Airport stocks are considered as moat stocks because of their competitive advantage. Generally, most of the cities have only one airport due to which, they have a kind of monopoly in that region, which puts them in a strong position to bargain their prices, as airlines and passengers do not have other options but to use the single available airport.

Letâs have a look at the moat stock - Australiaâs Sydney Airport.

Sydney Airport

About the Company: Sydney Airport (ASX: SYD) is Australiaâs one of the most significant infrastructure, as its global gateway and crucial part of the transport network, links more than ninety destinations worldwide. The airport also has significant contribution in the local and national economies and produces $38 billion in economic activity a year. The market capitalisation of the company stood at $18.09 billion (as on 23rd September 2019).

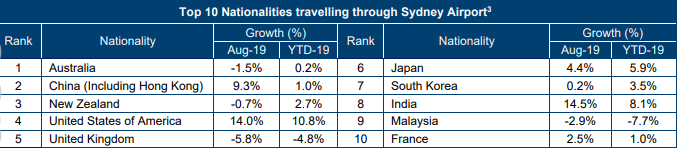

Traffic Performance in August 2019: As per SYDâs release to the market, on 20 September 2019, the traffic from international customers saw an increase of 2% on pcp to ~1.3 million passengers in August 2019. On Year-till-date basis, international customers increased by 1.4% to ~11.1 million. However, domestic passengers declined by 1.3% on pcp to ~2.2 million in August 2019.

The arrivals from USA showed a double-digit growth on year-to-date basis, which shows that there are good load factors on US routes and the attractiveness of Sydney to US travellers.

Passengers from India also showed good growth, with a total increase of 14.5% in August 2019 as compared to August 2018. The company believes that there is still plenty of upside to arrive from the Indian market.

Traffic Performance in July 2019: SYD had declared traffic performance on 20 August this year, wherein it mentioned that the traffic from international customers saw a decline of 2.2% on pcp to ~1.45 million passengers in July 2019. On year-till-date basis, international customers increased by 1.3% on pcp to ~9.76 million. Also, domestic passengers declined by 0.7% on pcp to ~2.3 million in July 2019.

Highlights of the July month-

- Qantas broadcasted that it would be adding an additional three return flights per week which would operate between Sydney and Santiago;

- LATAM Airlines would start a 3/week, non-stop service starting from Santiago till Sydney from November 2019;

- Malindo Air started their opening Sydney flight, opening their daily services to Kuala Lumpur via Denpasar, which added 120,000 seats annually.

1H19 operational Highlights:

On 15 August 2019, SYD provided interim results for the period closed 30 June this year. The highlights of the same is as follows:

- Sydney Airport witnessed 21.6 million passengers for the half year;

- International passengers increased by 1.9 percent, but overall there was a decline of 0.2% due to a decline of 1.5% in domestic passengers;

- The company reported EBITDA of $649.2 million, up 4.1% on the pcp;

- Capital investment of $116.1 million invested in increasing aviation capacity and enhancing customer experience;

- Cost initiatives reduced operating expenses by 1.4% versus pcp.

Companyâs EBITDA grew by 4.1% on the back of international passenger growth of 1.9% and a very good contribution from non-aero businesses.

Financial Highlights:

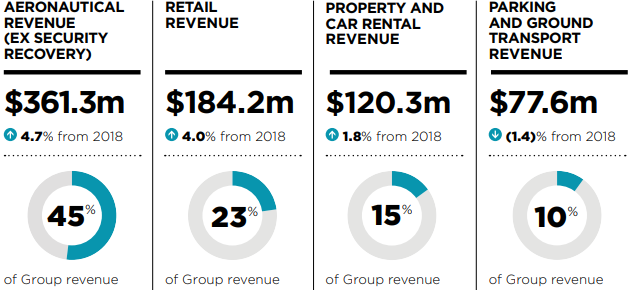

The companyâs top-line increased by 3.4% compared to the pcp, which was mainly due to international passenger growth and a very good performance from the retail business.

- Property and car rental revenue was up by 1.8% reflecting rent reviews, new leases and strong hotel occupancy rates;

- Retail revenue was up by 4% due to duty free performance, the renegotiated advertising contract and 14 new terminal (T2) speciality stores;

- Aeronautical revenue was up by 4.7% due to 1.9% international passenger growth, agreed international charge increases and continued capital investment in aeronautical facilities and the passenger experience;

- Car parking and ground transport revenue was down by 1.4% which was in line with domestic passenger growth.

Segmental Performance Source: Companyâs Report

Segmental Performance Source: Companyâs Report

Future investment of the company:

- Terminal Works: Terminal 1 (T1) would increase baggage handling capacity and automation for the airline community;

- Commercial Capacity: Staged expansion of T2 and T3 speciality retail offerings;

- Aeronautical Capacity: Development of aircraft parking facilities, including upgrades to several active bays and construction of several new layover bays and associated taxiways.

Financial position of the company: The company has a strong balance sheet and credit metrics, with cashflow cover ratio increasing to 3.2x compared to 3.1x for the pcp. The companyâs net debt to EBITDA ratio stood at 6.6x compared to 6.7x for the pcp. SYD had effectively managed its interest rate exposure with 96% of all debt hedged on a spot basis as at 30 June 2019. Foreign currency exposures on offshore debt remained 100% hedged for the life of all facilities.

Cost Control Measures:

- The operating expenses decreased 1.4% or $1.6 million vs prior corresponding period;

- The company is on track for full year decrease in operating expenses;

- The savings realised in this half was mainly due to energy procurement, simplified organisation and other contract negotiations;

- This organisational restructure will benefit in 2H19.

Outlook for Future Years: Sydney Airport has a very strong business model which has a justified history of performance and growth across every economic cycle. The company has given a three-year capex guidance of $0.9-$1.1 billion between 2019-2021 period. Also, in 2019 company would make capital expenditure of $300-$350 million.

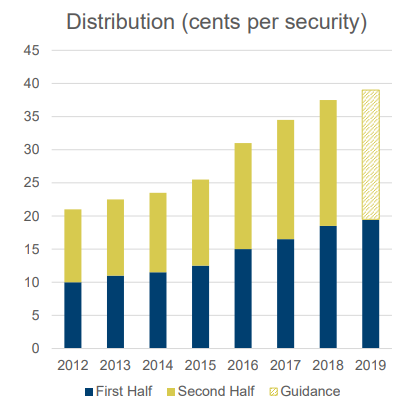

Dividend: The company declared a total dividend of 19.5 cents per share which was 100% unfranked. The dividend/distribution was paid on 15 August 2019.

The company provided distribution guidance of 39 cents per share for 2019 period, which is up by 4 percent from the previous yearâs distribution. The annual dividend yield of the company stood at 4.81% (as on 23 September 2019).

Source: Companyâs Presentation

Stock Performance: On 23rd September 2019, SYD stock was trading at A$8.08, moving up by 0.874 percent (at AEST 11: 54 AM). In the last six months period, the stock has generated a positive return of 11.72 percent. Currently, the stock is trading at a PE multiple of 45.360x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.