What are retail stocks?

The retail industry is amongst the most interesting and volatile investment sectors. Retail stocks are basically the stocks of companies that sell consumer products. Apple, Amazon, H&M and Samsung are few examples of these stocks.

Few examples of retail stocks (Source: Company Websites)

3 factors to consider before investing in retail stocks:

Retail stocks may appear to be easy to understand and relate, but they can be difficult for an investor to make trade-related decisions. Below are the three key strategies that can be followed to pave the investorsâ way to trade in retail stocks:

- Before deciding, investors should assess the retailerâs digital presence, understand the ecosystem and evaluate how the company is engaging its customers online and offline.

- Investors should vigilantly gain knowledge about the methods through which the retailers are selling their products.

- Digital presence is a blessing in the current times. Hence, the retailerâs approach and ability to change and grow should always be well judged before cherry picking the stocks.

Few retail stocks on the Australian Securities Exchange:

Below mentioned are few popular stocks from the retail industry, listed on ASX:

- JB HI-FI Limited (ASX: JBH)

- Nufarm Limited(ASX:NUF)

- Afterpay Touch Group Limited(ASX:APT)

- Nearmap Ltd(ASX:NEA)

- Appen Limited(ASX:APX)

- Super Retail Group Limited (ASX:SUL)

- Harvey Norman Holdings Limited (ASX:HVN)

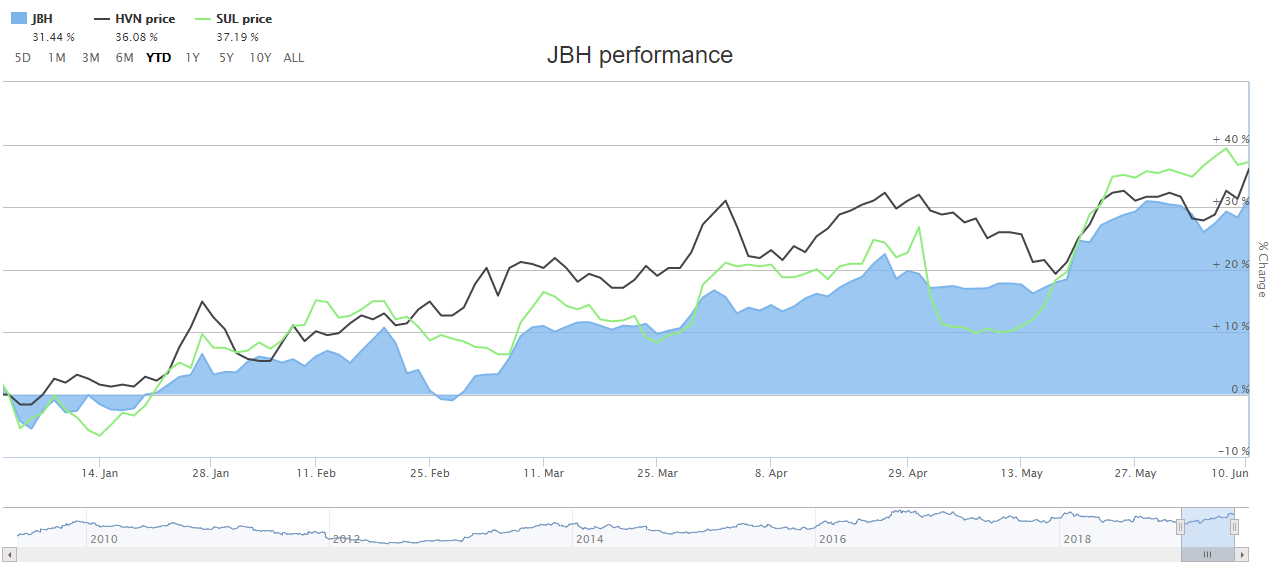

Let us now look at the updates and stock performance of three retail stocks listed on ASX- JBH, SUL and HVN. The below-mentioned graph depicts the upward trend that these three stocks have in their YTD returns:

YTD return graph for JBH, SUL and HVN (Source: ASX)

- JB HI-FI Limited (ASX: JBH)

Company Profile:

Amongst Australiaâs leading home entertainment retailer, JBH has three functional segments, namely The Good Guys, JB HI-FI New Zealand and JB HI-FI Australia. It is a retail company pertaining to consumer electronic products such as televisions and cooking products. Additionally, the company provides information technology and consulting services. JBH has retail stores across Australia and New Zealand.

Recent Updates:

The company, on 30th April 2019, gave updates regarding its 2019 Macquarie Australia Conference, covering its trading and FY19 outlook and sales updates. Let us look at the sales figure region-wise:

- In Australia, JB HI-FI Australia recorded a Q3 FY19 total sales growth of 2.6% and comparable sales growth of 1.5%. The YTD FY19 total sales growth stood at 4.1%, whereas the comparable sales growth was 2.7% for the reported period.

- In New Zealand, JB HI-FI New Zealand recorded a negative Q3 FY19 total sales growth of 1.2% along with a comparable sales growth of 4.6%. The company recorded a 3.7% total sales growth and the comparable sales growth of 10.2% for YTD FY19.

- The Good Guys total sales growth was 2.2% in the period, whereas the comparable sales growth was 1.0%. YTD FY19 total sales growth and comparable sales growth was 2.6% and 1.3%, respectively.

As per its outlook for the financial year ending 30th June 2019, the company expects total group sales to reach circa $7.1 billion. Of the total sales, $4.73 billion, $0.24 billion and $2.15 billion will be contributed by JB HI-FI Australia, JB HI-FI New Zealand (NZD) and The Good Guys, respectively. The Total Group NPAT is most likely to reach $237 million-$245 million, which would be an increase of 1.6% to 5.1% on the pcp.

The companyâs group model has five key enablers, namely Scale, Quality Store Locations, Supplier Partnerships, Low Cost Operating Model and Multichannel Capability, which gives it a unique competitive advantage.

On 29th April 2019, the company announced that it had changed its registered office to Southbank, which would be its principal place of business.

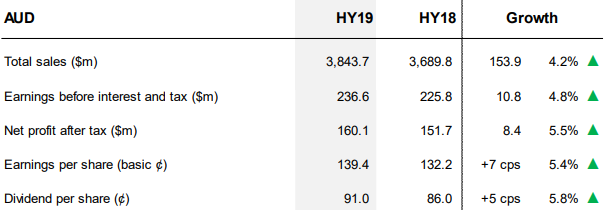

As per the half yearly results provided by the company for 1H FY19 earlier this year, there was a 4.2% growth in the overall sales of the group. The below image showcases the group performance overview:

Group Performance (Source: Companyâs report)

Share Price Information:

The market capitalisation of the stock is A$3.07 billion with 52-week high of A$28.650. After the close of business on 14th June 2019, the stock stood at A$26.580 with 114,883,372 shares traded. It has given a return of 5.31%, 11.74% and 17.58% in the last one month, three months and six months

- Super Retail Group Limited (ASX: SUL)

Company Profile:

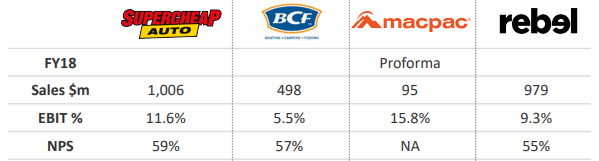

Counted amongst Australasiaâs top 10 retailers, SUL has its headquarters in Brisbane and is a market leader in the retailing of sport, auto and outdoor leisure products across ANZ. The company has more than 670 retail stores and over 12,000 team members in ANZ and China. Some of its brands are BCF, Macpac, Rebel and Supercheap Auto. The company has an annualised turnover of over $2.5 billion.

Company brands (Source: Companyâs report)

Recent Updates:

On 11th June 2019, the company announced that it had appointed a new member on its board. Global retail executive Benjamin Ward will assume the role of Managing Director and lead the companyâs Auto division, Supercheap Auto. He would also join the Executive Leadership Team, w.e.f 29th July 2019. Mr Ward was earlier working as the MD at ALDI Supermarkets for Global Business Coordination in Germany.

Another update on the board side was that Chris Wilesmith, who was part of the Supercheap Auto business, would leave the company in August 2019.

The company gave a presentation at the Macquarie Conference 2019 and provided its product-wise FY18 highlights:

Brands FY18 Performance (Source: Companyâs report)

On the group trading side, the like for like sales were 3.3% YTD to 27th April 2019. The unallocated costs were expected to be circa $21 million, while capital expenditure was circa $85 million.

On the operations side, the company had proposed an Enterprise Agreement of approximately 10,000 retail and clerical team members, which secured approval in November last year. The store wage inflation for the proposed EA over the 4 years is 5.8% in FY20 and FY21 to FY22 circa 2.9%, given the alignment of penalty rates in the first year.

The company appointed retail executive Gary Williams as Managing Director of Sports Retailing, according to an announcement with ASX on 7th March 2019. Gary, who was set to assume his new role on 8th April 2019, was previously working as the CEO at Alceon Retail Group.

Share Price Information:

The market capitalisation of the stock is A$1.82 billion with 52-week high of A$10.440. After the close of business on 14th June 2019, the stock reached A$9.170 with 197,383,751 shares traded. It has given a return of 21.37%, 17.95% and 25.34% in the last one month, three months and six months.

- Harvey Norman Holdings Limited (ASX: HVN)

Company Profile:

Harvey Norman Holdings Limited, which is an Australia-based retailer, deals in the sale of bedding, furniture, consumer electricals, computer and communication products. The key activities comprise integrated retail, franchise, property and digital enterprise. HVN primarily operates as a franchisor and provides franchises across ANZ, South-East Asia and Europe under three of its brand names - Harvey Norman, Joyce Mayne and Domayne.

Recent Updates:

On 27th March 2019, the company made an announcement regarding a new board appointment. John Craven has been appointed as an independent non-executive director w.e.f. 27th March 2019. With prior experience of working with several organisations in both the private and public sector domain, John boosts mix of skills, knowledge and experience at the board.

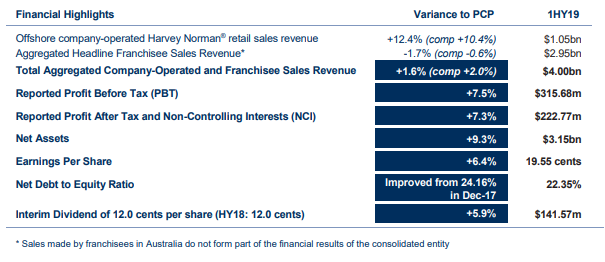

Earlier in February this year, the company announced its results for the half year ended 31st December 2018. It stated that the NPAT and non-controlling interests for the period was $222.77 million, which was up by $15.08 million or 7.3%, from $207.69 million in the previous corresponding period. The companyâs PBT stood at $315.68 million, depicting a 7.5% increase from $293.61 million recorded in the same period a year ago.

One of most interesting outcomes of this result was the Underlying PBT, which was reported to be $297.04 million. This figure was the highest-ever underlying PBT result for a half-year period and the fourth successive record-breaking underlying PBT recorded by the consolidated entity for a half-year period ending December.

Financial highlights (Source: Companyâs report)

Moving over to the offshore performance, there was a 25.4% increase in profitability offshore to $77.53 million during the period, compared with $61.82 million registered in the previous corresponding period. Solid sales at all the overseas Flagship stores and impressive results are pushing market shares and resulting in increased brand awareness.

From the balance sheet overview, the value of net assets increased by 9.3% to $3.15 billion in the first half of FY19, up from $2.88 billion as at 31st December 2017 (pcp).

Share Price Information:

The market capitalisation of the stock is A$4.71 billion with 52-week high of A$4.340. After the close of business on 14th June 2019, the stock reached A$4.040 with 1,179,736,590 shares traded. It has given a return of 0.50%, 5.00% and 22.77% in the last one month, three months and six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.