S&P/ASX 200 Financial sector index settled the dayâs trade at 6054.70 on 16 August 2019 which is ~7.8% down from the recent high made at $6528.60 on July 30, 2109. The major reason can be attributed to the recessionary fear, from the indication of inversion of the US bond yield curve.

Let us look at two important Australian Banking stocks: Commonwealth Bank of Australia (ASX:CBA) and Australia and New Zealand Banking Group Limited (ASX:ANZ).

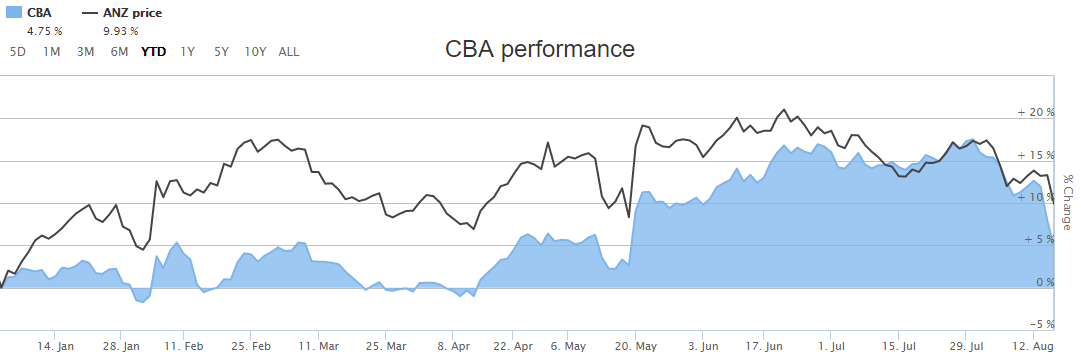

Comparative Performance chart of CBA, ANZ on YTD basis (Source: ASX)

Commonwealth Bank of Australia (ASX:CBA)

Commonwealth Bank of Australia (ASX:CBA) provides financial services to more than 17.4 Mn customers with a focus on retail and commercial banking.

- Retail Banking Services â It provides home loans, customer finance and other banking products and services to personal and business customers.

- Business and Private Banking â It serves banking needs of business, corporate and agribusiness customers across the full range of financial services solutions ranging from banking and advisory services for high net worth individuals.

- Institutional Banking and Markets â It serves the commercial and wholesale banking needs of large corporate, institutional and government clients across a full range of financial services solutions including access to debt capital markets, transactional banking, working capital and risk management capabilities.

- ASB New Zealand â It serves banking and funds management businesses operating in New Zealand.

- Wealth Management â It provides superannuation, investment, retirement and insurance products and services including financial planning.

- International Financial Services â It includes the Indonesian retail and business banking operations and associate investments in China and Vietnam. Other countries include the United Kingdom, the United States, Japan, Europe, Singapore and Hong Kong.

Recent Updates:

CBA equity products group informed the market that RIOIYE has been suspended from trading due to an incorrect Loan amount which was stated at $47.9742; the correct loan amount for RIOIYE has been amended to $44.1397.

CBA changed its stake in Australian Finance Group Ltd, with voting power being reduced from 11.22% to 9.81%, effective August 13, 2019. Its stake in SRG Global limited changed with voting power being reduced from 8.44% to 7.43%, effective August 9, 2019.

Financial Highlights for FY2019 (ended on June 30, 2019): Groupâs net banking operating income was reported at $23,114 Mn as compared to $23,765 Mn in FY2018. Its net funds management operating income was reported at $1,073 Mn as compared to $1,124 Mn in FY2018. Its net insurance operating income for the period was reported at $150 Mn as compared to $241 Mn in FY2018.

The total net operating income before impairment and operating expenses was reported at $24,337 Mn as compared to $25,130 Mn in FY2018. The net profit before tax for the period stood at $11,763 Mn as compared to $13,022 Mn last year while the net profit after tax from continuing operations was recorded at $8,372 Mn as compared to $9,070 Mn in FY2018.

Earnings per share from continuing operations: Basic and Diluted for the period was reported at $473.7 Mn and $457.5 Mn, as compared to $518.8 Mn and $503.2 Mn, respectively, in FY2018.

Balance Sheet:

ASSETS

- Cash and liquid assets: $29,387 Mn ($36,417 Mn in FY2018)

- Receivables due from other financial institutions: $8,093 Mn ($9,222 Mn in FY2018)

- Derivative assets : $25,215 Mn ($32,133 Mn in FY2018)

- Loans, bills discounted and other receivables: $755,141 Mn ($743,365 Mn in FY2018)

- Property, plant and equipment: $2,383 Mn ($2,576 Mn in FY2018)

- Total assets at the end of FY2019 :$976,502 Mn ($975,165 Mn in FY2018).

LIABILITIES

- Deposits and other public borrowings: $636,040 Mn ($622,234 Mn in FY2018).

- Payables due to other financial institutions: $23,370 Mn ($20,899 Mn in FY2018)

- Derivative liabilities: $22,777 Mn ($28,472 Mn in FY2018)

- Total liabilities: $906,853 Mn ($907,305 Mn in FY2018)

- Total shareholdersâ equity: $69,649 Mn ($67,860 Mn in FY2018).

Stock Performance: On August 16, CBA settled the dayâs trade at $75.120, up 1.05% with the market cap of ~$131.6 Bn. Its current PE multiple is at 14.490x and its last EPS was noted at $5.132. Its 52-week high and 52- week low stand at $83.990 and $65.230, respectively, with an annual average volume of 3,398,326. It has generated an absolute return of 0.47% for the last one year, 4.99% for the last six months, and 2.48% for the last three months.

Australia and New Zealand Banking Group Limited (ASX:ANZ)

Australia and New Zealand Banking Group Limited (ASX:ANZ) provides banking and financial products and services to around eight million individual and business customers across 34 markets. Its business is structured across the following divisions:

- Australia â It comprises the Retail and Business & Private Bank business units, providing a full range of banking services.

- Institutional â It services global institutional and corporate customers located in Australia, New Zealand, Asia, Europe, America, Papua New Guinea and the Middle East across three product sets such as Transaction Banking, Loans & Specialised Finance and Markets.

- New Zealand â It comprises the Retail including the wealth management services and Commercial business units providing a full range of banking services.

- Wealth Australia â It provides investment, superannuation, insurance and financial advisory Part of the Wealth Australia division is considered to be a discontinued operation.

- Asia Retail & Pacific â It comprises the Asia Retail and Pacific business units, connecting customers to specialists for their banking needs.

These divisions are supported by Group-wide functions including Technology, Services & Operations and Group centre. Digital Banking forms part of group centre and leads the strategic development and delivery of a superior digital experience for the bankâs customers and staff.

Recent Updates:

The Bank has informed the market about the credit quality, capital and Australian housing mortgage flows as part of the scheduled release of its Pillar 3 disclosure statement for quarter ending June 30, 2019. The total provision charge for the quarter remained broadly flat at $209 Mn as compared with the H1FY19 quarterly average, while the individual provision increased to $258 Mn. The total loss rate was 13 bp which is consistent with the H1FY19 loss rate of 13 bp. Groupâs common equity Tier 1 ratio (APRA Level 2) was 11.8% at the end of June 2019, which is a ~30 bp improvement for the June Quarter compared to 11.5% at the end of March 2019. On a pro-forma basis, inclusive of announced divestments and the recently announced capital changes, ANZâs Level 2 CET1 ratio is 11.5%.

ANZ Group Executive Australia Retail & Commercial Mark Hand stated that they have taken action to give their customer greater certainty by improving turnaround times and providing greater clarity to their bankers, mobile lenders and mortgage brokers about its lending policies. They are witnessing an increase in application volumes following the policy and process changes; the next stage is to maintain that and see it translate into settlements over the coming months.

On August 16, 2019, ANZ stock settled the dayâs trade at $26.390, up 0.61% with a market-cap of ~$74.35 Bn. Its 52 weeks high and low levels was reported at $30.390 and $22.980, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.