A rational investor prefers investing in dividend-paying stocks. But why? The answer lies to the fact that these stocks give investors an option to re-invest the earned dividends back into the firm. Also, dividend-paying stocks help investors grow their investment bucket in the long run. The companies that offer dividends and on sustained basis are considered to be more stable than their non-dividend paying counterparts. This is so because generally, only the well-established companies distribute their earnings back to the shareholders.

Many real estate companies listed on the Australian Stock Exchange have a track record of paying steady and high-yield dividends on a regular basis. Let us discuss two of these companies that have recently announced their dividend updates:

Aventus Group

Australiaâs largest fully integrated developer, owner and manager of large-scale retail centres, Aventus Group (ASX: AVN) has a portfolio of 20 centres that are spanned over 535,000m2. Aventus Group consists of Aventus Capital Limited (entity accountable for Aventus Retail Property Fund) and Aventus Holdings Limited (AHL). The group aims to offer investors with consistent returns by building a superior portfolio of large-scale retail centres across Australia.

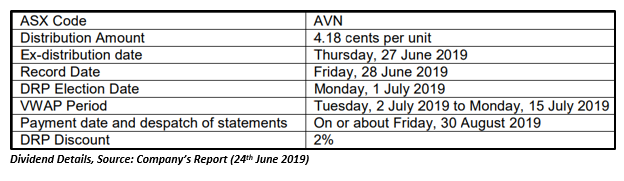

Dividend Update: Recently, the group announced an unfranked dividend amounting to AUD 0.0418 per unit for its fully paid ordinary securities/units stapled securities. The announced dividend was for the quarter ending 30th June 2019. It carried an ex-date, record date and payment date of 27th June, 28th June and 30th August 2019, respectively. The group also offered a Dividend Reinvestment Plan on the distribution with a DRP discount rate of 2 per cent.

Post the announcement of the dividend, the group informed that it has signed an underwriting agreement with Macquarie Capital Limited to act as an only underwriter of the offer of stapled securities in the Aventus Group under the DRP Offer. The group also notified that Macquarie would underwrite the complete DRP offer up to ~$22.5m at the DRP Underwritten Price. The DRP price was to be calculated using the average of the ten daily VWAP for total sales of Stapled Securities sold on the ASX over the ten Trading Days of the Pricing Period, reducing a discount of 2 per cent. The group then advised the DRP issue price of 2.35 dollars per stapled security for the June quarter.

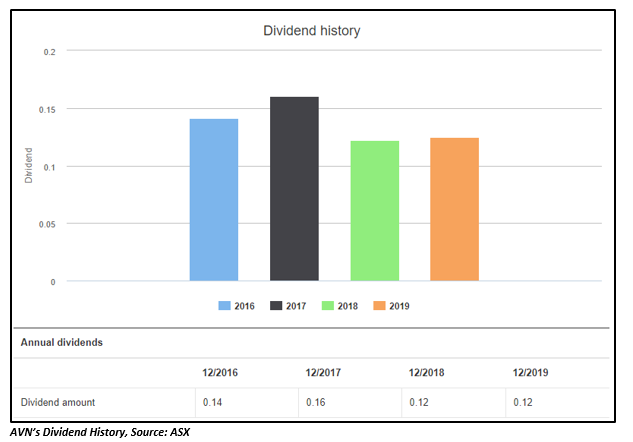

As per ASX, the annual dividend yield of the group stands at 6.6 per cent.

Operational Performance: The group has recently notified through the ASX update that Aventus Cranbourne Thompsons Road Pty Ltd, subsidiary of the Aventus Group, is the lessor under the lease of the prior Masters store located at Cranbourne Home. The company updated about it after the Supreme Court of Victoria provided judgement last week.

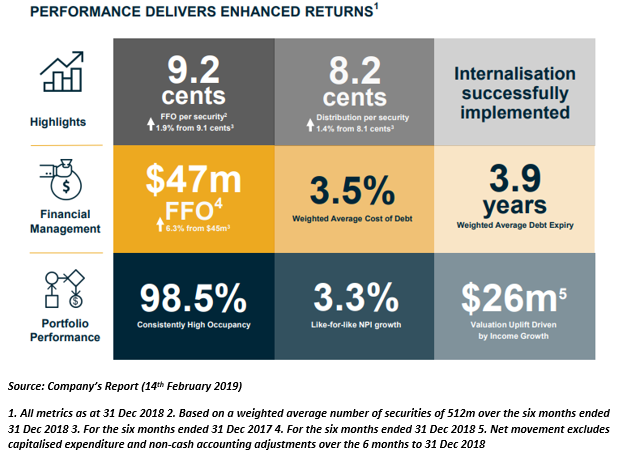

Financial Performance: The group delivered strong financial results for the half-year period ending 31 December 2018. The profit of the group was recorded at $64 million. It achieved a high occupancy of 98.5 per cent, gearing of 39.4 per cent and like-for-like NPI (net property income) growth of 3.3 per cent, respectively during the period. It also attained property valuation gains of $26 million in its portfolio that brought its value of AUM (assets under management) to $2.1 billion.

The group also informed that its distribution per security has grown at a CAGR of 4 per cent since its listing on the ASX in 2015.

Stock Performance: As on 13th August 2019, AVN is trading at AUD 2.510 (as at 1:00 PM AEST). With approximately 537.47 million outstanding shares, the market cap of AVN stands at AUD 1.35 billion. AVN has delivered a return of 17.29 per cent on a YTD basis and 15.15 per cent over the last one year.

National Storage REIT: One of Australasiaâs largest self-storage providers, National Storage REIT (ASX: NSR) tailors self-storage solutions to commercial and residential customers at more than 140 storage centres across New Zealand and Australia. The company offers services like packaging, self-storage, insurance, climate-controlled wine storage, vehicle and trailer hire, vehicle storage, business storage, and other value- added services.

Dividend Update: The National Storage has recently announced a fully unfranked dividend for its fully paid ordinary or units stapled securities, amounting to AUD 0.051. The dividend carried an ex-date, record date and payment date of 27th June, 28th June and 5th September 2019, respectively. The announced dividend was for the half-year period ending 30th June 2019. The company had a Dividend Reinvestment Plan (DRP) applicable to the distribution, which was an alternative to cash payment. The DRP election date was 1st July 2019 while the DRP discount rate was 2 per cent. Previously, the company declared a distribution of 4.5 cents per share on 18th December 2018 that was to be paid on 1st March 2019.

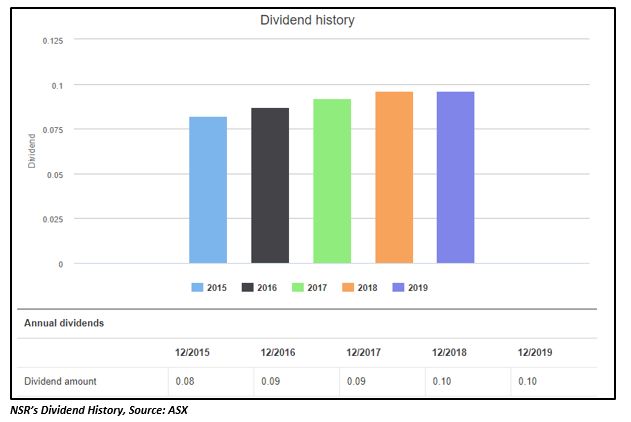

As per ASX, the annual dividend yield of the company stands at 5.78 per cent.

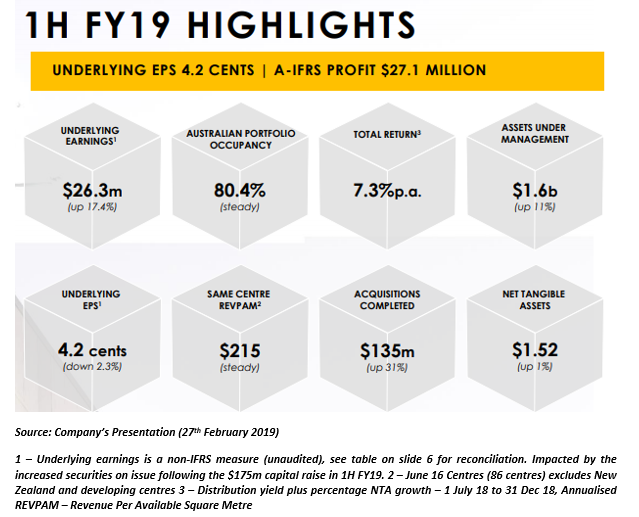

Financial Performance: The companyâs first-half financial results for FY19 were out in February this year. The company reported a rise of 17.4 per cent in its underlying earnings to $26.3 million relative to 1H FY18 figure. However, the companyâs 1H FY19 IFRS profit after tax was 55 per cent down on 1H FY18, at $27.1 million. NSRâs total assets under management and Net Tangible Assets increased by 11 per cent and 1 per cent to $1.6 billion and $1.52 per stapled security, respectively during the period. The group kept its FY19 underlying EPS guidance steady at 9.6 to 9.9 cents per share.

Stock Performance: NSR is trading at AUD 1.675, up by 0.9 per cent on 13th August 2019 (1:00 PM AEST). The stockâs 52-week high and low value stands at AUD 1.907 and AUD 1.600, respectively. The stock has generated negative returns of 5.95 per cent on a YTD basis and 12.63 per cent during the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.