We will be discussing remote identity verification and payment authentication company, iSignthis Ltd (ASX:ISX), which has emoney, transactional banking, IBAN issue and payment processing capability under its operating activities.

The company offers services like end-to-end onboarding service for its merchants, through a unified payment and identity service via its in-house Paydentity⢠and ISXPay® solutions.

Let us have a look at iSignthis Ltd and its recent updates below:

iSignthisâ Business Segments

iSignthis has developed ISXPay®, Paydentityâ¢, Probanx® CorePlus and CoreConnect platforms inhouse, that have allowed it to deliver a financial ecosystem and provide advanced services to both merchants and retail customers.

ISXPay®

ISXPay® is a primary member of the prestigious regulatory bodies like Visa Inc, Diners, Discover, Mastercard Inc, Union Pay International and JCB International. Through this segment, the company offers merchants with access to payments via alternative methods including SEPA, Poli Payments, Sofort, and others.

Paydentityâ¢

iSignthis Paydentity⢠service is primarily designed for regulatory entities and is the reliable back office solution. The solution allows merchants to stay ahead of the regulatory curve and concentrate on the growth of their respective businesses.

Probanx Information Systems Ltd (Probanx®)

It is a wholly owned subsidiary of iSignthis Ltd. The company operates across banking software segment and has been serving the industry from 2000. The operating activities include integrated banking software services to several global banks. The company has a client base located across the five continents. The company offers the core banking software and integrated services to its retail clients also.

UAB Baltic Banking Service (BBS)

The company has another subsidiary named, UAB Baltic Banking Service, which is engaged in providing API based solutions to SEPA business schemes, SEPA Core and SEPA Instant, primarily for emoney institutions, neobanks, banks and credit unions. This segment also acts as a bridge to the CENTRO Link service of Central Bank of Lithuania. The company provides services to several other regulated entities.

Operational Updates

Recently, the company has updated regarding the following operational activities:

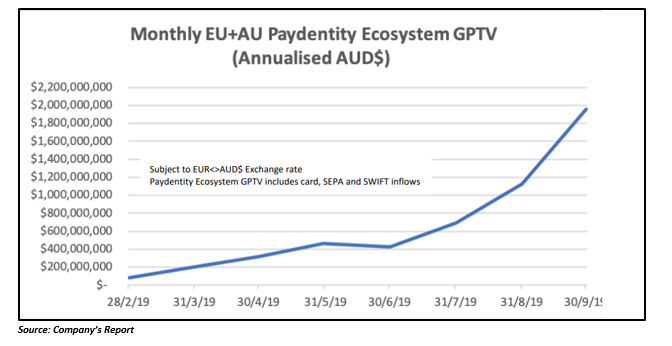

- iSignthis reported that its Actual Annualised GPTV has increased by 360%, surpassing $1.9 billion from 30th June 2019 to 30th Sept 2019. The company recorded this growth within the EU and AU Paydentity ecosystem in terms of actual processed transactional volumes. The above growth falls in line with the guidance and is driven by the onboarding of new business customers.

- Last month, ISX updated that annualized GPTV exceeds $1.1bn in August this year, up by 160% from June 2019, on account of volumes growth from the EU and AU regions. The company also informed that Business Customer approvals grew by 28% to 270 from 30 June 2019.

- The company stated that its MSF (Merchant Services Fee) segment was consistent with targeted 125 Bps ecosystem average. Paydentity ecosystem continues to deliver growth as a new business service offering, along with keeping a focus on growth through multiple revenue lines and customer acquisition, including eMoney accounts and card acquiring growth.

- In the Business Customer Group segment, the company reported that the approvals ending for the third quarter have improved by 45% to 304, relative to 210 as at 30th June 2019.

- As reported that the Paydentity ecosystem delivered growth on account of business service offering.

Financial Performance During the Half-Year Ended 30 June 2019

iSignthis Ltd declared its H1 FY19 results on 28th August 2019, wherein the company reported a revenue of $7.5 million, higher by 49% year-on-year. The company also posted a statutory loss after tax of $0.73 million versus a loss of $2.93 million in H1 FY18.

The company reported EBIT of $0.3 million during H1 FY19, adjusted for non-cash share-based payments, compared to $2.85 million in H1 FY18. The company recorded a positive cash flow position during the mid-May. The company posted that it has successfully achieved to secure both positive EBIT and cashflow during the second quarter of FY19.

The company stated that the Client Funds held during H1 FY19 were around $34 million. The company expects that MSF from the EU Tier 1 Network has continued to improve as expected, in line with new client onboarding and rising processing volumes.

ISX posted $9.9 million of cash balance and total assets at $51.81 million during the first half of FY19. Net Assets during H1FY19 stood at $12.86 million.

Operating Highlights After H1 FY19

ISX also announced an agreement with the Asia Pacific (Singapore) based regional subsidiary of Visa Inc during August 2019 (Australian Principal Member Licensing Agreement).

The business posted actual annualized monthly GPTV at July circa at $830 million, an increase of 96% from 30th June 2019. As far as the companyâs approvals are concerned, it came out at 240 as compared to 210 during the 2Q FY19, delivering a 14% growth.

Acquiring approvals stood at 95 against 80 approvals during the second quarter of the financial year. EMA approvals stood at 145 during the quarter versus 130 in the 2Q FY19. Apart from the approvals, the marketing team has updated about a major pipeline of several merchant applications which are being processed by the underwriting team.

The company revised its operating cost base during August 2019 to circa $11 million per annum from $8.75 million, which includes new product initiatives to aid further revenue generation opportunities.

The management cited an EBITDA target of $10.7 million for the financial year 2019. The management also expects growth from the electronic money and card services.

Stock Update

The company has informed about substantial change in shareholding where one of its directors named Timothy Hart acquired 500,000 Ordinary Shares as on 02 September 2019, and his present shareholding stands at 15,641,220 fully paid ordinary shares.

ISX ended last traded at $1.070 on 1st October 2019. The stock has generated a stellar return of 50.7% and 262.7% during the last three-months and six-months, respectively. However, the stock has performed negatively during the last one month delivering 11.93% return.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.