Retail Sector is that part of economy where businesses sells their goods through stores or through internet to the public. The one way this sector is different from the other sectors is that the retail sector does not create its own products, instead purchases the products in bulk from the other manufacturers.

Some of the retail stocks are:

The Reject Shop Limited

The Reject Shop Limited (ASX: TRS) is engaged in retailing discount variety merchandise.

AGM Address to Shareholders:

The top management of the company addressed the shareholders at the 2019 Annual General Meeting of the company and stated that the sales during the year went down by 0.8% to $793.7 million and comparable store sales went down by 2.5%. During the year, EBITDA of the company also decreased by 57.6% year over year to $18.2 million.

Outlook:

The sales trajectory of the company has improved significantly with respect to the overall comparable sales rate in the previous year. The first seven weeks of FY20 have achieved total sales of 0.7% on prior corresponding period and comparable sales went down by 0.5%. The positive impact of both strategic and immediate tactical changes is expected to continue to benefit the underlying business earnings in FY20.

Stock Performance:

The stock closed at $2.280 on 17 October 2019. The annual dividend yield of the stock stands at 9.46%. The market capitalisation of the stock is $64.18 million.

Harvey Norman Holdings Limited

Harvey Norman Holdings Limited (ASX: HVN) is engaged in integrated retail, franchise and property and digital. The company operates under a franchise system in Australia and offers its customers an unparalleled range of retail products embedding technological innovation.

HVN- Renounceable Pro Rata Entitlement Offer:

Harvey announced to raise approximately $173.49 million from pro rata entitlement offer, under which Shareholders were offered the opportunity to acquire 1 fully paid ordinary Share (New Share) for every 17 Shares held by Eligible Shareholders at the issue price of $2.50 per New Share. The company received applications for 66,270,064 New Shares from Eligible Shareholders representing 95.5% of all Shares offered.

HVN- Sale of Interest in The Byron at Byron Resort:

Harvey Norman have completed agreements for sale of the Byron at Byron Bay Resort on 30 September 2019.

Outlook:

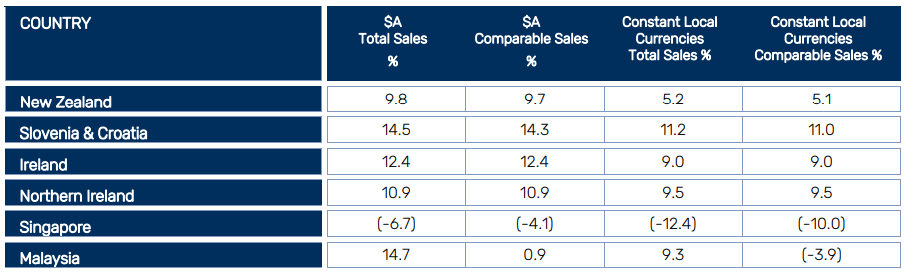

The company intends to grow its international retail footprint and expects to open 21 stores overseas within the next 2 years. By the end of 2021 it expects to have 111 Harvey Norman stores across 7 offshore countries. Sales growth from company-operated stores in New Zealand, Slovenia, Croatia, Ireland and Northern Ireland have been strong for the first 2 months of the 2020 financial year.

Overseas sales revenue (Snapshot Source: Companyâs Annual Report)

Stock Performance:

The stock closed at $4.100 on 17 October 2019 with an annual dividend yield of 8.25%. On the valuation front, the stock is trading at a P/E multiple of 11.530X with the market capitalisation of $4.72 bn.

Kogan.com Limited

Kogan.com Limited (ASX: KGN) is a portfolio mix of retail and services business and earns majority of its revenue from sales of goods and services to Australian customers.

Dividend/Distribution â KGN:

The company announced an ordinary fully paid dividend of AUD 0.082 per share on 20 August 2019 which was paid on 14 October 2019.This was the final dividend declared for FY 2019.

Gross sales crossed Half a billion dollars in FY 2019:

The company showed a year-over-year growth of 41.6% on their exclusive brand portfolio business in FY 2019 and Kogan mobile commission-based revenue went by 9.8% compared to the prior year. During the financial year 2019, gross sales crossed the half a billion dollars mark and EBITDA went up by 15.6% year over year.

Outlook:

Kogan will launch Kogan Money Super, Kogan Money Credit Cards, Kogan Mobile New Zealand and Kogan Energy Kogan Money Super, Kogan Money Credit Cards, Kogan Mobile New Zealand and Kogan Energy in FY2020. The company will also scale up and will launch new verticals which will diversify income across its portfolio. This will allow the company to become a stronger business for customers and shareholders alike.

Stock Performance:

The stock closed at $6.860 on 17 October 2019. The stock has delivered a return of 48.86% in the past 6 months and is trading at a P/E multiple of 35.690X.

Kathmandu Holdings Limited

Kathmandu Holdings Limited (ASX: KMD) is a retailer of clothing and equipment for travel and adventure.

Kathmandu completes Institutional Bookbuild:

On 4th October 2019, Kathmandu Holdings Limited announced that it has successfully completed the institutional bookbuild component of its fully underwritten 1 for 4 pro-rata accelerated entitlement offer of new fully paid ordinary shares raising a total of NZ$145 million.

Capital Change notice:

Kathmandu Holdings Limited issued 44,374,676 Ordinary shares for the issue price of NZ$2.55 on 11 October 2019.

Dividend Distribution â KMD:

The company declared dividend of NZD 0.14117646 per ordinary fully paid share which was paid on 11 October 2019.

Year of record sales and profit in FY 2019:

The company delivered another year of record sales and profit in FY 2019 where the sales went up by 9.7% year over year to NZ$545.6m and net profit increased by 13.6% over the prior year to NZ$57.6m. The company scored an âAâ in the ethical fashion report two years running and was ranked second in the textile exchange report for three consecutive years. The online sales growth went up by 9.2% at the constant exchange rate and operating costs took a dive of 2.5% as percentage of sales over the prior year.

Stock Performance:

The stock closed at A$2.900 on 17 October 2019. The return from the stock was 36.84% in the past 6 months and the stock was trading at a P/E multiple of 11.800X.

Myer Holdings Limited

Myer Holdings Limited (ASX: MYR) is engaged in the operation of the Myer departmental store business.

FY19 Financial Performance (for the year ended 27 July 2019)

- During the year, total sales went down by 3.5% to $2,991.8 million while comparable store sales were down by 1.3% excluding sales in Apple products.

- Operating cash flow before interest & tax was increased by $8 million to $138 million during the year and capex went down to $45 million reflecting a heightened focus on return hurdles, particularly in an environment of subdued consumer sentiment during the second half of FY 2019.

- During the year, Earnings before interest, tax, depreciation and amortisation increased by 7.2% to $160.1 million and Net profit after tax pre-implementation costs and individually significant items was up by 2.2% to $33.2 million.

Outlook:

The company is expecting the challenging environment to continue during the FY20 but has identified several opportunities to improve productivity and to reduce costs via high cost savings and efficiencies. During the FY20, the company will further invest in the online business with several key improvements to be introduced ahead of Christmas 2019, and a renewed focus on developing customer value and business integration of MYER one is also expected.

Stock Performance:

The stock closed at $0.575 on 17 October 2019, up by 7.48% in the past 3 months. The market capitalisation of the stock is $472.24 million, trading at P/E multiple of 19.17X.

Woolworths Group Limited

Woolworths Group Limited (ASX:WOW) is engaged in the retail operations across Australian food, Endeavour drinks, New Zealand Food, Big W and Hotels. The group also has online operations for its primary trading divisions.

Marley Spoon AG (ASX:MMM) Secures A$8m Funding Deal:

Woolworths Group invested $4 million in Marley Spoon AG, a leading global subscription-based meal kit provider for a term of six months bearing an interest at a fixed rate of 7% p.a.

Dividend Distribution â WOW:

The company declared a dividend of 57 cents per share which was paid on 30 September 2019.

Outlook: The company unlocked value for customers and shareholders in FY20 and revived Australian Food after a slower 1H FY19. The company is expecting the continued sales growth with an increase in the roll out of Metro stores. New Zealand Food focused on prices, fresh quality and experience and build out of âSimpler for Woolworths New Zealandâ program. The company is also anticipating the reduction in losses as unprofitable stores are closed.

Stock Performance: The stock closed at $37.930 on 17 October 2019 and has a dividend yield of 2.66%. The market cap of the company is $48.32 billion, and the stock is trading at a P/E multiple of 18.580X.

Super Retail Group Limited

Super Retail Group Limited (ASX: SUL) is engaged in retailing of auto parts and accessories, tools and equipment, sporting equipment and apparel and operation of specialty retail stores in the automotive, tools, leisure and sports categories.

Dividend Distribution â SUL: The company declared a dividend of AUD 0.285 per share which was paid on 26 September 2019.

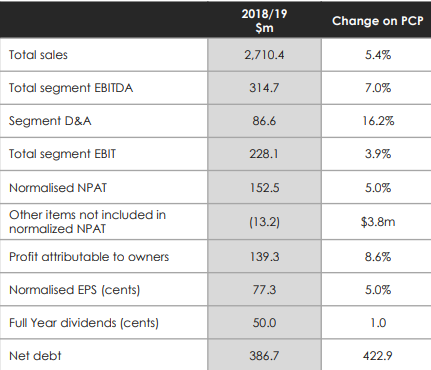

Business Highlights for the year ended 29 June 2019

- The company had over six million active customers in loyalty programs and loyalty club members represent over 56% of total Group sales.

- The online sales went up by 25% to over $200m. During the year, total group sales went up by 5.4% to $2.71 billion and EBITDA increased by 7% on the previous prior corresponding period.

Financial Performance (Source: Companyâs Presentation)

- During the year, Return on Capital increased to 13.3% and remains above WACC and Basic EPS increased by 8.6% on previous corresponding period to 70.6 cents.

Stock Performance: The stock closed at $9.240 on 17 October 2019 and has an annual dividend yield of 5.35%. The stock delivered a return of 13.61% in the past 6 months and is trading at a P/E multiple of 13.240X.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)