Counted amongst the top countries of the world for technological readiness, Australia is known for its steadily growing services and technology sectors. The countryâs transition to a services-based economy is driving the development of new technologies in education, health, agriculture, financial services, among other sectors. Australia is currently commercialising and developing new disruptive technologies in a range of sectors. As per Austradeâs Australia Benchmark Report 2019, the country has around 700 Fintech start-ups, 500 Medtech companies, 350 Edtech companies and 300 Agtech and Foodtech companies.

In Australia, the businesses have expanded with the adoption of new technologies, including robotics, remote sensors, autonomous systems and artificial intelligence. The adoption of new technologies has increased connectedness, improved quality of life and brought well-paying jobs for people of all qualifications in Australia.

The technology sector of Australia is one of the strongest sectors, that has grown substantially over the years. The S&P/ASX 200 Information Technology Index has delivered a return of more than 30 per cent in 2019 so far (calculated till 23rd September 2019).

ASX-Listed Tech Stocks

There are multiple Australian companies engaged in the information technology sector that are listed on the Australian Stock Exchange (ASX). Let us discuss five of them in some detail below:

ReadyTech Holdings Limited

An ASX-listed software company, ReadyTech Holdings Limited (ASX: RDY) offers mission-critical people management software for facilitators, employers and educators of career transitions. The company holds around 20 years of experience in employment and education that enables it to deeply understand its customersâ businesses and needs.

Financial Performance

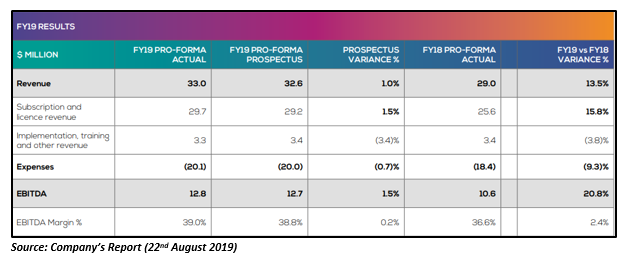

During FY19, the company reported a rise of 27.7 per cent in its revenues from ordinary activities to $32.7 million, and an increase of 13.5 per cent in its pro forma revenue to $33 million. The companyâs pro forma EBITDA was 1.5 per cent ahead of prospectus forecast and 20.8 per cent up on FY18, at $12.8 million during the period.

Stock Performance

As at 2:52 PM AEST on 24th September 2019, RDY is trading higher at $1.845, with a rise of 2.5 per cent. The stock has delivered returns of 14.65 per cent and 3.45 cent in the last three months and one month, respectively.

Volpara Health Technologies Limited

A MedTech SaaS company, Volpara Health Technologies Limited (ASX: VHT) was founded ten years ago on research originally conducted at Oxford University. The companyâs technology and services have been used by research projects and/or customers in thirty-eight countries and are supported by numerous trademarks, patents, and regulatory clearances, including CE marking and FDA clearance.

Financial Performance

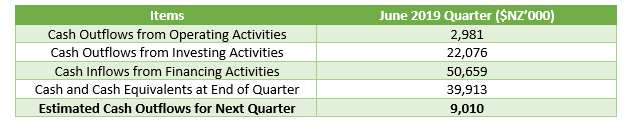

The company released its quarterly results for the June 2019 quarter in July this year. The companyâs cash receipts from customers for Q1 rose by 137 per cent to NZ$2.3 million. The company had a cash balance of NZ$39.9 million as at the end of the quarter. The below table summarises the key financial metrics reported by the company:

Stock Performance

VHT is currently trading at $1.515 (as at 2:52 PM AEST on 24th September 2019), with a fall of 1.3 per cent relative to the last closed price. The stockâs market cap was recorded at $334.73 million, with approximately 198k shares in rotation. The stock has generated a substantial return of 213.75 per cent since it commenced trading on the ASX.

Whispir Limited

A global SaaS provider, Whispir Limited (ASX: WSP) was founded in 2001 to deliver a communications workflow platform that automates communication between people and businesses. The companyâs products enable organisations to strengthen their communications via automated communication workflows to ensure shareholders receive timely, useful, accurate and actionable insights in a manner that is responsive to individual preferences and contexts.

The company has recently progressed its expansion into the North American market via new channel partner collaborations, new product innovations, AWS Partner certification and a new contract with US healthcare company.

Financial Performance

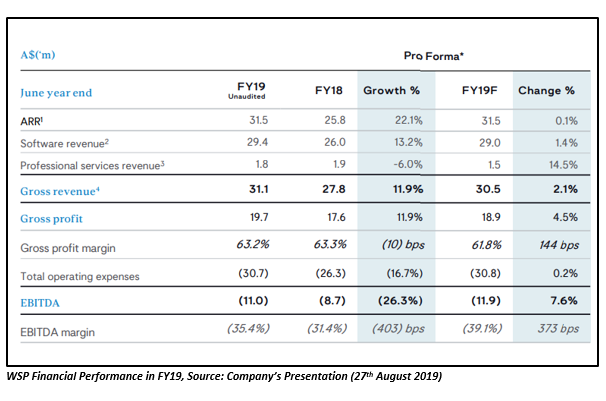

The company outperformed its Prospectus forecasts during the financial year 2019. Its revenues were $0.6 million ahead of Prospectus forecast, and 12 per cent up to $31.1 million. The companyâs Pro-forma gross margins surpassed Prospectus forecast by 144bps, standing at 63.2 per cent. Although the company recorded negative EBITDA of $11.0 million during the period, it was 8 per cent or $0.9 million ahead of Prospectus estimate. The companyâs Annualised Recurring revenue was in line with Prospectus projection, at $31.5 million, witnessing a rise of 22 per cent from FY18.

Stock Performance

As at 2:52 PM PM AEST on 24th September 2019, WSP is trading at $1.485 on the ASX, with about 26k shares in rotation. WSPâs 52-week high and low value were recorded at $1.740 and $1.150, respectively. The stock has delivered a return of 4.56 per cent in the last one month.

Bigtincan Holdings Limited

New South Wales-headquartered Bigtincan Holdings Limited (ASX: BTH) assists service and sales teams to improve customer satisfaction and win rates. Bigtincanâs Artificial Intelligence-powered, mobile sales enablement automation platform showcases premium user experience that promotes team-wide adoption and encourages representatives to more efficiently connect with customers and prospects.

Recently, the company has secured a 3-year contract for $2.8m total contract value with US-based Nike, Inc for a retail deployment.

Financial Performance

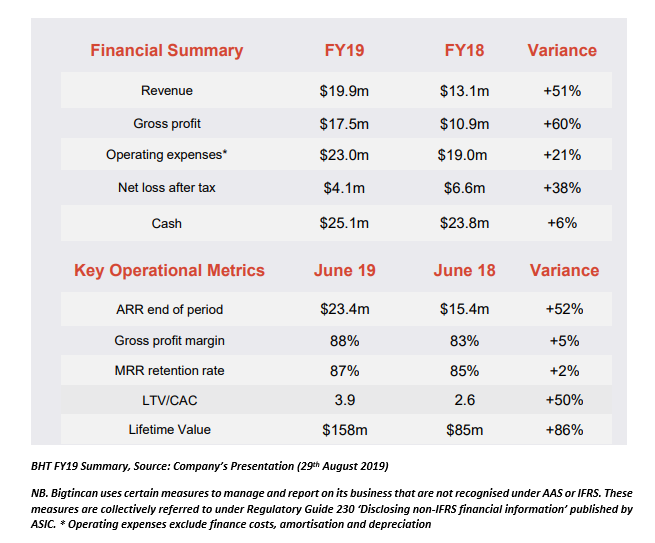

The company announced its financial results for the 12 months ended 30 June 2019 in August this year. The revenue of the company from ordinary activities improved by 51 per cent on pcp to $19.9 million during the period. The loss of the company attributable to its members was 38 per cent down on pcp at $4.13 million.

The companyâs Annualised Recurring Revenue and Subscription revenue grew by 52 per cent and 60 per cent to $23.4 million and $18.5 million, respectively in FY19.

Stock Performance

BTH is trading lower at $0.595, with a fall of 0.83 per cent relative to the last closed price (As at 2:52 PM AEST on 24th September 2019). The stockâs market cap was recorded at $157.16 million, with approximately 747k shares in rotation. The stock has generated a substantial return of 157.92 per cent since it began trading on the ASX.

Splitit Payments Ltd

A New York-headquartered global monthly instalment payments solution business, Splitit Payments Ltd (ASX: SPT) is a payment method solution that allows its customers to make payment for their purchases with their existing credit or debit card by dividing the cost into fee-free monthly payments and interest, without additional applications or registrations.

Recently, the company announced that its Chief Executive Officer post would be taken by the companyâs Managing Director, North America, Brad Paterson from 1 October 2019.

Financial Performance

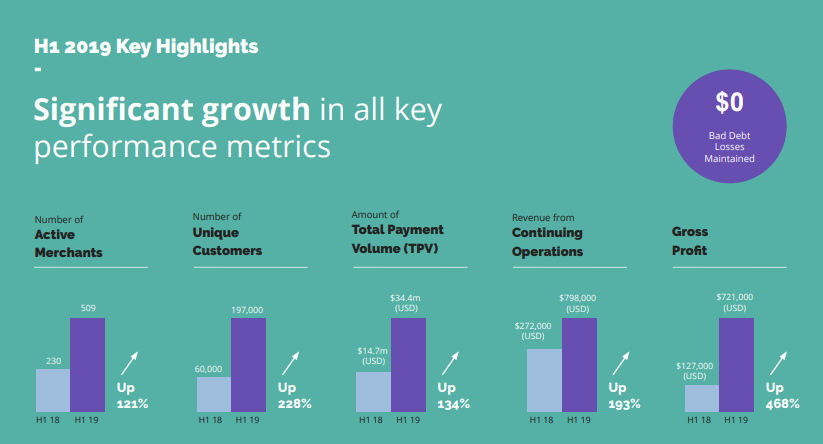

The company reported strong growth across its key operational performance metrics during the half-year ended 30 June 2019. The company recorded a growth in Active Merchants, Unique Customers (shoppers) and Total payment volume by 121 per cent, 228 per cent and 134 per cent, respectively on pcp. The revenue of the firm from continuing operations also improved by 193 per cent on pcp, to US$798k.

Source: Companyâs Presentation (30th August 2019)

Source: Companyâs Presentation (30th August 2019)

Stock Performance

As at 2:52 PM AEST on 24th September 2019, SPT is trading higher at $0.50 with a rise of 2.04 per cent and with about 752k shares in rotation. The stock has delivered negative returns of 55.66 per cent and 28.47 per cent during the last six months and three months, respectively. However, it has generated a return of 15.29 per cent in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.