Why Investors require Dividend?

When a company makes a substantial profit, it has the option to either share it with its shareholders or keep it as earnings and use it for reinvestment in the future. If a company opts to pay dividends to its shareholders, they can be issued as Stock shares, cash payments or other types of property. The companies which pay a portion of their respective profits to the shareholders, allowing them to maintain a steady stream of income, are called dividend stocks. These companies pay a dividend to their shareholders on are regular basis and have a good track of distributing dividends.

Investors invest with the aim of getting a good return. The primary source of attraction for the investors is a good dividend return and they conduct thorough research to ensure they their investments bear fruits. Companies that trade on the stock exchange and have a good record of dividend distribution are the preferred choice for investors.

In most cases, large cap companies pay dividends at regular intervals. These stocks create another source of income (and a steady one) for the investors in the form of dividends.

Let us have a look at the four large caps paying dividends and their recent updates:

Westpac Banking Corporation (ASX: WBC)

Founded in 1917, Westpac Banking Corporation is the oldest bank in Australia and is one of the four major banking organisations in the country. The bank offers a wide range of business, consumer and institutional banking.

Westpac Self-Funding Instalments over securities in iShares Core S&P/ASX 200 ETF (IOZ)

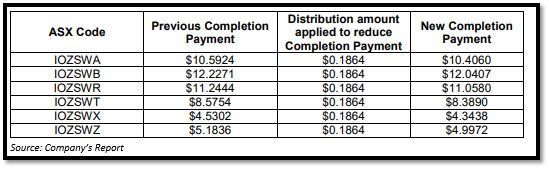

On 03 January 2020, WBC, Westpac Self-Funding Instalments issuer, announced that as mentioned in the Westpac SFIs Product Disclosure Statement, holders direct that distributions be applied to lower the Completion Payment of the Westpac SFIs. The new completion payment would be applicable from the ex-distribution date.

The below-mentioned series of the company’s SFIs will commence trading ex-distribution on the same date as the Underlying Securities are ex-distribution. The company may issue a further notice checking the actual distribution amount.

Dividend Distribution

On 03 January 2020, the company had announced a dividend of $1.016 on the security WBCPG - CAP NOTE 3-BBSW+4.90% PERP NON-CUM RED T-12-21 for the period of three months to be paid on 30 March 2020. The ex-dividend date was 19 March 2020. The declared dividend/distribution will be 100 per cent franked with the dividend distribution base rate of 0.9224 per cent.

To know about the class action lawsuit notice served to the bank on 19 December 2019, click here

Stock Performance

The stock of WBC closed at $24.320 on ASX on 06 January 2020, a decrease of 0.164 per cent from its previous closing price. The company has a market cap of $87.98 billion and approximately 3.61 billion outstanding shares. The 52-week high and low value of the stock is $30.050 and $23.860, respectively. The stock has generated a negative return of 13.06 per cent 0.16 per cent on a six-month and year-to-date basis, respectively.

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited is Australia’s largest business bank that works with all types of business (Small, medium and Large). The company employs over 30,000 people at more than 900 locations across Australia, New Zealand and globally. Recently, NAB had announced that its first quarter trading update would be released on 13 February 2020.

Dividend Distribution

On 23 December 2019, the company had announced a dividend of $0.7718 on the security NABPC - CAP NOTE 3-BBSW+3.50% PERP NON-CUM RED T-03-20 for the period of three months to be paid on 23 March 2020. The ex-dividend date was 12 March 2020. The declared dividend/distribution will be 100 per cent franked with the dividend distribution base rate of 0.9221 per cent.

Results of Annual General Meeting

The company had declared the Annual General Meeting results held on 18 December 2019. Below are the resolutions which were passed during the AGM:

- Adoption of the Remuneration Report for the year ended 30 September 2019

- Re-election of Director - Mr Philip Chronican

- Re-election of Director – Mr Douglas McKay

- Election of Director - Ms Kathryn Fagg

- Selective capital reduction under the CPS II Terms

- Selective capital reduction outside the CPS II Terms

To know about the company’s agreement with Murray River click here

Stock Performance

The stock of NAB closed at $24.520 on ASX on 06 January 2020, a decrease of 0.809 per cent from its previous closing price. The company has a market cap of $72.86 billion and approximately 2.95 billion outstanding shares. The 52-week high and low value of the stock is $30.000 and $23.470, respectively. The stock has generated a negative return of 7.59 per cent 0.68 per cent on a six-month and year-to-date basis, respectively.

Australia and New Zealand Banking Group Limited (ASX: ANZ)

An ASX-listed company, Australia and New Zealand Banking Group Limited offers a wide range of financial and banking services and products. The company’s strategy is to improve the financial wellbeing of customers.

Dividend Distribution

On 20 December 2019, the company had announced a dividend of $0.904 on the security ANZPH - CAP NOTE 3-BBSW+3.80% PERP NON-CUM RED T-03-25 for the period of three months to be paid on 20 March 2020. The ex-dividend date was 11 March 2020. The declared dividend/distribution will be 70 per cent franked with the dividend distribution base rate of 0.914 per cent.

Change of Director’s Interest

On 20 December 2019, the company had announced the change one of its director’s (Shayne Cary Elliott) interest with effect from 19 December 2019. The number of shares held by the director after the change was 295,592 ordinary shares.

Stock Performance

The stock of ANZ closed at $24.620 on ASX on 06 January 2020, a decrease of 0.445 per cent from its previous closing price. The company has a market cap of $70.14 billion and approximately 2.84 billion outstanding shares. The 52-week high and low value of the stock is $29.300 and $23.810, respectively. The stock has generated a negative return of 11.30 per cent and 0.28 per cent on a six-month and year-to-date basis, respectively.

Commonwealth Bank of Australia (ASX: CBA)

Commonwealth Bank of Australia is the country’ largest provider of banking and integrated financial services. The ASX-listed company employs ~49,000 people and has around 16 million customers.

Substantial Holder for Altium

On 02 January 2020, CBA announced that it had become a substantial holder of Altium Limited with effect from 31 December 2019. The number of securities held by the company was 6,562,143 person votes or 5.01 per cent of the voting power.

Dividend Distribution

On 17 December 2019, the company announced a dividend of $0.836 on the security CBAPF - CAP NOTE 3-BBSW+3.90% PERP NON-CUM RED T-03-22 for the period of three months to be paid on 16 March 2020, and the ex-dividend date was 5 March 2020. The declared dividend/distribution will be fully franked with the dividend distribution base rate of 0.895 per cent.

Stock Performance

The stock of CBA closed at $79.770 on ASX on 06 January 2020, a decrease of 0.672 per cent from its previous closing price. The company has a market cap of $142.17 billion and approximately 1.77 billion outstanding shares. The 52-week high and low value of the stock is $83.990 and $69.150, respectively. The stock has generated a negative return of 1.19 per cent and 0.97 per cent on a six-month and year-to-date basis, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.