As people are becoming more aware of their carbon footprints; world is gradually moving towards the use of low carbon emission vehicles and in this gradual shift, players which will get benefitted are all the players which are related to the production of electronic vehicles batteries. One of the major constituents in battery making is: Lithium. Lithium, also referred to as âWhite Petroleumâ, is a major component in green energy storage and in the coming years its demand is expected to increase exponentially. Letâs take a quick look at the recent updates of a few lithium players trading on ASX.

De Grey Mining Limited (ASX:DEG)

De Grey Mining Limited (ASX: DEG) is a mining company. The company is engaged in exploration activities in Australia. The current market capitalisation of the company is A$53.5 million.

Recently, company announced its 100% ownership of Indee Gold with 3 operating rigs. Through this ownership, company gets 1.7 Moz resource base and potential for substantial resource growth. The three rigs currently operating in funded in the next phase of exploration.

The company entered into an agreement to gain ownership of Indee Gold Pty limited and the deal was for $15 million.

This acquisition has now been successfully completed with the final payment of $9.7 million cash and 59 million shares in De Grey, representing a 6.3% equity holding.

Since entering the option agreement, De Grey has:

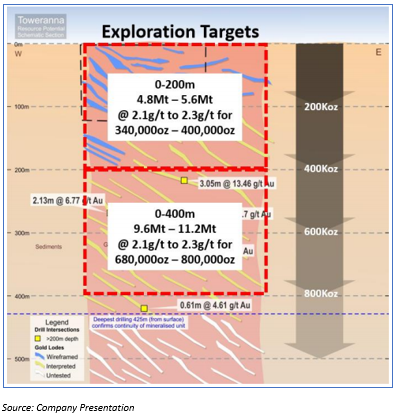

- Aggressively explored the Indee Gold tenement package, expanding the resources from 9.15Mt at 1.8g/t Au for 538,000 oz to 17.79Mt @ 2.0 g/t for 1,141,400 oz.

- Added significant new resources centres that were not part of the 2017 resource estimate, notably Mellina and Toweranna

- Defined significant new targets with substantial new resource potential.

The exploration strategy remains focused on growing resources towards an initial corporate target of 3.0 Moz and a parallel regional thrust targeting new discoveries along 200km of highly prospective shear zones and exciting intrusion targets.

Exploration drilling re-commenced in early August and 3 drill rigs are currently operating. Resource extension RC and diamond drilling is underway at Toweranna and Withnell and over 10,000m of air-core drilling has been completed across various regional targets. A strong news flow is expected to come in a few months.

Stock Performance: On 6th September 2019, the stock of DEG closed at a price of AUD 0.057, and near to the 52-week low of 0.052. The stock has a market cap of around AUD 53.5 million and approximately 938.95 million outstanding shares. The company is trading at a PE multiple of 28.500x. In the previous six months the company has given a negative return of 37.31%.

Piedmont Lithium Limited (ASX:PLL)

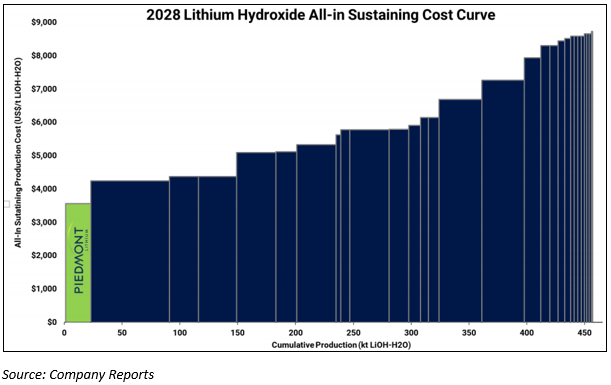

Piedmont Lithium Limited (ASX: PLL) is an emerging lithium chemicals company focused on the development of its 100% owned Piedmont Lithium Project in North Carolina, with the goal of becoming a strategic domestic supplier of battery grade lithium hydroxide and other chemicals to the growing electric vehicle and the battery storage markets in the United States.

The company owns 4 drill campaigns on the project and now has total 333 drill holes with 52,441 meters of drilling.

This project is equipped with a lithium hydroxide chemical plant which has been supplied with spodumene concentrate from an open pit mine and concentrator. This particular project has good economies of scale due to attractive operating costs, long mine life, short transportation distances, and low corporate income taxes.

The integrated Piedmont project is expected to have a sustainable cost (AISC) of approximately $3,700/tonne, including royalties, making Piedmont as the industryâs lowest cost producer.

Stock Performance: On 6th September 2019, the stock of PLL closed at a price of AUD 0.105, trading near to its 52-week low of 0.091, with a market cap of around AUD 81.54 million and approximately 815.38 million outstanding shares. In the previous six months the stock has given a negative return of 4.76%.

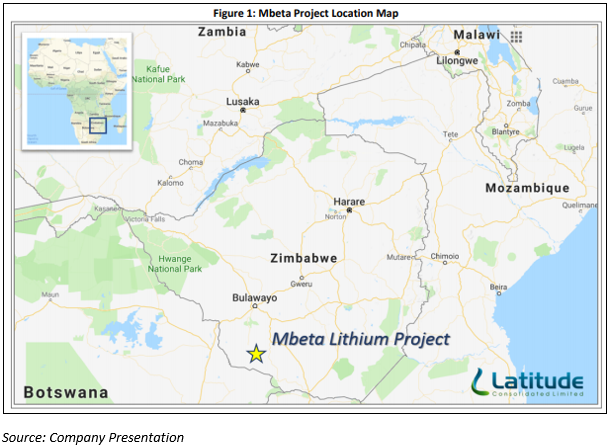

Latitude Consolidated Limited (ASX:LCD)

Latitude Consolidated Limited (ASX: LCD) is an ASX-listed Perth based resources-based company currently focused on lithium opportunities in Zimbabwe. LCD also has a portfolio of gold tenements in Western Australia.

Recent announcements: Company released its quarterly activities report. Important activity that took place was that it acquired 70% interest in the Mbeta Lithium Project in southern Zimbabwe. The company paid US$50,000 (AUD $71,089) in full to Zimbabwean national Robert David Hutchings.

The key commercial terms of the agreement are as follows:

- Payment to the owner of the cash sum of US$50,000 on signing of the agreement as a non-refundable deposit

- Payment to the owner of the cash sum of US$50,000 on registration of the transfer of the Mbeta claims into the JVCO

- Issue to the owner and its nominees a total of 6 million fully paid ordinary shares in the capital of LCD within 7 days following the receipt of the approval from the shareholders of LCD

- LCD will finance all exploration by the JVCO up to the completion of a Definitive Feasibility Study.

Further opportunities explored in Zimbabwe and other locations: Latitude continues to evaluate several potential investment opportunities in Zimbabwe and Zambia. The company has performed due diligence on several prospects.

Stock Performance: On 6th September 2019, the stock of LCD closed at a price of AUD 0.016, with a market cap of around AUD 4.4 million and approximately 275.18 million outstanding shares. On YTD basis, the stock has given a negative return of 11.11%.

Core Lithium Limited

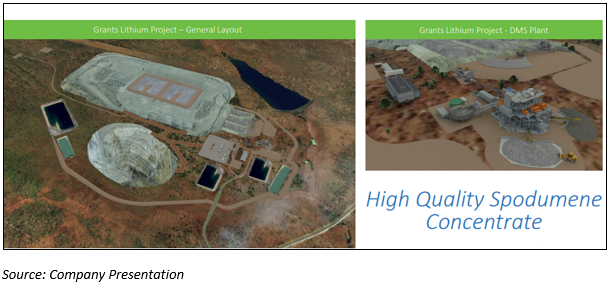

Core Lithium Limited (ASX: CXO) is into lithium production. It is in the process of developing high-potential Finniss Lithium Project. This project is located near Darwin in the Northern Territory in Australia.

Coreâs Finniss Lithium Project is poised to contribute to the global demand with a Northern Territory project uniquely characterised by:

- Lower capex

- Lower transport and operating costs

- Lower technical risks

- High quality/ low iron spodumene concentrate

- Healthy margins

- All leading to faster returns and paybacks

Core has established binding offtake and prepayment agreement with Sichuan Yahua Industrial Group Co. and is also in the process of negotiating further offtake and finance agreements with some of Asiaâs largest lithium consumers and producers. Yahua is considered as one of the major suppliers of lithium salts in China.

Core has made an agreement with Darwin Port to ship 250,000 tpa of spodumene concentrate. Darwinâs port is Australiaâs nearest port to China and is well suited to handle potential future production from Coreâs lithium projects. Heads of agreement have been signed with Darwin Port in respect of potential export of lithium products from Grants. Agreement provides Core with capacity to export up to either:

- 250 ktpa of spodumene concentrate

- 1Mtpa of spodumene Direct Shipping Ore (DSO)

Stock Performance: On 6th September 2019, the stock of CXO closed at a price of AUD 0.038, trading near to its 52-week low of 0.035, with a market cap of around AUD 30.76 million and approximately 788.66 million outstanding shares. On YTD basis, the stock has given a negative return of 26.42%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.