Return on Equity is measured in the form of the amount of net income generated by the company as a percentage of the amount invested by shareholders in the company (or shareownersâ equity). The ratio plays an important role in helping the investors analyse the profitability and quality of the business. Return on Equity is calculated by dividing the amount of net income earned by shareholderâs equity. A high ROE reflects that the company is able to utilise shareholderâs money efficiently and has a good amount of retained earnings for generating revenues.

Now let us have a look at few stocks with good return on equity.

CSL Limited

CSL Limited (ASX: CSL) is engaged in research, development and distribution of biopharmaceutical and allied products. The company recently notified that it will release its full year result on 14 August 2019. In another recent announcement, the company updated on the appointment of new Executive Vice President and General Manager for its Seqirus business. Anjana Narain was appointed to the role, to replace Gordon Naylor, the retiring Executive VP and GM.

Own Distributor Model in China: Pursuant to the plan to transition to its own Good Supply Practice License in China in FY20, the company provided an estimate of the one-off financial effects of the same. The transition will result in lower reported albumin sales in the range of $340 million - $370 million. Cashflows of the company will see a positive impact with collections of outstanding receivables from distributors. Following the transition, FY21 sales of albumin in China are anticipated to return to a more normalised level.

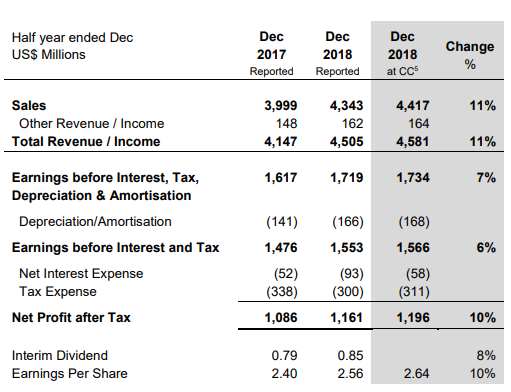

During the six months ended 31 December 2018, revenue for the company amounted to $4,505 million, up 11% on pcp at constant currency. Reported net profit after tax came in at $1,161 million, rising 10% at constant currency. Earnings per share for the period amounted to $2.56, up 10% at constant currency. The company declared an interim dividend of $0.85 per share, up 8% on prior corresponding period. In 1HFY19, the company had a ROE of 26.0%.

Financial Summary (Source: Company Presentation)

FY19 Guidance: The company has provided FY19 NPAT guidance in the range of $1,880 million - $1,950 million. NPAT for the year is now expected to be around the upper end of the said guidance.

The stock of the company settled the dayâs trading at a market price of $217.430, down 3.983% on 06 August 2019 with a market capitalisation of $102.61 billion.

Magellan Financial Group Limited

Magellan Financial Group Limited (ASX: MFG) is engaged in funds management for offering international investment funds to high net worth and retails investors in Australia and New Zealand. The company recently updated that Hamish Douglass, one of its directors, acquired ordinary shares in the company along with units in Magellanâs funds & trusts.

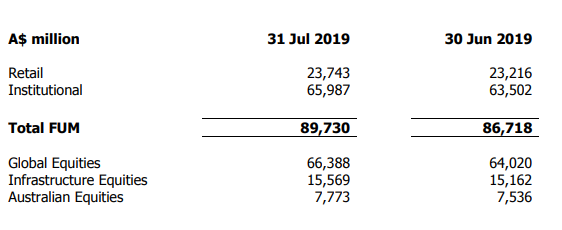

FUM Update: In the most recent update regarding funds under management as at 31 July 2019, the company reported retail funds under management amounting to $23,743 million, as compared to $23,216 million as at 30 June 2019. Institutional funds under management as at 31 July 2019 stood at $65,987 million, as compared to $63,502 million as at 30 June 2019. In the month of July, the company witnessed net inflows amounting to $574 million, comprising $349 million in net retail inflows and $225 million in net institutional inflows. Also, Magellan funds paid distributions amounting to $603 million in the month of July.

Funds Under Management (Source: Company Reports)

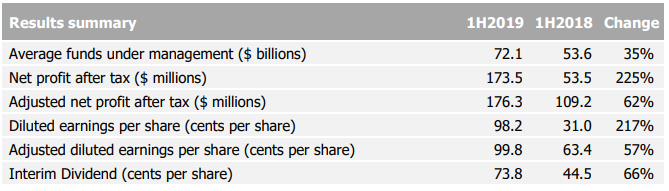

Interim Results Update: During the period ended 31 December 2018, the companyâs adjusted net profit after tax stood at $176.3 million, up 62% on prior corresponding period. Average funds under management during the period were reported at $72.1 billion, up 35% in comparison to prior corresponding period value of $53.6 billion. During the period, an interim dividend of 73.8 cents per share was declared by the company, representing 66% increase on pcp. The company had a ROE of 27.1% in the first half.

1HFY19 Results Summary (Source: Company Reports)

The stock of the company is currently trading at a market price of $57.960, down 1.227% by the close of market trading on 06 August 2019.

Amcor Plc

Amcor Plc (ASX: AMC) engaged in development and production of packaging for a variety of food, beverage, pharmaceutical and personal care products. The company recently updated the exchange on the issue of CHESS Depository Interests (CDIs) for the purpose of transmutations between CDIs quoted on ASX and shares quoted on NYSE.

Acquisition of Bemis: In the month of June, the company released an announcement regarding the acquisition of Bemis Company Inc. The acquisition helped strengthen Amcorâs industry leading value proposition and generate significant shareholder value.

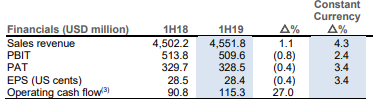

Half-Yearly Results: During the six months ended 31 December 2018, the company reported statutory profit amounting to USD 267.6 million. Profit before interest and tax was reported at USD 509.6 million, up 2.4% on prior corresponding period on a constant currency basis. Earnings per share were reported at 28.4 US cents, up 3.4% on prior corresponding period on a constant currency basis. An interim dividend amounting to 21.5 US cents per share was declared, paid as AUD 29.78 cents, up 13.8% on prior corresponding period. During the period, the company had a ROE of 26.6%.

Key Financials (Source: Company Presentation)

FY19 Guidance: The company expects FY19 net interest costs to be in the range of USD 200 million â USD 210 million, in constant currency terms. Free cash flow, after deducting capital expenditure and dividend payment is expected to be in the range of USD 200 million to USD 300 million.

The stock of the company is currently trading at a market price of $15.250, down 2.06% on 06 August 2019 and has a market capitalisation of $25.32 billion.

Lovisa Holdings Limited

Lovisa Holdings Limited (ASX: LOV) is engaged in retail sale of fashion jewellery and accessories.

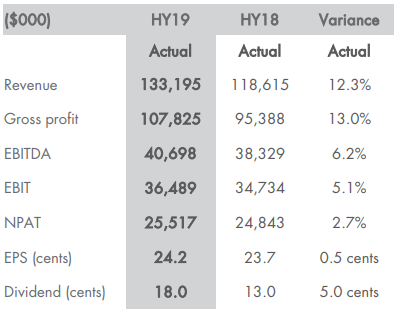

Financial Highlights: The first half of 2019 was characterised by continued earnings growth on the back of store rollout and gross margin expansion. Gross margin for the first half was reported at 81.0%, up 60 basis points from 80.4% in prior corresponding period. During 1HFY19, the company generated revenue amounting to $133.20 million, up 12.3% on prior corresponding period revenue of $118.62 million. Gross profit for the period was reported at $107.83 million, up 13.0% in comparison to gross profit of $95.39 million in the corresponding year-ago period. During the period, EBITDA amounted to $40.70 million, increasing 6.2% from prior-year corresponding period EBITDA of $38.33 million. NPAT for the period was reported at $25.52 million, as compared to $24.84 million in corresponding prior- year period. The Board declared a fully franked final dividend of 18.0 cents, increasing by 5.0 cents on prior comparable period. ROE of the company for the first half stood at 49.5%.

Key Financial Measures (Source: Company Presentation)

Sales by Region: Sales during the period increased from continued global rollout. Growth was driven by new regions with USA reporting the highest variance of 836.4% - at $1.41 million. Sales in Europe reported an increase of 110.7% at $17.09 million in 1HFY19 compared to $8.11 million in 1HFY18. Sales to Africa amounted to $17.68 million, up 10.5% in comparison to corresponding prior year periodsales of around $16.0 million. Asia reported a year-over-year growth of 5.6% in sales at $18.23 million. Sales in Australia increased the lowest by 1.9% compared to corresponding period of prior year.

Outlook: The company continues to focus on expanding its store network and expect the number of stores in FY19 second half to be higher than those in FY18 second half.

The stock of the company is currently trading at a market price of $10.270, down 3.113% on 06 August 2019.

Sydney Airport

Sydney Airport (ASX: SYD). The company recently notified that it will release the results for half year ended 30 June 2019, on 15 August 2019.

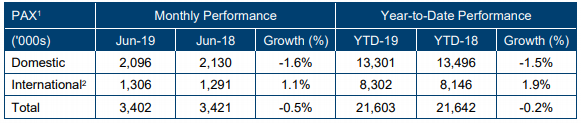

The company released an announcement regarding the traffic performance for the month of June 2019.

Monthly Performance: The number of domestic passengers traveling through the airport were reported at 2,096,000 in June 2019, as compared to 2,130,000 in the corresponding month of prior year. This depicted a comparative fall of 1.6%. International passengers on the other hand were reported at 1,306,000, up 1.1% compared to 1,291,000 in corresponding prior-year period. Overall, total passengers travelling during the month declined 0.5% compared to the year-ago period at 3,402,000 passengers.

Year-to-Date performance: Domestic passengers travelling through airport declined by 1.5% based on YTD performance. International traffic increased by 1.9% from 8,146,000 in YTD-18 to 8,302,000 in YTD-19. Total passengers transiting through the airport in 2019 declined 0.2% compared to the year-ago period.

Passenger Traffic Details (Source: Company Reports)

The top five fastest growing passenger nationalities over the month of July were India, Vietnam, Japan, USA and Taiwan. These nationalities recorded double digit growth in comparison to June 2018. Domestic passenger traffic witnessed a decline due to capacity reductions along with the impact of subdued load factors. During the 12 months period to June 2019, the company had total passenger traffic of 44,350,000, up 0.8% in comparison to passenger traffic of 44,009,000 in corresponding period of prior year. The company witnessed strong passenger, revenue and EBITDA growth in 2018. In FY18, the company had a remarkable ROE of 103.3%.

The stock of the company is currently trading at a market price of $8.090, down 3.23% on 06 August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.