Australian Stock Market

Australia is one of the healthy and strong economies across the globe. The country has three major stock exchanges, namely: the Asia-Pacific Stock Exchange, the Australian Securities Exchange Group and the National Stock Exchange of Australia. The stock market in Australia has developed in terms of the market cap, listed companies, volume and value of stock traded and the turnover ratio.

Numerous growing and successful private entities contemplate listing on the Australian Securities Exchange via Initial Public Offerings (IPOs) at some stage in their development cycle to grab new opportunities and expand different verticals of the business by raising funds through various instruments available. The year 2019, witnessed a lot of acquisitions and merger activities, since Australian dollar was softer than before, enticing a lot of foreign investors, as well as the private equity funds cashing up, post growing billions of dollars during the last few years.

ASX profile, Source: ASX

In the last one-month period, some of the stocks on ASX â MTC, IGN, OKU, SM8, VTI have provided a better return when compared to others.

Letâs look at five ASX listed stocks and their recent updates.

MetalsTech Limited (ASX: MTC)

MetalsTech Limited is involved with activities like acquiring, exploring and developing lithium projects in Canadian region.

MetalsTech inks option to acquire Gold Project in Slovakia

On 20 November 2019, the company notified that it has inked an option agreement with Arc Minerals Ltd and Ortac s.r.o to acquire 100 per cent stake in the Sturec Gold Project in Slovakia region. As per the option, MetalsTech has forty-five business days to conclude technical, legal and financial investigation on the project under discussion.

The company has already concluded a substantial amount of desktop technical due diligence on the project. As a part of the transaction, it is also suggested that MTC issue (subject to the receipt of the prior shareholder approval) to approximately 20,000,000 performance rights among directors of the company and Company Secretary as a facilitation fee for the introduction of the project to MTC.

The companyâs Chairman, Mr Russell, commented:

The companyâs financial performance can be read here.

Stock Performance

On 21 November 2019, the stock of MTC settled the dayâs trading session at $0.066, slipping

by 21.429 per cent from its previous close. The company has ~95.45 million shares outstanding and a market cap of $8.02 million. The stock has generated remarkable return of 342.11 per cent in the last six months, while its YTD return is at 180.00 per cent.

Ignite Limited (ASX: IGN)

Ignite is re-imagining talent services, providing specialist recruitment, on-demand talent and outsourced people services designed to ignite potential in this new world. The company has been connecting people with talent services for more than 34 years now and is one of the most established and leading recruitment agencies in Australia. Ignite has more than 120 employees working in 5 cities across Australia and makes sure to determine the best employee and employer connection.

Results of Annual General Meeting

The company announced the results of the Annual General Meeting conducted on 19 November 2019, the resolutions which were passed during AGM were as follows:

- Resolution 1: Adoption of the Remuneration Report

- Resolution 2: Re-election of Mr Fred van der Tang

- Resolution 3: Approval to exempt from Listing Rule 7.1 options issued under the Equity Incentive Plan

Sale of China Business

Recently, on 18 November 2019, the company updated the market that its wholly-owned Hong Kong subsidiary Lloyd Morgan Limited has agreed to sell 100 per cent of Lloyd Morgan Hong Kong Limited, which in turn owns 89 per cent of its China business, Lloyd Morgan China Limited (LMC), to the current China Chief Executive Officer (CEO) of LMC.

Stock Performance

The stock of IGN last traded at a price of $0.054, on 20 November 2019. The company has ~89.58 million shares outstanding and a market cap of $84. million. The stock has generated negative return of 10.00 per cent in the last six months, while its YTD return stands at 5.88 per cent.

Oklo Resources Limited (ASX:OKU)

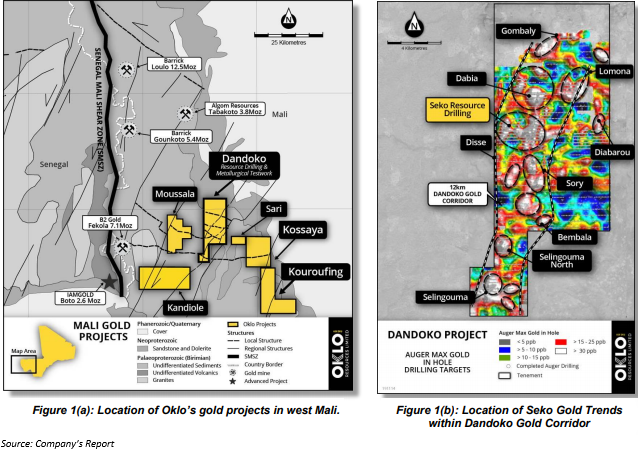

Oklo Resources Limited is an Australian Securities Exchange listed company with offices in Australia and Mali, West Africa. OKU is an exploration company with gold and phosphate projects in Africa. The companyâs management is a blend of technical and financial management skills from metals and mining sector.

Spectacular intersection of 47m at 10.97g/t Gold from Extensive Drilling at Seko

On 20 November 2019, OKU updated the market with the impressive start from Okloâs 10,000m resource drilling program at Seko within its Dandoko Project in west Mali. The program consisting of reverse circulation, diamond core and aircore is the precursor to a maiden Mineral Resource estimate has been planned to be concluded by the initial part of Q2 2020 period.

Also, aircore part of the drilling program aiming at oxide mineralisation has been concluded and the second drill rig is anticipated on site in late November to commence deeper reverse circulation and diamond drilling ahead of an initial Mineral Resource estimate has been planned to be concluded in the beginning of Q2 2020 period.

Stock Performance

On 21 November 2019, the stock of OKU settled the trading session flat at $0.145. The company has ~412.79 million shares outstanding and a market cap of $59.85 million. The stock has generated negative return of 19.44 per cent in the last six months, while its YTD return stands negative at 44.23 per cent.

Smart Marine Systems Limited (ASX:SM8)

Smart Marine Systems Limited, founded in 2011, is a marine technology solutions company based in Western Australia. The company has created, and commercialised award-winning patented marine products and services.

September Quarterly Activities Report

On 31 October 2019, the company provided its activities report for the three months period ended 30 September 2019. Key highlights of the results are as below:

- During the period, the company witnessed an enhanced revenue growth.

- VOS Shine, offshore supply vessel arrived in Australia and completed the inaugural of Tiwi Island fibre optic cable lay project.

- SM8 agreed to acquire Advanced Offshore Streaming Pty Ltd.

- Harvest Technology awarded vessel supply contract by Fugro Australia Marine Pty Ltd for operations in Bass Strait.

- Marcus Machin joined the board as a Non-Executive Director.

Stock Performance

On 21 November 2019, the stock of SM8 settled the trading session at $0.051, falling by 15 per cent from its previous close. The company has ~307.86 million shares outstanding and a market cap of $18.47 million. The stock has generated positive returns of 160.87 per cent in the last six months, while its YTD return stands positive at 235.14 per cent.

Visioneering Technologies, Inc (ASX: VTI)

Visioneering Technologies, Inc is a provider of Ophthalmic devices. The company was founded in 2008 and headquartered in Atlanta, Georgia. It is a medical device entity that is into manufacturing, selling and distribution of contact lenses.

FDA approved CooperVisionâs MiSight contact lens

On 19 November 2019, VTI updated the market that The U.S. Food and Drug Administration (FDA) has granted approval for CooperVisionâs MiSight contact lens on 18 November 2019, which would delay the development of near sightedness in kids. The registration was granted to CooperVisionâs MiSight® 1 - day contact lens. MiSight is available in distance powers around -6.00 diopters.

Stock Performance

On 21 November 2019, the stock of VTI settled the trading session at $0.072, falling by 23.404 per cent from its previous close. The company has ~399.14 million shares outstanding and a market cap of $37.52 million. The stock has generated return of 51.61 per cent in the last six months, while its YTD return stands negative at 39.35 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.