Every day, the market comes up with new surprises as well as new gifts, which lead to increase in wealth of the investors. Similarly, the companies provide new announcements like new agreement, expansion, and acquisition, which helps them in the long run.

Letâs have a look at three ASX-Listed stocks with their recent updates:

ApplyDirect Ltd

ApplyDirect Ltd (ASX: AD1) provides customer branded recruitment technology platforms. It also provides utilities software, billing services as well as management platforms.

The company secured a New Contract

- As per the release dated 25th September updated the market that it has entered into a contract with Environment Protection Authority Victoria.

- The Scope of work under the contract include integration of the Environment Protection Authorityâs new human resource management system with the Careers. Vic jobs portal, which is being powered by the companyâs software.

- With respect to the announcement made on 17th September 2019, AD1âs fully owned subsidiary Utility Software Services has inked an agreement to provide iGENO Pty Ltd with SaaS platform and Managed Services.

Issue of Shares

- On 13th September 2019, AD1 has issued 23,333,333 fully paid ordinary shares at the consideration of $0.015 per share.

- The objective behind the issue of share was to complete the private placement to cornerstone investor as announced to the ASX on 30 August 2019.

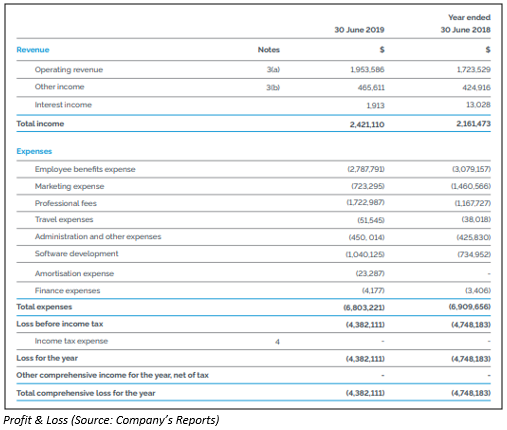

A Look back at Financial Year ended 30 June 2019

The company has provided a brief on financial performance for financial year 2019 in its Annual Report for the period:

- It witnessed a rise of 13.3% in total operating revenue and the figure stood at $1.95 million. This growth in revenue was mainly because of continued strong contribution from the existing client base as well as the addition of a diversified revenue stream via the acquisition of Utility Software Services Pty Ltd.

- The company also experienced a decline of 2.2% in operating costs in comparison to the same period.

- It posted loss before income tax, which amounted to $4.38 million, reflecting a fall of 7.7% against prior corresponding period.

Capital Raising

- Subsequent to the financial year ended 30th June 2019, the company raised amount totaling to around $1.83 million from the Smedley Family Office (Cornerstone Investor) as well as Share Purchase Plan.

- It was mentioned that the cornerstone investor would be eligible to a board position in order to support and drive the M&A activity of group.

The stock of AD1 last traded at $0.016 with total shares outstanding at 548.06 million on 2nd October 2019. The stock has generated return of 45.45% and 33.33% during the last three months and six months, respectively.

The GO2 People Limited

The GO2 People Limited (ASX:GO2) is primarily into the provisioning of Labour Hire, Training and Building Services.

Termination of Share Sale Agreement

- As per the release dated 2nd September 2019, the company advised that market that it had received notification from its lead manager to the capital raising in relation to the commitment for the $1.3 million minimum subscription at 7.5 cents per share.

- However, in the release of 6th September 2019 it was mentioned that GO2 has been notified about the termination of the Share Sale Agreement from the Vendor of Industry Pathways Pty Ltd.

- This leads to the conclusion of proposed acquisition of Industry Pathways Pty Ltd.

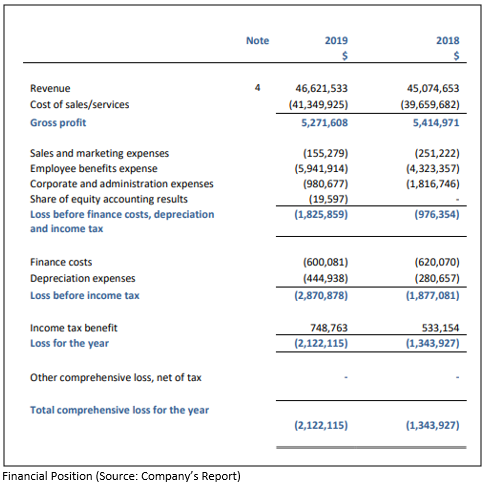

Operational and Financial Summary

As per the release dated 30th August 2019, the company published a preliminary final report, wherein it mentioned operational and financial performance for the year ended 30 June 2019:

- The company reported revenue amounting to $47 million, reflecting a rise of 4.4% in comparison to FY18.

- Gross margin declined to 11.3% which primarily resulted from a decrease in revenue contribution from the Building Division.

- It added that the recruitment division witnessed a rise in its margin to 10.2% from 9.6%, which outlines the gross margin and revenue growth momentum coming into FY20.

- In FY19, the company invested in and integrated 2 indigenous owned businesses.

Future Priorities

- The company is focused on continued organic growth in its core Recruitment and Training Divisions. It is a belief that these divisions are well positioned for continuing EBITDA growth for a number of reasons:

- The GO2 People Limited has presented a clear pathway for positive EBITDA post recent operational review and decline of overheads amounting to $1.5 million per annum.

- Its renewed focus on servicing higher margin clients is being anticipated to drive organic growth.

- GO2âs focus is to become a national, integrated labour recruitment and training business. Its emphasis is to generate growing, positive free cash flow for its shareholders.

Results of Annual General Meeting

The company completed its 2019 Annual General Meeting on 9th August 2019, wherein it following resolutions were passed:

- Resolution 1- Issue of Capital Raising.

- Resolution 2- Issue of broker options to lead manager.

- Resolution 3- Shares Issued in consideration for the acquisition of Industry Pathways Pty Ltd.

The stock of GO2 last traded at $0.023 with the total shares outstanding at 117.96 million on 3rd October 2019. The stock has generated return of -69.33% and -70.89% during the last three months and six months, respectively.

Peppermint Innovation Limited

Peppermint Innovation Limited (ASX:PIL) is in business of commercialisation and deployment in addition to the development of the Peppermint Platform.

Issue of Securities

- On 30th August 2019, the company has issued $185,000 convertible notes and 3,700,000 options. The issue price of convertible notes stood at $185,000 and for options it was nil.

- The purpose behind the issue of securities was sourcing funds for working capital.

Key takeaways from Annual Report 2019

- In the financial year 2019, there was growth in cash receipts, reflecting a rise of 47.5%, 92% and 14% for the December 2018 quarter, March 2019 quarter and 30thJune 2019 quarter, respectively.

- There is a rise in scale and reach of programs forecast in forward quarters.

- The company was named in 50 winning companies in 2019 global âInclusive Fintech 50â competition.

- It secured a $2 million placement from PEGG Capital.

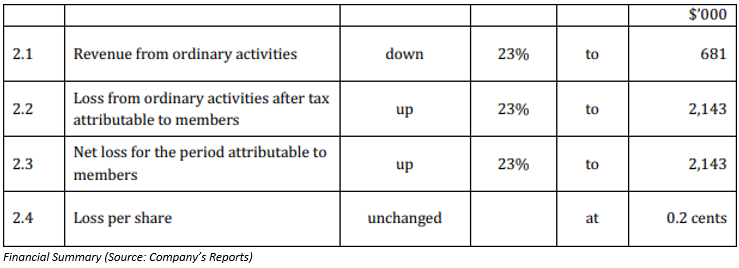

Financial Summary

- As of 30th June 2019, the cash balance of the company stood at $82k with operations covered by the $1.5 million Caason Convertible Note whilst the major fund raising with PEGG had been completed.

- The following graphic provides an idea of financial summary for the financial year ended 30th June 2019:

Roll Out of App

- As per the release dated 17th May 2019, the company updated the market that its developed mobile Application was formally rolled out by Cooperative Health Management Federation.

- It was mentioned in the release that the App gives various medical-related information to Cooperative Health Management Federationâs 41,000 members.

- The next phase for the App is to introduce wallet, QR code payments and other member-to-member payment functionalities for CHMFâs members.

The stock of PIL last traded at $0.013 on 2nd October 2019 with the total shares outstanding at 987.58 million. The stock has generated returns of 18.18% and -7.14% during the last one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.