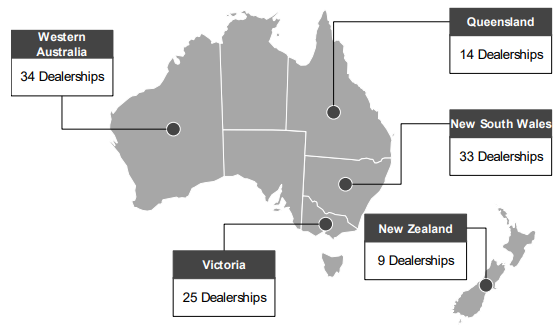

Automotive Holdings Group Ltd (ASX:AHG) deals with the automotive retail and logistics businesses. It operates in automotive retail, cold storage logistics, property and other Logistics. The company sells new and used vehicles, and aftermarket products. It also provides vehicle services as well as finance and insurance services.

Automotive Retail franchised geographic footprint (Source: Companyâs Report)

On 16th May 2019, the company announced that A.P. Eagers Limited (ASX: APE) would be acquiring all the ordinary shares that the company does not already own. AHG accepted the offer and sent its approval statement to AP Eagers along with the Australian Securities and Investments Commission. KPMG Corporate Finance had prepared an independent expert's report related to the offer. The company was expected to release a statement to its shareholders on 17th May 2019 after modification granted by ASIC.

The offer was announced on 5th April 2019 and commenced on 23rd April 2019. AP Eagers will provide a Notice of Status of Bid Condition on 6th September 2019. If the Offer Period is extended, the date would be postponed for the same period. The offer will close on 16th September 2019 (unless it is changed as permitted by the Corporations Act).

The Chairman of the AHG, Richard England, informed shareholders that AP Eagers had bettered its offer to acquire all the shares in AHG that it does not already own. The improved consideration offers 1 APE share for every 3.6 AHG shares held by shareholders with the company.

The directorsâ of the company, recommended shareholders to accept this improved offer (in the absence of a better proposal) once AP Eagers has relinquished the No Material Adverse Change Condition. He also stated that in the event of the offer becoming unconditional, shareholders who had accepted it, would be entitled to receive any dividend declared by AP Eagers (post 8 May 2019 and before the end of the Offer Period), assuming that these Shareholders would not dispose of their APE Shares before the record date for the applicable dividend.

The chairman is of the belief that the shareholders would reap benefits out of the offer as an investor in a larger group. The shareholders would reap better benefits that the initial offer.

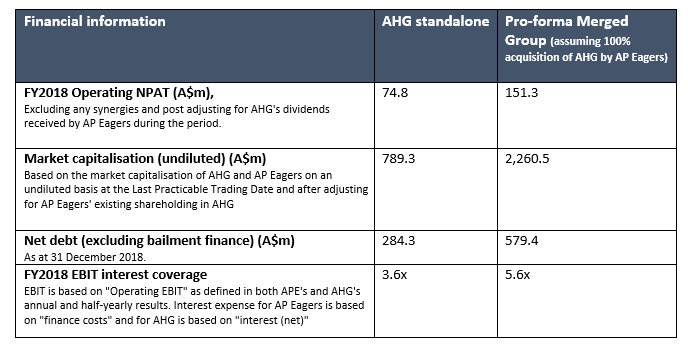

The table below depicts the financial profile of the Merged Group:

According to the individual analysis done by KPMG, there is a strong degree of correlation in the relative performance of Australian motor vehicle retailers over the period considered, AP Eagers had outperformed its principal listed Australian peers but underperformed against the broader S&P.

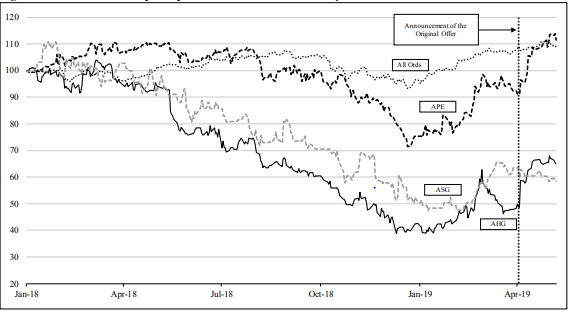

According to the individual analysis done by KPMG, there is a strong degree of correlation in the relative performance of Australian motor vehicle retailers over the period considered, AP Eagers had outperformed its principal listed Australian peers but underperformed against the broader S&P.

Relative share price performance since 1 January 2018. (Source: Companyâs report)

Share Price Information:

As on 17th May 2019, the companyâs stock traded at A$2.340 on ASX, up 1.739%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.