About the Company (ASX: AB1)

Animoca Brands leverages gamification, blockchain, and artificial intelligence technologies to develop and publish a broad portfolio of mobile products including games such as The Sandbox, Crazy Kings, and Crazy Defence Heroes as well as products based on popular intellectual properties such as Formula 1®, Garfield, Snoopy, Thomas & Friends™, Ever After High and Doraemon.

The Company Receives ASX Letter

Animoca Brands Corporation Limited has been warned by ASX that it has breached ASX listing rules. ASX has issued a letter to AB1 describing what ASX trusts to be violations of the listing rules. The letter mainly focusses on elements of the Company’s business that ASX does not consider to be appropriate for a listed company like involvement in cryptocurrency related activities and significant use of SAFEs issued by subsidiaries. AB1 has been given the chance to make a good case to the opposite, otherwise, ASX intends to eliminate it from the official list pursuant to listing rule 17.12 w.e.f and from the beginning of trading on Friday, 21 February next year.

The company expects to tackle the issues mentioned in the letter by ASX and give a written reply as soon as practicable.

Other key highlights of the company are as follows:

Appointment of Finance Director

The company has appointed Raymond Shuai as finance director. He has more than seventeen years of experience in finance and industry. Mr Shuai’s professional career started in 2002 with Deloitte & Touche, JP Morgan in 2004, Ambrian Partners from 2006 to 2008, where he earned substantial experience in audit, operations, fundraising, M&A, and IPOs, and advised corporates listed on the London Stock Exchange.

Animoca Brands to acquire nWay

The company has entered a non-binding memorandum of understanding (MoU) to acquire 100% of the issued capital in nWay, Inc. from the shareholders of nWay for an upfront consideration of US$7.69 million (approximately $11.4 million). The acquisition depends upon shareholder approval, execution of a formal deal, satisfactory conclusion of due diligence, and securing of any essential regulatory approvals.

Also, nWay is a game developer and publisher of high-quality AAA games on console, PC, and mobile platforms;

· Share consideration will be based on a price per share of the higher of A$0.18 or the 30-day VWAP as of the effective date;

· Cash consideration includes US$250,000 to the Sellers and a US$1.69 million cash investment into nWay for operating purposes.

AB1 has inked unsecured twelve months loan agreements for a total of $2.5 million, with attached 12- month options, from sophisticated investors connected to it, in order to fund the acquisition and other prospects.

Appointment of Co-Company Secretary

The company has hired its present financial advisor John Madden as co-company secretary. He has above thirty years of work experience in financial reporting in small and big listed companies, both. He has held company secretarial designations for Indophil Resources NL, Aura Energy Limited and Indian Pacific Resources Limited.

The Company Enters into an Agreement to Acquire Sky Mavis

The company has entered into a subscription agreement with Sky Mavis to acquire US$420,000 (approximately $610,000) worth of ordinary shares in Sky Mavis for cash and shares in the company. AB1 has also inked an advisory agreement and a collaboration MoU with Sky Mavis. Mr Mavis is the creator of the very well rated Axie Infinity (blockchain game). Axie Infinity is among the highest-grossing blockchain games, with sales of over US$1.1 million and partners that include Samsung, Klaytn (Kakao), MakerDAO and Loom Network.

The Company Launches Official Mobile Game Based on MGM Film

The company has announced that The Addams Family Mystery Mansion (official mobile game) built on the highly awaited animated movie - The Addams Family that has been introduced worldwide on the App Store and Google Play. It is a mobile game that welcomes players to aid the two characters - Morticia and Gomez to bring together the remaining members of the family members and renovate their house. By chapters and missions propelled by an original story line and humorous conversation, players gather their preferred characters from the movie The Addams Family and increase their catalogue of spooky furniture and home decoration.

The Company Secures A Three-Year Global Licensing Agreement

The company secured a three-year global licensing agreement Dorna Sports to develop and publish the official blockchain manager game and associated digital collectibles of FIM Road Racing World Championship Grand Prix, commonly known as MotoGP™. AB1 has concluded a strategic capital raise of $1 million to sponsor business opportunities including the advancement of the Manager Game.

· MotoGP is the oldest motorsports championship around the globe and witnessed by more than 400m viewers across the world;

· Capital raise of $1m closed at a premium at a price per share of A$0.20 from sophisticated investors, including Moses Tang.

Strong Revenue Growth Registered in First Half

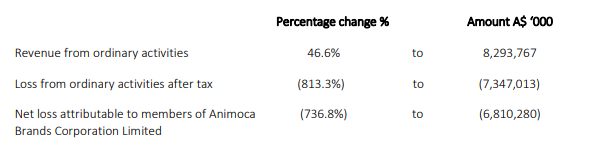

The company’s operating revenue increased by 47 percent YoY standing at $8.3 million due to the solid performance of the company’s core mobile games segment, and incremental contributions from the developing blockchain game division. $16.6 million in cash, digital and financial current assets, increasing by 177 percent YOY, because of rise in cash generation and growth in the value of digital assets. AB1 raised $5.7 million in new capital in the first half of year at a 4.2 percent premium to the 30-day VWAP. A further $2.0 million in new capital was issued to vendors of assets and suppliers of services.

Half Yearly Results (Source: Company’s Report)

Stock Performance

As per the ASX update, by AB1 on 2 September 2019, the shares of the company were suspended from Official Quotation with Listing Rule 17.5 after they failed to lodge the relevant periodic report by the due date. AB1 on 14 October 2019, further notified that the shares would be under suspension pending the release of price-sensitive announcements and the conclusion of the ASX’s continuing inquiries with regards to the AB1’s 6-month results closed 30 June this year.

The stock of AB1 last traded at $0.180 per share on 30 August 2019. The stock has given a total return of 20% and 100% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)