Cannabis stocks have been creating a buzz among the investors and have gained popularity among them as well. Upon finding benefits of using cannabis to treat several different conditions such as cancer, Nausea, Pain, Muscle spasm, Crohn's diseases, appetite loss, Alzheimer’s’ disease, etc. Many medicine experts and political parties have endorsed the legalisation of cannabis over the recent years.

Cannabis stocks have shown significant growth delivering considerable returns to the shareholders and witnessed expansion of operations. As an integral part of the Australian economy, the cannabis stock impacts the growth of the Australian healthcare sector as well as other related sectors.

Post-legalisation of marijuana for the recreational purposes by Canada, there have been increasing speculations in the market related to the exponential business growth in the industry.

Read: How To Identify Good Cannabis Stocks Early-On?

These speculations were supported by the US giving green signal to marijuana companies for recreational and medical purposes.

The medicinal cannabis space in the Australian economy is set to get an increase by the Australian Government through prioritisation of the projects that have been awarded MPS or Major Project Status and eventually propelling economic expansion.

Let us look at some of the cannabis stocks with exciting growth in Cannabis space:

Australian licensed producer, supplier and exporter of pharmaceutical grade medicinal cannabis, Althea Group Holdings Limited (ASX:AGH) offers a range of products, education, access and management services to support eligible patients and healthcare professionals in navigating medicinal cannabis treatment pathways.

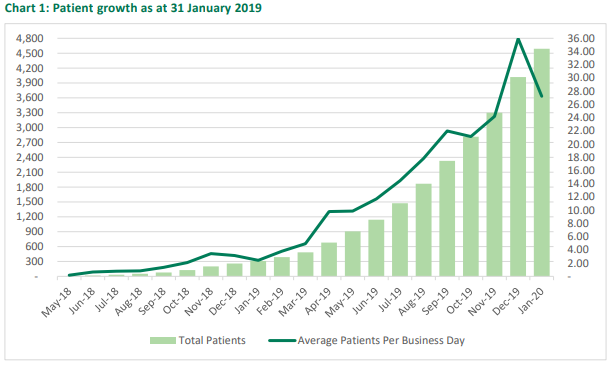

The Month of January this year closed as the second-best month on record for Althea, with 572 fresh patients making an addition to it, highlighting the solid demand from new patients for Althea’s medicines.

459 Healthcare Professionals had prescribed Althea’s medicinal cannabis products to 4,590 Australian patients, as at 31 January 2020.

Althea also reported a plus point for its business that the Australian medicinal cannabis market soared at its fourth top rate in January, making an addition of 3,151 TGA SAS Category B approvals.

Source: Company's Report

The Company CEO believes that the efforts of the Company are unrelenting towards the growth in the number of patients utilising Althea products and undoubtedly the patient growth in January was better than expected.

He further added that AGH is extremely lucky to have Althea Concierge, its proprietary online prescribing platform, enabled to cater to the doctors and patients 24/7 with all their medicinal cannabis requirements along with its great performance on the ground sales team.

The Company looks forward to continuous acceleration into February in the number of patients experienced across both the December and January months.

With plans to expand into Germany, emerging markets throughout Asia and other parts of Europe, Althea presently operates within highly regulated medicinal cannabis markets, including Australia and the United Kingdom.

The AGH stock closed the day’s trade on 12 February 2020 at a price of $0.370, down by 2.632%, with a market capitalisation of $88.66 million.

Diversified global cannabis company, THC Global Group Limited (ASX: THC) owns and operates -

- The largest pharmaceutical bio-floral extraction facility in the Southern Hemisphere with one of the largest production capacities for pharmaceutical GMP medicines in the cannabis sector globally, and

- Crystal Mountain, an established hydroponics equipment and supplies wholesaler and retailer operating across Canada servicing the rapidly expanding cannabis sector in North America.

THC is currently looking forward to starting the global delivery of medicines as per the Canndeo brand in Australia and worldwide. This expansion comprises of THC Global’s medicines range under the Canndeo brand which is expected to launch by the end of Q1 2020 and shall be four products including a full spectrum CBD medicine in the beginning.

Fascinated by THC Global’s ability to be cost effective to patient whilst offering a medicine of TGA pharma GMP standard compels the Company to forecast more of the Australian Government’s estimated 100,000 potential annual prescription demand for medicinal cannabis to come forward.

Moreover, the Company has expanded its team, which includes:

- Appointment of a Senior Distribution Channel Executive

- Increases in support staff in medical and science

In addition to the above, the Company has also introduced an information portal for healthcare professionals in support of the Canndeo medicines.

The Company’s licences have been submitted, upon clearance of which, THC Global shall be delivering to the Canada’s market under the brand- Canndeo Canada. The Company is currently aiming at more than 369k Canadian medical client registrations with permission to access medicinal cannabis within the current valid authorities.

THC Global is now looking forward to commencing the import of crude cannabis extract into Australia from Canada for further processing at the its Southport Facility into pharma GMP medicines.

The THC stock last traded at a price of $0.375 on 12 February 2020 and has a market capitalisation of $53.49 million.

Cannabis centric healthcare company, Bod Australia Limited (ASX: BDA) is an international health and wellness focussed Company with a mission to innovate and transform the way of life and enjoy life through delivering premium, proven and trusted products for both the consumer markets and medical markets.

BDA recently on 11 February 2020, received an import licence for two new medical cannabis products, which indicates the expansion of the offering which now include a CBD isolate in 2.5% and 10% strengths, while enabling the Company to target a larger portion of the addressable market.

The NSW Department of Health and the Office of Drug Control (ODC) has approved the import of the extracts and the new products shall be bottled and sold under the MediCabilis™ brand.

The Company believes that the introduction of the new products strengthens its position to address a broader market and increase its market share in the near term.

Bod now has three MediCabilis™ products to offer approved prescribers and patient and the introduction of the 2.5% and 10% CBD Isolates allow Bod to target around an additional 32% of the total medicinal cannabis prescription market in Australia.

Bod’s MediCabilis™ product suite is believed to provide greater product alternatives to the physicians and patients while seeking treatment, and the increase in the greater product alternatives shall in turn increase in the coming months for Bod.

Moreover, Bod is amongst the companies to have completed a Phase I clinical trial using a finished dose form and cannabis extract which shall ignite the tremendous confidence to the prescribers and patients in Bod’s product.

The Company’s stock surged 5.66% during the day’s trade on 11 February 2020 and settled on $0.280. The increase in the stock prices of BDA came after the Company’s announcement regarding the import permit to expand medicinal cannabis products.

Also, on 12 February 2020, the stock closed flat at $0.280 and its market capitalisation was noted at $25.58 million.

Moreover, the overall S&P/ASX 200 Health Care (Sector) settled in the green zone gaining 188.8 points (0.4%) and settled at 47,272.9 at the close of the day’s trade on 11 February 2020.