Time and again we have all heard the rumors of the looming recession. But not many people know what exactly a recession is. Some refer recession to the growing prices of commodities, while some believe it is a period where unemployment is high.

So, what exactly a recession is?

In economic terms, recession comes when a nationâs economy declines continuously for several months (usually 6 months). A recession is visible in a countryâs GDP, employment rates as well as in its production and exports.

A recession brings along an economic slowdown which impacts a countryâs household income, consumption, savings etc. It impacts the countryâs employment rates and creates unrest in the overall economy. This was evident in 2007 when US was hit by a recession, which resulted in precarious levels of employment and output. In 2007, many people lost their homes, jobs and savings due to recession.

Are you Prepared for the Next Recession?

Many economists look at recession as a reality which sooner or later will occur in an economy. This is a reason why one must always be prepared to face or combat a recession. Letâs look at a few suggestions which can be used in surviving a recession.

Have a Backup Plan- When recession comes, many employees are laid off, and many organizations go bankrupt. For individuals who solely rely on their jobs to support themselves and their family, losing a job could be a shattering experience. To avoid these situations, one must always diversify his/her income, so that even after losing a job, he/she has something to fall back on.

Emergency Fund â Emergency funds helps people to carry on for some more time till they find a second job or any other alternative to support themselves and their families. These are small surpluses which are set aside with an intention to be used in case of an emergency only.

Donât keep credit for too long- If you have any debt in your account, try to pay it back as soon as you can. Pay-checks generally shrink during recessions. People who have outstanding loan or debt find it difficult to pay back during recession. Hence, one must always try to settle his debt as soon as possible, instead of dragging it for years.

Be Prepared to Invest During Recession

This may sound very risky, but generally during recessions, prices of various commodities as well properties are down, making it a great period to invest. However, there is a chance that the economy may never fully recover from recession and prices may never rebound to the original levels.

in times like this, one must carefully analyze the governmentâs decision which are taken to deal with the recession. If the steps taken by the government are effective, it will result in the betterment of the economy and prices may rise once again.

Savings

In order to invest during recession, one must have sufficient money to invest. Where will this money come from? The money will come from savings that have been accumulated over many years.

Besides this, savings acts like as a cushion in hard times like recession. It provides a sense of relief to individuals who are hit by recession.

The way you have saved your money is also an important factor at the time of recession. If you have saved your money by investing it in property, equities, mutual funds, etc, you are exposed to the risks of erosion in value and your savings might not help you much in the crisis.

Be Aware of Whatâs Happening- A key to good investing is information. An informed investor can foresee possible future scenarios and make investing decisions accordingly. In order to avoid the uncertainties of a recession, one must always be aware of whatâs happening in the economy.

One of the best ways to gather information about the current economic situation is through government published articles and reports.

Recently when RBA (Reserve Bank of Australia) slashed its interest Rates it informed that outlook for the global economy is reasonable; however, the risks are tilted towards the downside. RBA also informed about the USâChina trade and technology disputes which are affecting international trade flows. This is a great piece of economic information.

An informed decision can help investors to even beat the market. In 2007 there were some analysts and researchers who successfully predicted recession as they were able to recognize the looming mortgage loan crisis in the US at that time. They bet against the market and as a result earned a lot of profits. There is a whole movie called âThe Big Shortâ based on this.

How is Australian Economy Performing?

Last year, much of the world witnessed low inflation, low unemployment and low interest with uncertainties generated by the ongoing disputes regarding trade and technology. Against this backdrop, the economy of Australia witnessed lower than expected growth with household spending affected by ongoing subdued growth in household incomes and a sizeable adjustment in housing prices.

As per RBA:

- The increase in housing prices and a turnaround in prices in Sydney and Melbourne have reduced the risk that comes with a sustained fall in housing prices;

- However, the rental vacancy rate in Sydney is relatively high;

- The fall in housing demand and prices over the past couple of years and tighter credit supply for developers, has resulted in residential building approvals falling sharply;

On the employment front, there has been a large increase in the number of Australians with jobs, resulting in achieving lower rate of unemployment than that experienced in the recent past.

As per recently released date of the Australian Bureau of Statistics (ABS) in September 2019, Australia's trend unemployment rate remained steady at 5.3 per cent with participation rate at 66.2 per cent.

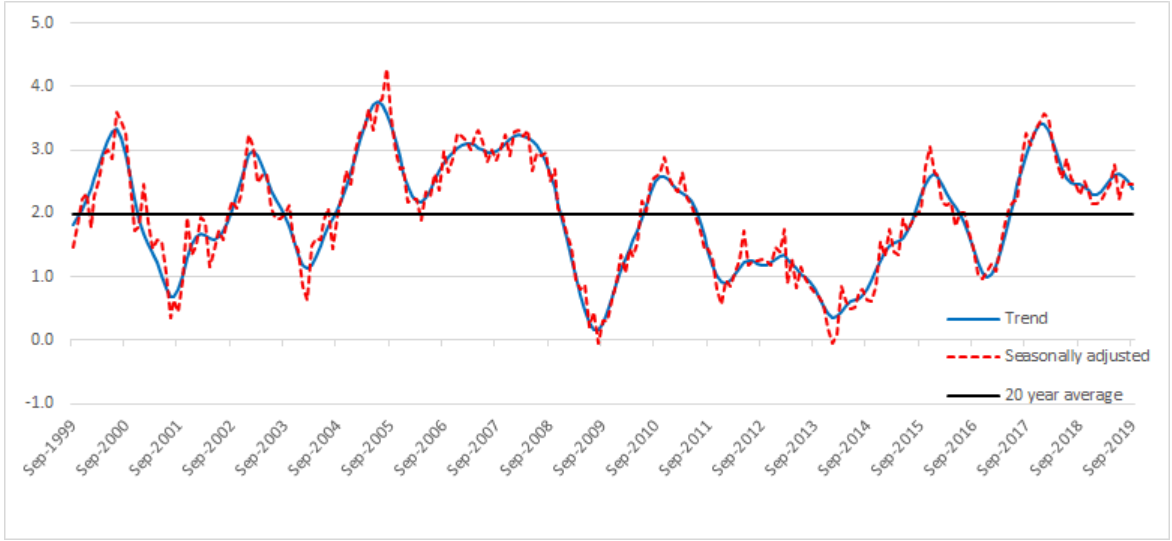

Annual Employment Change Over 20 Years (Source: ABS)

Employment Highlights for September 2019

- Trend monthly employment increased by around 20,200 people;

- Part-time employment increased by about 11,300 people;

- Full-time employment increased by about 9,000 people;

- The trend monthly hours worked increased by 0.1 per cent;

- The trend monthly underemployment rate remained steady at 8.4 per cent.

Investing in Consumer Staples Stocks

With the decline in the household income, the overall consumption also decreases. However, people still buy basic products like food and apparel. Hence, it can be said that the companies operating in consumer staples business are less likely to get impacted by a recession. Some consumer staple stocks in Australia include popular name like Woolworths Group Limited (ASX: WOW), Coles Group Limited (ASX: COL) and The A2 Milk Company Limited (ASX: A2M).

For the last one-year, retail giant Woolworthsâ stock price increased by 31.27% as on 31 October 2019. Coles, on the other hand, has provided 19.51% in the past six months. Infant nutrition company A2M has witnessed an increase of 23.87% in its stock price in the last one year.

It is very difficult to forecast a recession in the economy. However, with the help of the above-mentioned strategies, one can comfortably take on the hardships of recession.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.