The Australian Stock Exchange comprise of more than 600 metals and mining companies, which are listed on it. On 26th Aug 2019, the benchmark index last traded at 6440.1 points with a fall of 1.3% compared to its last close. Besides, the S&P/ASX 300 Metals and Mining (Industry), by the closure of the trading session was at 4,134.2 with a fall of 0.3% from the last close.

Letâs have a look at the three players from metals and mining sector.

Alumina Limited

Alumina Limited (ASX: AWC) is a resource entity in the Australian region. It exclusively concentrates on alumina and owns forty percent of the western side of the globeâs biggest alumina sector, AWAC which has been acknowledged as the leader in the market.

Recently, the company through a release announced that Allan Gray Australia Pty Ltd and its related bodies corporate as investment manager for the funds or investment has made a change towards the substantial holding in AWC, with the current voting power of 6.95 percent as compared to the previous voting power of 5.93% on 20th August 2019.

In another update, the company announced that BlackRock Group (ASX:BKT) and its subsidiaries have become a substantial holder in the company with the voting power of 5.00%, effective 19th Aug 2019.

A look at First-Halfâs Performance

On 23 August 2019, AWC declared the interim report closed on 30 June 2019. The company stated that the tight Western world alumina market conditions of last year have waned in the 1H FY19 period since reduced supply came back on stream and fresh refineries have increased.

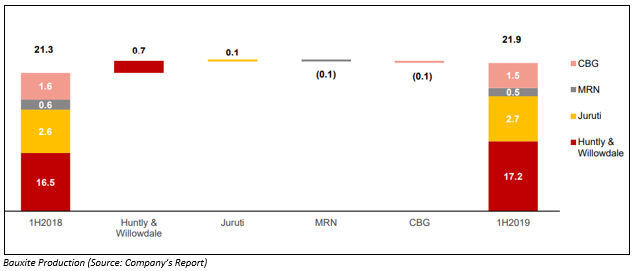

Adding to that for the half-year ended 30th June 2019, the statutory net profit after tax stood at US$210.9 million. On US GAAP basis, the company reported EBITDA and NPAT amounting to ~$950 million and $552 million in comparison to $1,208 million and $737 million in 1H FY18, respectively. It further added that the alumina realised price and alumina production for 1H FY19 stood at $375/t and 6.2 metric tons as compared to $424/t and 6.1mt in 1H FY18, respectively. With respect to AWAC Bauxite, it witnessed improved productions and third-party shipments with production of 19.9 mt in 1H FY19 as compared to 19.1 mt in 1H FY18 and cash cost of mining stood at $10.5/t for the period against $11.7/t of 1H FY18.

The following picture provides an idea of bauxite production for 1H FY19:

Outlook

For FY19, the company is expecting production of Alumina of 12.6 mt and sales of bauxite (third party) of 6.2 mt. It anticipates sustaining capital expenditure and growth capex amounting to $155 million and $55 million. The company is projecting the production of aluminum of around 165,000 tons and SGA shipments expected to be based on alumina price indices or spot of around 94% for the year.

Moving to the stock performance, the stock of Alumina Limited was trading at A$2.105 per share (at AEST 3:23 PM), with a fall of 2.546% during the trading session of 24the August 2019. In the time frame of three months and six months, it witnessed a fall and generated return of -12.55% and -21.17%. When it comes to the time period of one month, AWC provided return of -6.90 percent.

Sims Metal Management Limited

Sims Metal Management Limited (ASX: SGM) is into global metal recycling as well as innovative recycling solutions. Sims Metal Management Limited got listed on Australian Stock Exchange in 2005.

Recently, the company via a release declared its results for FY19 wherein, it communicated about the operational and financial performance for the FY19. The company stated that it is navigating significant market challenges like low turkish demand and volatile purchasing behaviour. There was a decline in the pricing of ferrous and non-ferrous compressing margins. It added that the short-term ferrous price volatility has made for challenging trading conditions.

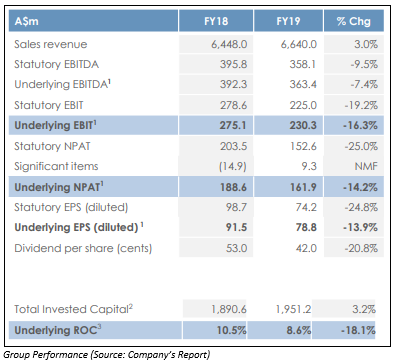

With respect to Employee Health & Safety, it added that the safety remains the prime concern for its employees and community. The company delivered sales revenue amounting to A$6,640.0 million in FY19 as compared to A$6,448.0 million, reflecting a rise of 3.0% on pcp but witnessed a fall of 2.5% on constant currency basis.

The company posted meaningful sales volume growth throughout Australia and New Zealand metals and flat volumes in North American Metals and reported tighter margins across FY19, primarily because of increased short-term volatility and greater fall in non-ferrous shred sales price than shredder feed buy price.

SGM further stated that the underlying EBIT amounted to -$59.4 million, which witnessed a rise of 10.3% over previous corresponding, mainly because of reduced employee benefits expense. With respect to Sims Municipal Recycling, the underlying EBIT stood at $7.4 million, comprising of contract amendment to adjust for the fall witnessed in price of the paper.

The net cash balance of the company stood at $348 million, which continues to support growth initiatives and it anticipates total capital expenditure of $205 million for FY20, which excludes potential bolt-on acquisitions. It further added that the resulting depreciation from current assets and new capital expenditure is anticipated to be around $135 million for financial year 2020.

Sims Metal Management Limited has declared a final dividend amounting to 19.0 cps, 100% franked for FY19. It brought the total dividend for FY19 to 42.0 cents per share, reflecting a 53% underlying payout.

Moving to the stock performance, the stock of Sims Metal Management Limited was trading at A$10.285 per share (at AEST 3:49 PM), with a fall of 1.201% during the trading session of 26th August 2019. In the time frame of three months and six months, it witnessed a positive return of 7.88 percent and -11.48 percent, respectively. When it comes to the time period of one month, SGM provided a return of -1.14%.

BlueScope Steel Limited

BlueScope Steel Limited (ASX: BSL) is involved with the manufacturing of steel. Bluescope Steel Limited got officially listed on Australian Stock Exchange in 2002.

On 23 August 2019, the company announced that it has bought back 102,369 shares on 25 August 2019 at the consideration of $1,268,802.33.

Going forward, on 19 August 2019, the company released the results for the FY19 period closed on 30 June 2019. BSL stated that safety is its priority, considering that the company has released five-year Health, Safety and Environment strategy in FY2019, having greater focus on injury severity and the care taken for the return of its employees to meaningful work. The strategy also focuses on building a strong culture of learning, trust and inclusion. Recently, the company has inked power purchase agreement.

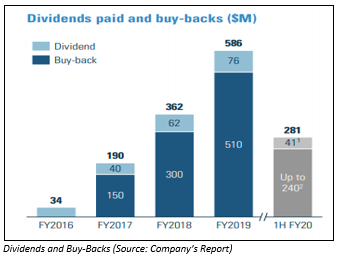

The company delivered underlying EBIT amounting to $1,348 million in FY19, reflecting a rise of $79 million from FY18 and reported free cash flow of $1,304 million with a rise of $573 million on pcp.

From 1st July 2019, the company adopted capitalisation of operating leases under AASB 16, which brings most operating lease commitments onto balance sheet as an asset and a form of debt as well as splits income statement charges between depreciation and amortisation and interest expense. It anticipates no impact in its bank debt facilities from capitalisation of operating leases under AASB 16.

The company posted return on invested capital of 19.5% in FY19, it added that ROIC is the primary measure of performance throughout all business units, and the Group. It is a key discipline for performance management, project assessment and executive incentives.

The companyâs results are being supported by a solid balance sheet and very efficient capital investment ethos comprising of one that balances yearly shareholder returns and long duration profitable growth. The cash balance of BSL stood at $692.7 million, out of which around $150 million was related to timing benefits in working capital. The company would now be aiming towards a revised capital structure of group net debt of approximately zero, as against its earlier mentioned objective of net cash in the ambit of $200 million - $400 million.

In FY19, the company has distributed at least 50 percent of free cash flow to that shareholders, which includes the final dividend of 8 cps and a rise of $250 million for buy-back, which was announced in June 2019 for 1H FY20 period.

Moving to the stock performance, the stock of BlueScope Steel Limited last traded at A$12.33 per share, with a decline of 1.753 percent on 26the August 2019. In the time frame of three months and six months duration, it gave a return of 6.09% percent and -4.42 percent, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.