Insurance market in Australia majorly comprises of three components including life insurance, general insurance and health insurance. Most of the companies in the industry have recently expanded their scope of services and are now competing with banks and subsidiaries of foreign companies.

Now let us have a look at few ASX-listed stocks in the insurance sector.

Insurance Australia Group Limited

Insurance Australia Group Limited (ASX: IAG) is a company which has expertise in general insurance services. The company also provides corporate and investment services.

Shareholder Resolutions: The company recently disclosed regarding the shareholder resolutions to the considered at its AGM to be held on 25 October 2019. One of the resolutions pertains to Amendment to the Constitution. The proposed amendment is to insert a clause 10.3A âAdvisory resolutionsâ, into the companyâs constitution. Another resolution represents the request for disclosure of targets for reduction of investment exposure to fossil fuel assets.

Change in Directorsâ Interest: The company recently updated on changes in its directorsâ interests. Sheila Mcgregor acquired 8,584 shares for a consideration of $66,740.60. Michelle Tredenick acquired 3,116 ordinary shares for a consideration of $24,195.74. Elizabeth Bryan 6,678 shares worth $51,821.28 and Peter Harmer acquired 266,186, valued at $2,076,250.80.

Appointment of Group General Counsel: In another recent announcement, the company updated that Peter Horton has been appointed as the Group General Counsel. Mr Peter Horton is an Executive Manager at TransGrid. His tenure with IAG is expected to begin by the end of 2019.

Dividend Distribution: The company recently declared an ordinary dividend amounting to AUD 1.1508, to be paid on 16 September 2019.

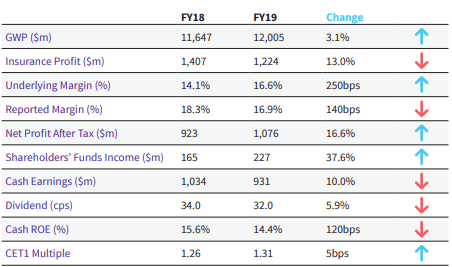

FY19 Financial Performance: During the year ended 30 June 2019, the company reported gross written premium amounting to $12,005 million, up 3.1% on prior corresponding period GWP of $11,647 million. Insurance profit for the year amounted to $1,224 million, down 13.0% in comparison to year-ago profit of $1,407 million. Net profit after tax amounted to $1,076 million, up 16.6% on corresponding prior -year period NPAT of $923 million. Cash earnings for the period stood at $931 million, down 10.0% on year-ago period cash earnings of $1,034 million. During the year, the company declared a dividend amounting to 32.0 cents per share, down 5.9% on corresponding prior-year period dividend of 34.0 cents per share.

Key Financial Indicators (Source: Company Reports)

FY20 Guidance: The company expects to report low single-digit growth in gross written premium compared to that in FY19. Reported insurance margin for the period is expected to be in the range of 16% - 18%.

Stock Performance: The companyâs stock given return of 4.34% in the prior six months. The stock closed at $8.060, up 1.639% over the previous close on 30 August 2019. The market capitalisation of the stock is $18.33 billion.

Suncorp Group Limited

Suncorp Group Limited (ASX: SUN) provides insurance. Additionally, the company provides banking and wealth management services. Target customers include retail, corporate and commercial customers. The operations of the company are mostly based out of Australia and New Zealand.

Change in Directorâs Interest: The company recently updated that Lindsay Tanner acquired 1,900 ordinary shares for a consideration of $13.15 per share. As per another update, Simon Machell, director of the company, acquired 10,000 ordinary shares for a consideration of $13.33 per share. Another director, Sally Herman, acquired 4,000 ordinary shares valued at $13.84 per share. Ian Hammond acquired 5,000 ordinary shares for a consideration of $13.50 per ordinary share.

FY19 Results: During the year ended 30 June 2019, the company reported cash earnings amounting to $1,115 million, up 1.5% year over year from $1,098 million in FY 2018. Net profit after tax for the period amounted to $175 million, down 83.5% from prior corresponding period NPAT of $1,059 million. The UITR ratio for the period was 12.3%, as compared to 10.6% in similar prior-year period.

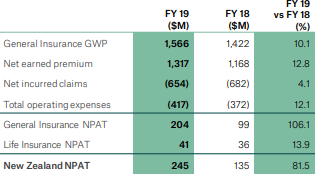

Profit after tax was an increase of 1.0% due to good performance by New Zealand. Profit after tax from New Zealand was reported at $245 million, up 81.5% from the corresponding period of prior year. Gross written premium amounted to $1.6 billion, up 10.1% in comparison to FY18.

Performance â New Zealand (Source: Company Reports)

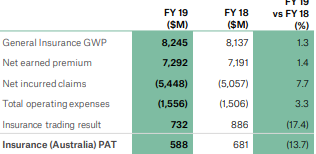

Insurance (Australia) âs profit after tax was $588 million, down 13.7% compared to the corresponding period of prior year. This ismainly due to higher natural hazard claims. Gross written premium stood at $8.2 billion, up 1.3% in comparison to FY18.

Performance â Insurance Australia (Source: Company Reports)

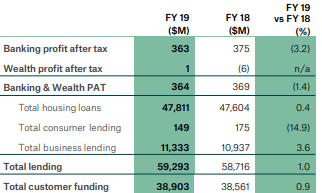

Banking & Wealth segment reported a profit after tax amounting to $364 million, down 1.4% in comparison to the prior corresponding period. Gross loans and advance were $59.3 billion, up 1.0% over the prior corresponding period of prior year.

Performance â Banking & Wealth (Source: Company Reports)

Dividend: In May 2019, the company paid a special dividend of 8 cents per share,. Final ordinary dividend amounted to 44 cents per share and this lead to ordinary dividend of 70 cents per share for the full year with payout of 81.2% of earnings.

Outlook: New Zealand is expected to perform well in FY20 with low single-digit growth levels. The company will increase FY20 natural hazard allowance to increase from $720 million to $820 million. In addition, for $200 million ,the group has purchased an additional stop loss for $45 million. As a result of cost pertaining to stop loss cover and increase in natural hazard allowance, the companyâs target to achieve at least 12% underlying ITR in FY20 will be impacted.

Stock Performance: The stock gave negative returns of 0.52% and 2.02% over a period of 1 and 3 months, respectively. The stock closed at a market price of $13.810, up 1.172% on 30 August 2019.

QBE Insurance Group Limited

QBE Insurance Group Limited (ASX: QBE) is a company which specializes in reinsurance services. It is also involved in management of Lloydâs syndicates and investment management services.

Share Buy-Back: The company recently updated that it has bought back 300,000 shares for a total consideration of $3,663,810.

Senior Management Changes: The company recently released an announcement providing the changes to senior management positions. Todd Jones was appointed as the CEO, North America after Russ Johnston stepped down from the role. Jonesâ tenure with QBE will commence from 01 October 2019.

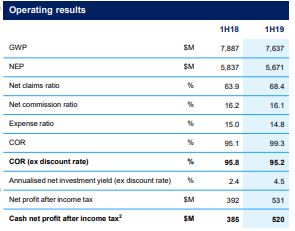

1H19 Financial Highlights: During the first half year of 2019, statutory net profit after tax was $463 million. It increased 29% in comparison to that in the corresponding prior-year period. Cash profit after tax amounted to $520 million, increasing 35% in comparison to that in prior year period ($385 million). Adjusted combined operating ratio of the group stood at 95.2%, less than the mid-point of FY19 target range of 94.5% - 96.5%. Gross written premium for the half was reported at $7,637 million compared to $7,887 million in prior corresponding period. The companyâs debt to equity ratio reduced to 36.8%, from 38.0% in FY18. An interim dividend of AUD 25 cents per share was also declared, as compared to AUD 22 cents per share in prior corresponding period.

Financial Results Summary (Source: Company Presentation)

FY19 Guidance: In FY19, the company expects to report a combined operating ratio in the range of 94.5% to 96.5%. Net investment return for the year is expected to be in the range of 3.0% - 3.5%.

Stock Performance: The stock of the company generated negative return of 0.48% and a positive return of 5.27% over a period of 1 month and 3 months, respectively. The stock has closed at a market price of $12.530, up 1.13% on 30 August 2019.

AMP Limited

AMP Limited (ASX: AMP) is engaged in investment management and retail banking businesses.

The company recently updated that Standard & Poor lowered its ratings on the company and its subsidiaries by one notch due to pending divestment of AMP Life. The companyâs rating moved from A- to BBB+.

Share Purchase and Recent Capital Raising: The company recently opened its Share Purchase Plan, providing equity holders a chance to get up to A$15,000 worth of shares at a discount. Recently, the company has also completed an institutional placement to raise A$650 million, through issue of approximately 406.3 million fully paid ordinary shares to new and existing institutional investors.

1HFY19 Results: During the six months ended 30 June 2019, the company generated underlying profit amounting to A$309 million, supported by earnings growth in AMP Capital and resilient AMP Bank performance.

Operating earnings for AMP Capital were reported at A$120 million, up 27.7% in comparison to prior corresponding period value of A$94 million. Other business units witnessed a decline in operating earnings. AMP Life reported at decline of 68.7% on prir-year corresponding period operating earnings at A$31 million. Australian wealth management reported operating earnings of A$103 million, as compared to A$204 million in the corresponding prior-year period. New Zealand wealth management witnessed a fall of 21.4% at A$22 million in 1H19 compared to A$28 million in 1HFY18. AMP Bank reported operating earnings worth A$71 million, down 9.0% in comparison to A$78 million in prior-year corresponding period.

Business Unit Results (Source: Company Reports)

AMP Strategy: The company also disclosed its three-year transformational investment program worth A$1.0 billion â A$1.3 billion, to drive growth, reduce costs and de-risk the business. Over the period, the company will undertake cost reduction initiatives to deliver annual run-rate cost savings of $300 million by FY22.

Stock Performance: The companyâs stock generated negative returns of 30.13% over a period of 6 months. The stock closed at a market price of $1.695, up 1.497% on 30 August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.