Macquarie Group Limited (ASX: MQG) is an Australian diversified financial services business with offerings, including asset management, banking, advisory, debt, equity and commodities. MQG is a constituent of S&P/ASX 20, S&P/ASX 50, S&P/ASX 100, S&P/ASX Dividend Opportunities Index, and more.

Macquarie Group increased its dividend to $2.50 per share for the first half of FY2020 ended 30 September 2019 compared with $2.15 per share in the interim period of the financial year 2019. However, the H1 FY2020 interim dividend was lower in sequential terms.

Half-Year FY2020 in Review

In the half-year ended 30 September 2019, the profit attributable to ordinary equity holders stood at $1,457 million, an increase of 11 per cent in a y-o-y terms and a decrease of 13 per cent sequentially. Net operating income for the period was $6,320 million compared with $5,830 million in the previous corresponding period (pcp), reflecting an increase of 8 per cent.

Income & Expenses

Net operating income increased 8 per cent on a y-o-y basis, primarily driven by an increase in fee and commission income, other operating income and charges, and net interest and trading income. These favourable items were partially offset by lower share of net profits of associates and JVs, coupled with higher credit and other impairment charges.

For H1 FY2020, total operating expenses were reported at $4,480 million, representing an increase of 9 per cent from $4,125 million in the same period a year ago. The increase was credited to several factors including an increase across employment expenses, non-salary technology expenses, and other operating expenses and occupancy. These were partially offset by a decline in commission, brokerage, and expenses related to trading.

During the period, income tax expense was $376 million, consistent with $374 million in the previous corresponding period, and the effective tax rate came down to 20.5 per cent from 22.2 per cent in the previous corresponding period, mainly driven by the geographic composition and nature of earnings.

Funding

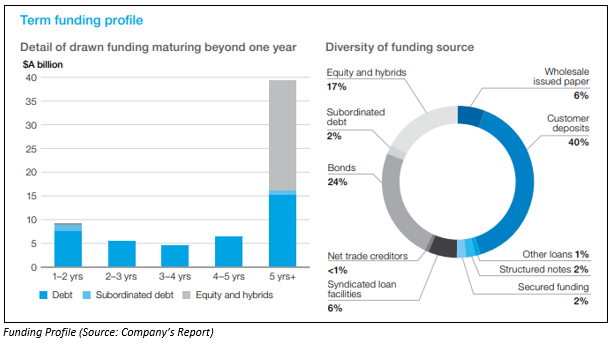

The group notes that the funding base is stable with minimal dependence on wholesale funding markets (short-term). At the half-year end, the term assets were covered by term funding maturing beyond 12 months, equity and stable deposits.

The group follows a liability-driven approach to balance sheet management. The funding is raised before assets are taken on the balance sheet. In H1 FY2020, the group raised $10.8 billion in term funding and $1.7 billion through equity.

Business Segments

Macquarie Asset Management (MAM)

In H1 FY2020, the segment was benefitted by higher performance fees in real estate funds and co-investors, and higher base fees augmented by beneficial forex movements coupled with investments made by real estate funds and mandates.

Factors that partially offset these increases were:

- higher operating expenses mainly driven by foreign exchange movements and the full period impact of the GLL and ValueInvest business acquisitions completed in the prior corresponding period

- a decreased net operating lease income was driven by the disposal of Macquarie AirFinance to a newly formed joint venture, of which MAM has a 75 per cent interest.

Macquarie Capital

During the reported period, the segment was adversely impacted by

- lower fee and commission income due to lower debt capital markets fee income, lower net interest and trading income due to reduced interest income from the debt portfolio

- higher credit and other impairment charges due to a small number of underperforming investments

- higher operating expenses reflecting additional headcount and foreign exchange movements.

These adverse impacts were partly compensated by higher net income on debt and equity investments, owing to the realisation of assets in the European region, particularly in the green energy sector.

Banking and Financial Services

In the interim period of FY2020, the division was favourably impacted by the growth in BFS deposits, Australian loan portfolio and funds on platform average volumes, coupled with reduced average headcount primarily due to the realignment of the wealth advice business to focus on the high net worth (HNW) segment.

These were partially offset by lower wealth management fee income associated with realigning the wealth advice business to focus on the HNW segment, increased costs associated with an investment in technology to support business growth and to meet regulatory requirements, and higher credit provisions in business banking loans and leasing.

Commodities and Global Markets

In H1 FY2020, the segment was benefitted by below-mentioned factors.

- strong results across the commodities platform from increased client hedging activity particularly in Global Oil, North American Gas and Power and EMEA Gas and Power, timing of income recognition on storage and transport agreements

- improved foreign exchange, interest rates and credit results driven by increased client activity across all regions

- improved equity trading and retail results primarily in Asian markets

These were partly compensated by higher operating expenses propelled by expenditure on upgrading technology infrastructure and increased cost of the regulatory compliance.

Outlook

In the outlook, the group stated that the impact of market conditions in the future makes predictions challenging. MQG expects the group performance during FY2020 (period ending on 31 March 2020) to be slightly down compared to the previous year.

Also, the short-term outlook is dependent on a range of factors, including the completion rate transactions and period-end reviews, the impact of foreign exchange, potential regulatory changes and tax uncertainties, and the geographic composition of income.

Nonetheless, in the medium term, the group remains well-positioned to register superior performance, backed by factors including:

- deep expertise in major markets

- diversified business

- ability to adapt business mix to dynamic market conditions

- ongoing cost-optimisation program

- conservative balance sheet

- proven risk management framework

Stock Price & Returns

Commanding a P/E of 14.57x, the stock of MQG was trading at $132.750, down by 1.499 per cent, on 4 December 2019 (AEST 01:02 PM). At a market capitalisation of $47.76 billion, MQG is one of the largest financial service companies in Australia.

Over the past five-year period, the stock has delivered a return of +125.10 per cent. Over the past one year, it has delivered a return of +14.59 per cent. On a YTD basis, MQG is up by +26.13 per cent. And, in the past six-month, three-month, and one-month period, the stock has delivered a return of +16.18 per cent, 9.13 per cent and 0.13 per cent, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.