Australia is a popular travel and tourism destination. The aviation industry plays an important part in supporting the business and tourism of the country. In 2017, the industry contributed $15.91 billion to the Australian economy.

Letâs look at few ASX listed aviation related stocks.

Virgin Australia Holdings Limited (ASX: VAH)

Virgin Australia Holdings Limited offers a variety of aviation products and services to all the important segments of the Australian aviation market, which includes government, corporate, low cost, leisure, regional and charter travellers and air freight customers.

ACCC Approves Virgin Australiaâs Application

The Australian Competition & Consumer Commission (ACCC) has approved Virgin Australiaâs application to work more closely with its key alliance partner, Virgin Atlantic. After this agreement, the company would be able to offer a unique Virgin experience all the way to the UK and Ireland for five years.

The alliance would deliver benefits for guests travelling between Australia and the UK/Ireland via Hong Kong, LA and any other future mutual connection points including:

- Through joint management of inventory, more competitive pricing on flights;

- Improved connecting flight experience;

- A consistent customer experience and enhanced products and services;

- Improved reciprocal frequent flyer arrangements, with further opportunities to earn and redeem points.

Highlights of AGM

FY19 was a challenging year for the company, as it reported underlying loss of $71.2 million. At the statutory level, including restructure costs, accounting adjustments and impairment, the business reported a loss of $315.4 million. The company has appointed a new CEO, and the focus of Board was towards ensuring the person had a strong ability to improve the business.

Stock Performance

The stock of VAH was trading at $0.150 per share on 11th November 2019 (AEST 02:06 PM), down 3.226% from its previous closing price. Market capitalisation of the company stood at $1.31 billion. The total outstanding shares of the company stood at 8.45 billion, and its 52-week low and high is $0.150 and $0.220, respectively. The stock has given a total return of -3.13% and -13.89% in the time period of 3 months and 6 months, respectively.

Qantas Airways Limited (ASX: QAN)

QAN Operations:

- Air transportation services for the domestic and international markets;

- Domestic and worldwide holiday tour offerings;

- IT, catering, ground handling, engineering and maintenance, and other related support services.

Qantas Successfully Completes Off-market Buy-Back

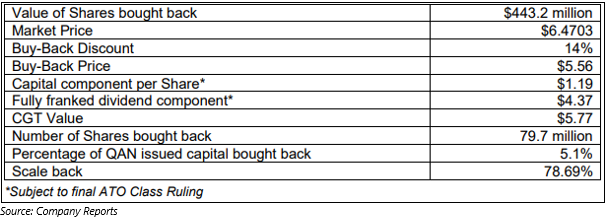

Qantas Airways Limited has successfully completed its off-market buy-back of 79.7 million shares worth $443 million.

The key outcomes of the buyback are given in the table below:

Director of the Company Retires

The company in late October 2019 announced that Richard Goodmanson would retire as a Director of Qantas after serving 11 years on the Board. Mr Goodmanson was appointed to the companyâs Board in June 2008, while his retirement became effective after the conclusion of Qantasâ 2019 Annual General Meeting on 25 October 2019.

Stock Performance

The stock of QAN was trading at $6.815 per share on 11th November 2019 (AEST 02:12 PM), up by 1.565% from its previous closing price. Market capitalisation of the company stood at $10 billion. The total outstanding shares of the company stood at 1.49 billion, and its 52-week low and high is $5.185 and $6.870, respectively. The stock has given a total return of 17.72% and 23.35% in the time period of 3 months and 6 months, respectively.

Auckland International Airport Limited (ASX: AIA)

Auckland International Airport Limited, which opened in 1966, is the 3rd busiest international airport in Australasia, as more than 75% of all international visitors to New Zealand arrive at the airport.

Recently, Elizabeth Savage became part of the companyâs Board as an IND director, following a go ahead for her nomination during the AGM. Meanwhile, Christine Spring was also appointed as an independent non-executive director (IND) of the company, after approval at the AGM.

Highlights of AGM

FY2019 ended 30 June 2019 was a solid year for Auckland Airport, as it reported revenue of $743.4 million, up by 8.7% year on year. Moreover, the total number of travellers increased by 2.8% to 21.1 million, as compared to the previous year. The companyâs operating earnings before interest, taxation, depreciation, fair value adjustments and investments in associates registered an increase of 9.6% to $554.8 million during the reported period.

However, the company reported PAT of $523.5 million, which declined by 19.5%, as the prior yearâs result was boosted by profit on the sale of 24.6% shareholding in North Queensland Airports.

The company declared a final dividend of 11.25 cents per share, up by 2.3% on the prior year, as underlying EPS rose 3.6% to 22.8 cents per share.

Outlook for FY2020

The company is expecting underlying PAT (excluding any fair value changes and other one-off items) to be in between $265 million to $275 million for FY20. The company expects total capital expenditure to be in between $450 million to $550 million

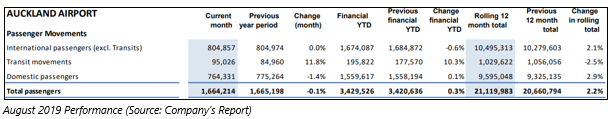

Monthly Traffic Update for August 2019

The total number of passengers decreased by 0.1% in the month of August 2019 as compared to the last year. International passenger volume was in accordance with the pcp; however, domestic passenger volume went down by 1.4%. During the reported month, transit passenger volume grew by 11.8%.

Stock Performance

The stock of AIA was trading at $8.590 per share on 11th November 2019 (AEST 02:26 PM), down by 0.808% from its previous closing price. Market capitalisation of the company stood at $10.52 billion. The total outstanding shares of the company stood at 1.21 billion, and its 52-week low and high is $6.460 and $9.450, respectively. The stock has given a total return of -7.18% and 15.16% in the time period of 3 months and 6 months, respectively.

Sydney Airport (ASX: SYD)

Sydney Airport connects more than 90 destinations around the world.

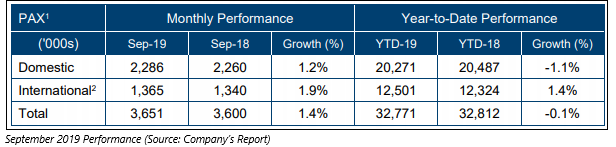

Traffic Performance for September 2019

Recently, the airport updated the market with traffic performance for the month of September 2019. The second consecutive month of double-digit growth was reported by arrivals from India with 11.2% growth year on year and 8.4% growth on a YTD basis in the reported month.

- Indonesian passenger growth was recorded at 16.1% over the previous corresponding period;

- Domestic traffic grew by 1.2% over September 2018;

- International passenger numbers were up by 1.9%.

Changes to Compliance Committee

The responsible entity for Sydney Airport Trust 1, The Trust Company Limited or Sydney Airport, advised following changes to the Compliance Committee.

- Michelene Collopy retired as the chairman and member of the committee

- Johanna Turner appointed as the chairman and member of the committee

The current members of the committee are Johanna Turner, Virginia Malley and Simone Mosse.

Stock Performance

The stock of SYD was trading at $8.885 per share on 11th November 2019 (AEST 02:33 PM), up by 0.966% from its previous closing price. Market capitalisation of the company stood at $19.88 billion. The total outstanding shares of the company stood at 2.26 billion, and its 52-week low and high is $6.330 and $9.045, respectively. The stock has given a total return of 5.64% and 16.56% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.