both stages of the project.

At the market close on 17th October 2019, the company's stock was at a price of $33.105 with a daily volume of ~ 2,890,569 and a market capitalisation of approximately $25.58 billion. The stock has a 52 weeks high price of $ 38.870 and a 52 weeks low price of $19.640 with an average volume (year) of ~3,282,723. In the past six months, the companyâs stock has provided 34.78% return.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)