During the CY2019, investors witnessed major appreciation in the stock price on account of the improved business prospect and new product offerings to the consumers. We will be discussing few stocks which has a unique business model and witnessed increased demand for its products offerings during FY19.

Afterpay Limited (ASX: APT)

Afterpay Limited is an IT based company, which provides credit services to the retailers. During CY19, businesses related to ‘buy now, pay later’ services witnessed robust growth and positive responses from the Australian consumers.

Key Operational Highlights for period ended 31 October 2019: Afterpay Limited came up with its four months ended results, wherein the company reported underlying sales of $2.7 billion, up 110% on y-o-y basis. The company reported active customers at 6.1 million, up 137% on y-o-y basis. Active Merchants, during the four months, came in at 39,450, up 96% on y-o-y basis. The company reported global underlying sales at $2.7 billion across all channels and geographies. The company reported more than 15,000 new onboarded customers per day. Across the Australia and New Zealand segments, the company reported average purchase of ~22x per year from the customers who has joined Afterpay during FY15- FY17. During the period, the company reported $200 million private placement and proposed strategic partnership with Coatue Management, a leading US based technology investor. The Management highlighted that the fund is likely to be used for, expansion opportunities for global platform.

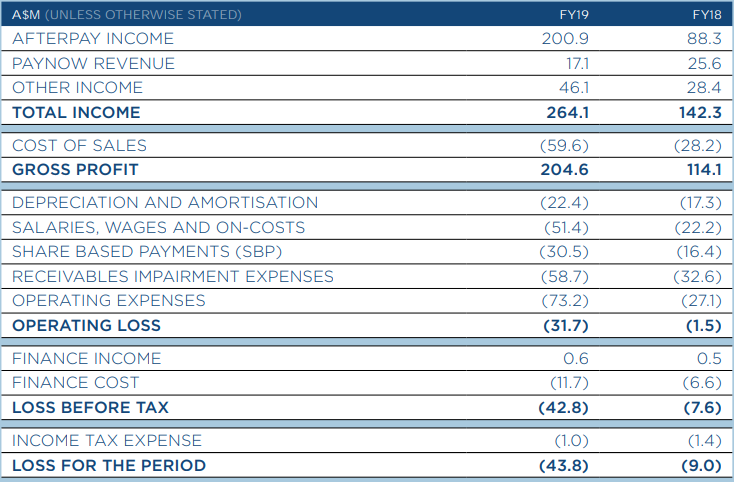

Key Operational Highlights for FY19 for the year ended on June 30, 2019: APT came up with its FY19 financial results, wherein the company reported total income of $264.1 million as compared to $142.3 million in previous financial year. The company reported gross profit at $204.6 million as compared to $114.1 million. The company reported higher depreciation and amortization of $22.4 million as compared to $17.3 million in previous financial year. The company reported an operating loss at $31.7 million as compared to an operating loss of $1.5 million in FY18. The company reported Net transaction margin (NTM) at 2.4%, notwithstanding significant contribution from lower margin US business.

FY19 Financial Highlights (Source: Company reports)

Stock Update: The stock of APT is quoting at $30.270 with a market capitalisation of $7.98 billion. The stock has delivered positive returns of 14.70% and 152.67% in the last six months and one-year, respectively.

Wisetech Global Limited (ASX: WTC)

Wisetech Global Limited operates in software solutions, primarily to the logistics industry across the globe. Recently, the company informed its acquisition of Ready Korea. The acquired business is a leading solutions provider of customs bonded warehouse and trade compliance based in South Korea.

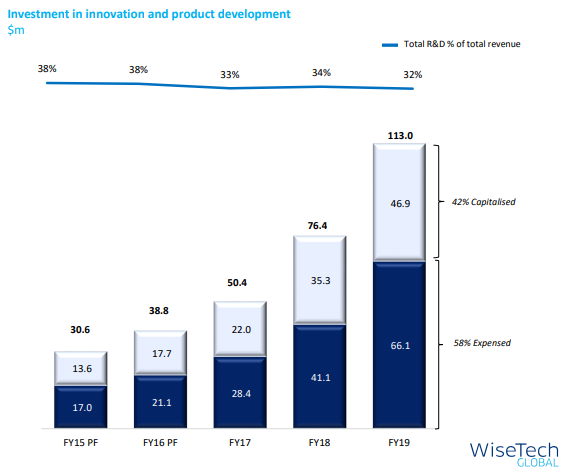

FY19 Operational Highlights for the Period ended 30 June 2019: WTC announced it FY19 full-year results, wherein the company reported revenue at $348.3 million, up 57% on y-o-y basis aided by higher usage across the existing customer base and new product launch. The business derived 33% growth in organic revenues driven by extensive business transformation, licence conversions, development partnerships and pilot programs. Recurring -revenue compromises 88% of the total revenue, which includes higher OTL and support services from different business models. The business reported its EBITDA margin at 48% excluding the acquisition, which states improvement from Cargowise One Efficiency segment. The business has expertise across the customer license transition with less than 1% attrition rate. research and development expense in terms of revenue stood at 32% as compared to 34% in FY18. The company expanded the pipeline of commercialisable innovations and upgraded more than 830 products smoothly across the CargoWise One platform for the customers across 150 countries.

FY15- FY 19 Research and Development Expense (Source: Company Reports)

Guidance: As per the FY20 guidance, the company expects revenue of $440 million to $460 million, representing a growth of 26% - 32% on y-o-y basis. The Company expects EBITDA of $145 million to $153 million, which denotes a growth of 34% to 42% on y-o-y basis. The business is going through innovation for long-term basis, which helps to derive decent revenue growth and efficient usage of the company’s workforce.

Stock Update: The stock closed at $23.810 with a market capitalization of $7.45 billion. The stock has generated negative return of 28.39% and 17.90% in the last three months and six months, respectively. At current market price, the stock is available at a price to earnings multiples of 134.520x on TTM basis and delivered an annualized return of 0.14%. The stock is quoting at the lower band of its 52-weeks trading range of $16.29 to $38.80.

Cochlear Limited (ASX: COH)

Cochlear Limited is engaged in manufacturing and marketing of Cochlear implant systems. Recently, the company informed that, it has appointed Michael Daniell to the Management committee.

Recent Update: COH received FDA clearance for one of its formulations named, Cochlear™ Osia® 2 System. The above medicine is used for conductive hearing loss, mixed hearing loss and single-sided sensorineural deafness among adults and children. The management highlighted, that The Osia 2 System has evolved at the first active osseointegrated steady-state implant across the globe. The company has used the digital piezoelectric stimulation technology - to bypass damaged areas of the natural hearing system followed by sending sound sensations directly to the cochlea.

FY19 Financial Highlights for the period ended 30 June 2019: COH announced its full-year results wherein, the company reported revenue of $1,426.7 million as compared to $1,363.7 million in FY18. Selling, marketing and general expense stood at $450.9 million as compared to $397 million in FY18. Research and development expense stood at $184.4 million as compared to $167.7 million in previous financial year. The company reported net profit at $276.7 million as compared to $245.8 million in FY18. The business reported total current assets of $635 million, which includes cash and cash equivalents of $78.6 million, trade and other receivables of $319.7 million and inventories of $195.4 million as on 30 June 2019.

Guidance: As per the Management guidance, the company is likely to start the marketing of the Osia 2 System during the second half of FY20 for the US market.

Stock Update: The stock of COH is trading at $225.680 with a market capitalization of $13.03 billion. The stock has generated positive returns of 4.75% and 26.93% in the last six-months and twelve months, respectively. At current market price, the stock is quoting at the P/E multiples of 47.060x on its TTM basis and generated an annualized dividend yield of 1.46%. The stock is trading at the upper band of its 52 weeks trading range of $164 to $238.54.

CSL Limited (ASX:CSL)

CSL Limited is engaged in manufacturing, development and distribution of pharmaceutical and diagnostic products actively used for cell culture media and human plasma fractions. Recently, CSL announced the issuance of fully paid ordinary shares of 3,059 numbers. Further, on 9 December 2019, the company reported, the appointment of Ms Carolyn Hewson AO as an independent Non-Executive Director.

FY19 Financial Highlights for the period ended 30 June 2019: CSL announced its FY19 full year results, wherein the company reported Total Revenue on reported basis at USD 8,539 million, as compared to USD 7,915 million in previous financial year. The company reported Net Profit after Tax at USD 1,919 million as compared to USD 1,729 million in FY18. The company reported total number of employees at 25,000, depicting a growth of 13% on y-o-y basis. During the period, the company introduced New Enterprise Resource Planning systems across its global network. The business also opened New research facility in Melbourne. CSL reported opening of 30 new plasma collection centers across the US market. The company reported major capital projects at all manufacturing sites progressing to support future demand.

Guidance: As per the FY20 net profit estimates, the business anticipates being in the range of approximately USD 2,050 million to USD 2,110 million, which indicates a profitability growth of 7% to 10% on y-o-y basis. The above growth is after the inclusion of one-off financial headwind of transitioning to a new model of direct distribution in China. The management further expects that the plasma and recombinant products are likely to remain strong while the business expects opening of 40 new collection centers in FY20 on account of growing plasma collections.

Stock Update: The stock of CSL is trading at $277.300 with a market capitalization of ~ $124.83 billion. At current market price, the stock is quoting at the upper band of its 52 weeks trading range of $184.00 to $287.90. The stock has generated stellar returns of 27.64% and 46.37% in the last six months and twelve months, respectively. At current market price, the stock is available at a price to earnings multiple of 45.91x on TTM basis and generated an annualized dividend yield of 0.96%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.