Arena REIT (ASX:ARF) is an ASX 300 listed, internally managed Australian Real Estate Investment Trust that owns, manages as well as develops social infrastructure properties in Australia. On 13 August 2019, Arena REIT released its FY2019 annual results. The company also unveiled the appointment of a new director.

Annual Results for FY2019:

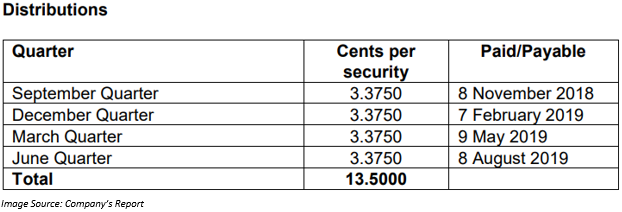

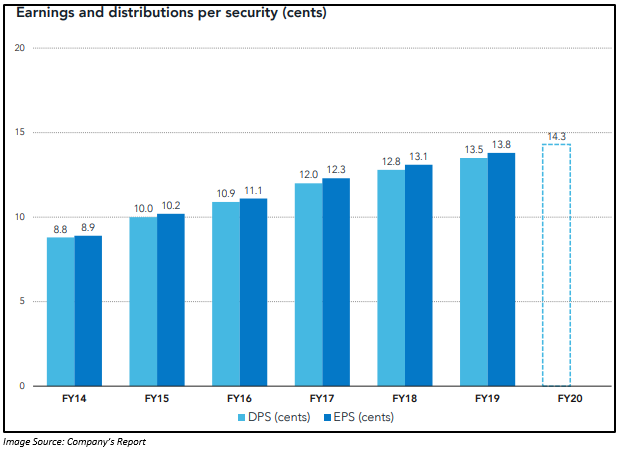

Arena REIT reported a 9% year-on-year increase in net operating profit (distributable income) for FY2019 to $ 37.7 million. Growth in the net operating profit was attributed to increased rental income from annual rent reviews and income from new investment in operating properties, in addition to the completion of development projects during the financial years, 2018 and 2019. The companyâs statutory net profit for the period declined by 8% to $ 59.3 million, as a result of the revaluation of interest rate hedges. Earnings per share went up by 5.3% to 13.8 cents during FY19 when compared with the same period a year ago. For FY19, distributions per security also increased by 5.5% year-on-year to 13.5 cents.

ARF reported an increase of 14% in total assets to $ 825.7 million, mainly driven by acquisitions, development capital expenses as well as the positive revaluation of the portfolio. The 7% growth in net asset value per security to $ 2.10 at 30 June 2019 was majorly attributed to the revaluation uplift. The balance sheet of the company witnessed a growth in net assets from $ 531.643 million in FY2018 to $ 610.330 million in FY2019. Growth in net assets was driven by a significant increase in total assets during the period.

Cash Flow Statement Highlights:

The companyâs net cash inflow from operating activities grew from $ 33.800 million in FY2018 to $ 36.867 million in FY2019. The increased cash inflow was the outcome of a jump in receipts in the course of operations. The net cash inflow through the financing activities of the company was $ 28.238 million in FY2019, down from $ 41.686 million in the same period a year ago. The net cash inflow from financing activities included $ 48.973 million generated through the issue of the companyâs securities and $ 59 million in capital receipts from lenders, in addition to $ 29.565 million, $ 170,000 and $ 50 million in distributions paid to securityholders, loan establishment cost payments and capital payments to lenders, respectively. The net cash available with the company by the end of FY2019 was $ 8.134 million.

Portfolio Overview:

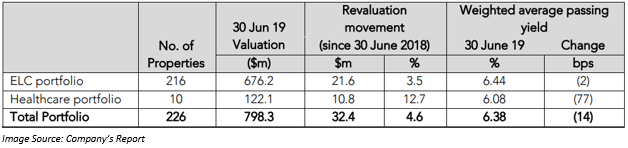

The company continued to maintain its 100% occupancy. The weighted average lease expiry of its portfolio got extended from 12.9 years at 30 June 2018 to 14.1 years at 30 June 2019. The average like-for-like rent review increased by 3.6%. The portfolio of the company consists of 216 ELC properties along with the development sites having 85% of the portfolio by value and 10 healthcare properties, which account for 15% of the portfolio by value.

The healthcare portfolio leases of the company with Healius extended from an average of 4 years to 14.6 years during the period. The company purchased 8 operating properties with a net primary yield of 6.4% for a total cost of $ 47 million, as well as completed 4 ELC development projects at a net initial yield of 6.4% for a total cost of $ 25 million.

Capital Management:

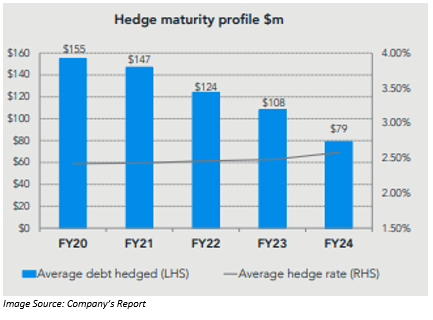

ARFâs syndicated borrowing facility limit grew to $ 280 million in the financial year 2019, representing an increase of $ 50 million. The FY2019 syndicated borrowing facility limit comprised of $ 130 million scheduled to expire on 31 March 2022 and another $ 150 million due for expiry on 31 March 2023. The company completed fully an underwritten institutional placement in May 2019. Through the placement, the company was able to raise $ 50 million. Moreover, via a share purchase plan, it raised $ 16.4 million, and the shares were issued after the end of FY2019.

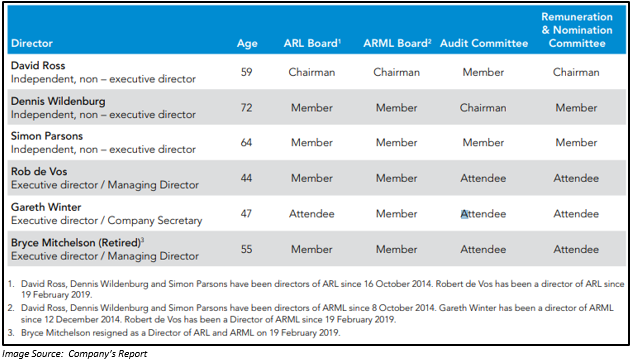

Corporate Governance: The company also released its corporate governance statement for the period ended 30 June 2019, under which it focused on several aspects as well as provided a list of board members as highlighted in the below table:

Outlook for FY2020: The company expects its distribution to increase by 5.9% year-on-year to 14.3 cents per share in FY2020. Moreover, according to the FY2020 outlook, annual rent is expected to grow, of which market rent reviews would include ~ 8% of income in FY2020 and ~ 9% of income in FY2021. As at 30 June 2019, the company has $ 50 million worth of development pipeline, which includes 9 ELC projects. The company would also be looking for new investment opportunities during the financial year 2020. It would invest in those opportunities that fulfil the preferred property characteristics of the company.

Appointment of Independent Non-Executive Director: Another announcement from the company on 13 August 2019 was related to the appointment of Rosemary Hartnett as an independent non-executive director. Rosemary is also the Chair and an independent director of ISPT Pty Ltd. She is also a director of International Property Funds Management Pty Ltd.

Rosemary holds more than 30 years of experience in the Australian property sector as well as extensive senior management experience in property finance. She was earlier holding the position of an independent director of Aconex and Wallara Australia. She was also the CEO of Housing Choices Australia. Rosemary has also worked as a senior property finance executive as well as a fund manager for trading and investment banks like National Australia Bank Limited (ASX: NAB), Australia and New Zealand Banking Group Limited (ASX: ANZ) and Macquarie Bank.

Stock Performance: The shares of ARF have generated a decent YTD return of 13.31%. The shares of ARF opened at a price of A$ 2.810 on 14 August 2019. The stock was trading at A$ 2.800 on 14 August 2019 (AEST 01:17 PM), down by 0.356% as compared to its last closing price. Arena REIT has a market cap of A$ 838.66 million with approximately 298.45 million outstanding shares, an annual dividend yield of 4.8% and a PE ratio of 12.350x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.