What are REITs?

Real Estate Investment Trusts are diversified and professionally managed portfolio of real estate assets. Through these assets, investors get access to a mix of assets, including commercial, industrial or retail. These assets offer investors an option of income alternatives at times of low interest rates when investing in other direct assets like bonds and term deposits. It provides a potential for capital growth, liquidity and stable returns.

Dexus Property Group

Dexus Property Group (ASX:DXS) primarily engages in the management and development of high-quality real estate assets and manages real estate funds. In a recent announcement on 7th June 2019, the company issued a notice of Change in Directorâs Interest. Wallace Richard Sheppard participated in the Securities Purchase Plan and bought 1,239 securities for a consideration of $15,000.

In the update on North Shore Property Tour on 5th June 2019, the company reported that the New South Wales office markets performed strongly. The group also reported a positive outlook for the North Sydney office market.

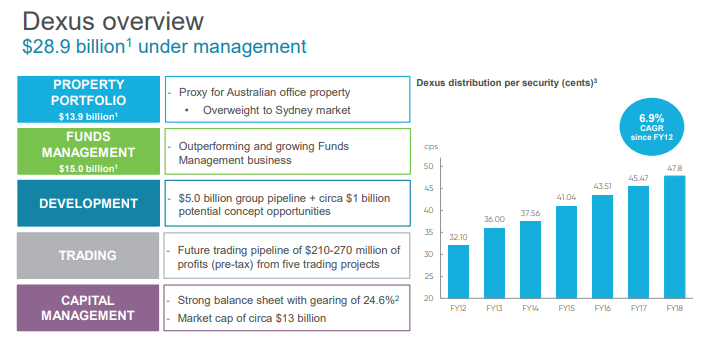

As at 31st March 2019, Dexus reported assets under management amounting to $28.9 billion. The company has so far leased 61,099 sqm of office space, 46% of the demand solely coming from cross-border buyers. On the industrial front, the company has leased 46,193 sqm of space with Western Sydney driving lease volumes. Overall, all the sectors provided attractive long-term returns with the Office sector demonstrating lower income volatility.

Assets under management (Source: Company Presentation)

With the positive office market fundamentals, a pipeline of development projects and quality partners to invest through the cycle, the company is well positioned to add value to the business. Furthermore, the company reaffirmed the market guidance for 12 months ending 30th June 2019 at a distribution per security growth of about 5%.

The companyâs stock is currently trading at a market price of $13.530, up 0.595% on 11th June 2019, with a market capitalisation of $14.75 billion. The stock has generated positive returns, including 21.50% for the past six months and 27.85% YTD.

GPT Group

GPT Group (ASX:GPT) owns and manages a portfolio of $14 billion assets in retail, office and logistics property assets. The Group has a total of $24 billion assets under management together with its fund management platform. In the most recent announcement to the exchange on 27th May 2019, the company issued a notice of Change in Directorâs Interest. Robert William Johnston acquired 585,864 performance rights at a price of $6.06 at the close of trading on the date of issue.

The company has been continuously working towards its growth strategy in the logistics sector. Recently, it purchased five prime logistics properties in Sydney for a consideration of $212 million and a total lettable area of 88,200 sqm. The group has also begun logistics development of 26,000 sqm at Truganina in Melbourne.

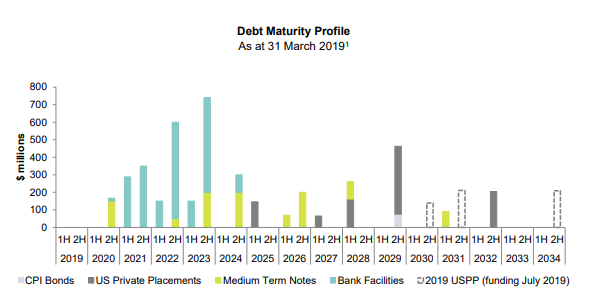

As per the operational update for the quarter ending 31st March 2019, 47,000 sqm of office leases were signed with office portfolio occupancy of 97.1%. Total Retail Speciality MAT growth during the period was 1.9% as compared to 3.6% during the previous quarter. Total Centre MAT growth was 1.3% as compared to 2.4% in the previous quarter. The company opened its $432 million Sunshine Plaza expansion with 50% ownership. During the period, the company issued US$400 million US Private Placement debt for an average term of 12.9 years. This is expected to provide credit strength to the company and continued access to global debt markets.

Debt Maturity Profile (Source: Company Reports)

With strong leasing position in office space and growth plans in logistics with acquisitions taking place, the company is heading towards its growth plans. The retail segment will also continue to maintain high occupancy despite subdued conditions. The 2019 guidance for both funds from operations per security and distributions per security is estimated at 4% for the full year.

The stock of the company is currently priced at $6.140, up 1.488% on 11th June 2019. It has a market capitalisation of $10.92 billion. In addition, the GPT stock has generated positive returns, including 10.20% for the past six months and 13.94% YTD.

Charter Hall Retail REIT

Charter Hall Retail REIT (ASX:CQR) is primarily engaged in the business of property investment. The company recently updated the investors that Vinva Investment Management has become a substantial shareholder with 5.01% of the voting power. In another announcement, the company also notified about the completion of its Unit Purchase Plan, wherein a total of about $14,733,137 was raised with 3,266,771 units to be issued at $4.51 per unit.

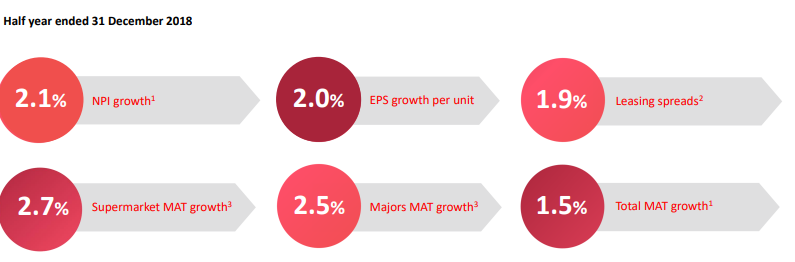

During the first half of FY19 ended 31 December 2018, Charter recorded operating earnings of 15.61 cpu and distribution of 14.28 cpu, both reporting an increase of 2% on pcp. The statutory profit for the period stood at $55.5 million or 13.89 cpu. Net tangible assets per unit amounted to $4.22. The occupancy rate remained stable at 98.1%. The like-for-like NPI growth was reported at 2.1% as compared to 1.8% as at June 2018.

Key highlights for half year ended 31 December 2018 (Source: Company Reports)

During the period, Charter maintained a disciplined investment strategy to enhance the quality and earnings of its portfolio. In parallel, the company executed a deal to acquire Campbellfield Plaza in Melbourne for a price of $74 million, which will offer Charter a secured income profile with its dominance in terms of quality. The company continued the strategy to divest smaller assets by selling two lower growth assets for $76.1 million.

Charter has a potential for high growth with its active asset management, strategic redevelopments and asset acquisitions. The FY19 operating earnings growth guidance is 2%. The distribution payout ratio is estimated to be in a range of 90% to 95% of operating earnings.

The companyâs stock is currently trading at $4.670, up 2.188% on 11th June 2019, with a market capitalisation of $2.01 billion.

Vitalharvest Freehold Trust

Vitalharvest Freehold Trust (ASX:VTH) provides investors with access to agricultural property assets. As per the announcement to the exchange, Industry Super Holdings Pvt Ltd ceased to be a substantial shareholder of the company.

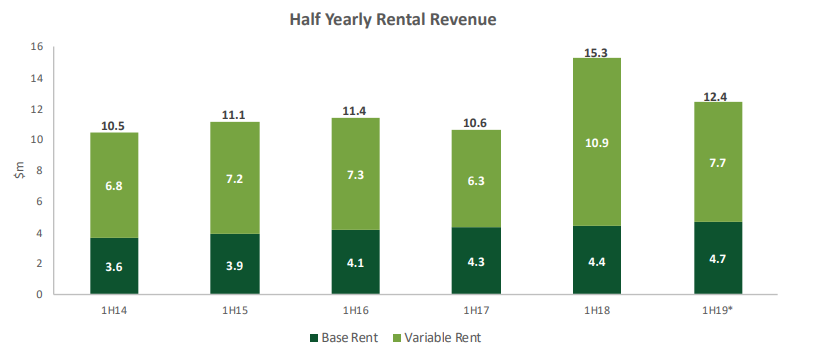

The company reported rental revenue of $10.7 million for the five months from its IPO and $12.4 million for the six months ended 31st December 2018. Net loss after tax for the five months from IPO amounted to $8.2 million. Gross assets as at 31st December 2018 amounted to $283.3 million, including $5.2 million in cash and cash equivalents.

Rental Revenue (Source: Company Presentation)

With respect to the market, export demand for Australian citrus was favourable despite the value slightly going down in comparison to 1H â18. Domestic citrus prices for 1H â19 were lower as compared to 1H â18. Blueberry wholesale prices were stronger with weaker raspberry prices as compared to 1H â18.

Going forward, the company has tremendous growth opportunities in the form of higher berry yields, better weather conditions, more access to water and increased irrigation efficiency. The CapEx contributed by VTH will act as a driver for base rent.

The stock of the company is currently trading at $0.930, down 0.535% on 11th June 2019, with a market capitalisation of $172.97 million.

Rural Funds Group

Rural Funds Group (ASX:RFF) is primarily engaged in the leasing of agricultural properties and equipment. It currently has a portfolio of $923 million assets.

During the half year ended 31 December 2018, Rural Funds Group made multiple acquisitions, including three cattle feedlots, three cattle properties and cotton property. Earnings were reported at 7.73 cpu, up 17% on pcp, adjusted funds from operations at 6.4 cpu, up 7% and distributions per unit of 5.22 cents, up 4%.

HY19 Financial Results (Source: Company Presentation)

In March, the Indonesia-Australia Comprehensive Economic Partnership Agreement was signed by Australia and Indonesia, which will help to increase the export opportunities by removal or reduction of tariffs on the products. Overall, 1H FY19 was a period of improved earnings resulting from acquisitions, sale of unleased annual water allocations and independent valuation of Kerarbury almond orchard.

RFF has forecasted FY19 AFFO yield of 6% for FY19 and payout ratio of 79%. DPU for FY19 and FY20 is estimated at 10.43 cents and 10.85 cents, respectively. FY19 AFFO is estimated at 13.2 cpu.

The stock of the company is currently trading at a market price of $2.300, up 0.877% on 11th June 2019, with a market capitalisation of $762.12 million.

Arena REIT

Arena REIT (ASX:ARF) invests in a portfolio of investment properties. The company recently raised $50 million by conducting an institutional placement of around 18.7 million securities at $2.67 per Security. The proceeds will be used to fund acquisitions and development of other properties. For the quarter ending 30th June 2019, Arena REIT distributed 3.375 cents per stapled security.

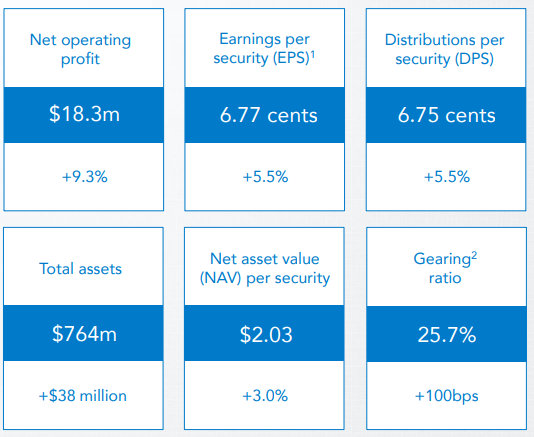

During 1HFY19, ARF reported a net operating profit of $18.3 million, up 9.3% on pcp. Earnings per security stood at 6.77 cents, up 5.5% on pcp and distributions per security at 6.75 cents, up 5.5% on pcp. Growth in rental income from annual rent reviews and new income from acquisitions and development contributed to the above performance. During the period, the company acquired two operating ELC properties and completed three ELC development projects, with two ELC development sites acquired. Arena has forecasted a total cost of $21 million for four ELC projects in the pipeline. As per results for 1H19, Arena reaffirmed FY19 DPS guidance at 13.5 cents, reflecting a growth of 5.5% over FY18.

Financial Highlights for 1H19 (Source: Company Presentation)

The companyâs stock is currently trading at a price of $2.810, up 1.812% on 11th June 2019, with a market capitalisation of $804.06 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.