Australia’s mining boom had kicked off in mid-2000s and ever since, the country’s resources sector has immensely contributed to the economic growth, wealth creation, employment generation, increased investments as well as tax revenues.

The country’s leading position in the resources sector on the global front can be credited to the world’s most diverse and plentiful mineral and energy reserves, with a high exploration upside, of bulk commodities such as thermal and coking coal, bauxite, natural gas, iron ore and uranium. Moreover, Australia also contains large deposits of base and precious metals such as copper, zinc, nickel, gold, silver and lead, and other green metals including rare earths and lithium.

Many companies, also listed on the Australia Securities Exchange, are actively making fortunes through exploration, production and commercialisation of mineral and energy projects, as the global demand is gradually consuming the present production capacities.

Let’s look at the following three ASX-listed mineral exploration companies and their recent activities.

IGO Limited (ASX: IGO)

South Perth, Australia-based IGO Limited operates as an exploration company with a key focus on copper, ore, nickel, gold, and other mineral resources.

December Quarter Results: The company continued its strong start to the year, beating the top end of guidance in the three months to 31 December 2019 (2Q20).

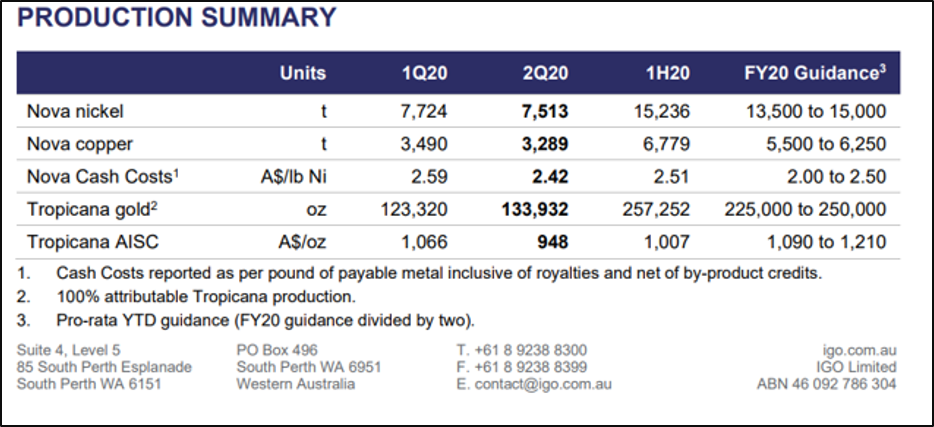

Source: December 2019 Quarterly Activities Report

From the table given above, it can be noted that, at Nova, nickel, copper and cobalt production all exceeded pro-rata FY20 production guidance at 7,513t, 3,289t and 279t respectively. At Tropicana, gold production increased by 10,613 ounces on the prior quarter to 133,932 ounces (at 100%).

Consequently, revenue and other income for the December Quarter amounted to AUD 211.6 million, resulting in an underlying EBITDA of AUD 116.7 million. The EBITDA margins for the period and financial year to date (1H20) were 55% and 57%, demonstrating the quality of the Group’s assets. Profit after tax turned out to be AUD 34.1 million, marking a reduction on the previous quarter primarily due to lower nickel prices.

The total cash from operating activities improved by 75% on the prior quarter to AUD 156.0 million (1Q20: AUD 89.4 million). This was mainly due to the receipt of the prior quarter’s Nova debtors in this Quarter while the increase followed through to a 93% increase in Underlying Free Cash Flow. The Net Cash improved substantially during the Quarter to AUD 395.6 million.

IGO has announced an ordinary fully paid dividend of AUD 0.060 (Record Date: 14 February 2020; Payment Date: 28 February 2020).

One the safety front, the 12-month rolling lost time injury frequency per million hours worked (LTIF) to 31 December 2019 was 3.3 (an increase from 2.1 as reported for the quarter ending 30 September 2019) reflecting an injury suffered by one of our contractors. There were two Serious Potential Incidents recorded during the quarter.

Stock Performance: IGO's market cap stands at ~ AUD 3.6 billion with ~ 590.8 million shares outstanding. On 31 January 2020, the IGO stock settled the day's trade at AUD 6.100, IGO has delivered a six-months' return of 8.35%.

Perenti Global Limited (ASX: PRN)

Perenti, established in Kalgoorlie in 1987, is a diversified global mining services group providing surface mining, underground mining and mining support services. It is one of the world’s biggest surface and underground mining services players with operations located in 13 countries across 4 continents.

Appointment for Savannah Project: Perenti Global informed the market on 30 January 2020 that the company’s subsidiary, Barminco (a leading hard-rock underground miner) has been selected as the preferred contractor by Panoramic Resources for the Savannah Project in the Kimberley the northernmost of the nine regions of Western Australia. The value of the contract is over $ 200 million.

Savannah is a nickel-copper-cobalt project located 110 km north of Halls Creek in Western Australia where mining operations began in December 2018, and the maiden shipment of concentrate left Wyndham in February 2019. Presently, Panoramic Resources is developing the higher-grade Savannah North ore body with a key focus on high- speed development and a ramp up to full production in this year.

The scope of work under the contract for Barminco includes mine development, production, and haulage over a term of 3 years, with work scheduled to begin in March 2020. The company expects to employ around 170 people and mainly use new equipment, which has been incorporated in the capital guidance provided earlier for the delivery of the project.

Mark Norwell, Managing Director at Perenti commented on the recent development stating that the project is a demonstration of the company’s ability to tap into organic growth opportunities, as the Barminco business is now well-integrated into the Perenti group, while it has further garnered for itself a leading position in the underground mining sector.

Stock Performance: Perenti's market capitalization stands at around AUD 1.03 billion with ~ 687.38 million shares outstanding. On 31 January 2020, the PRN stock settled the day's trade higher at AUD 1.535, up 2.67% with ~ 2.83 million shares traded.

Metals X Limited (ASX: MLX)

Metals X Limited operates as a diversified resource company engaged in mining, development, and exploration of copper, nickel, cobalt, and other metals.

Renison Resource Update: The company published an updated estimate for the Mineral Resource at Tasmania’s Renison Tin Operations on 30 January 2020. The operation is 50% owned by Metals X under the Bluestone Mines Tasmania JV (BMTJV).

The last Mineral Resource estimate was released on 31 March 2019 and since then, BMTJV has accomplished a lot of drilling at this location, having utilized up to 3 underground diamond drilling rigs and total 416 new holes completed for ~41,079 meters of drilling so far. The main focus of the drilling has been the infill and resource definition programs at Huon North areas, Area 5, Bell 50 and Leatherwood.

Highlights from the drilling include-

- An increase of 8% in contained tin (Sn) in the Mineral Resource at the Renison Bell underground mine delineated from the further drilling including 416 diamond drill holes.

- The position of the cross-cutting Doliminator Fault was further defined through drilling and delineates the boundary between Area 5 and the new Bell 50, which was consequently modified for the updated Mineral Resource estimate.

- The total Measured, Indicated and Inferred Resource estimate for:

- Renison Bell now stands at 18.54 Mt at 1.54% Sn for 285,100t Sn.

- Area 5: 4.32 Mtat 2.10% Sn for 90,700t Sn.

- Maiden Bell 50: 1.17Mt at 2.05% Sn for 24,000t Sn.

Also, the updated Mineral Resource resulted in a noteworthy increase of 34% in contained Sn from 85,200t to 114,700t along with 10% rise in grade from 1.91% Sn to 2.09% Sn for the Area 5 – Bell 50 region. The Mining Optimization Study and Life of Mine Plan for Area 5 is scheduled for delivery in the June 2020 quarter (mid of this year).

Stock Performance: The market capitalization of Metals X Limited is ~ AUD 73.49 million with ~ 907.27 million shares outstanding. On 31 January 2020, the MLX stock settled the day's trade at AUD 0.081, dpwn1.23% with 3.36 million shares traded. MLX has delivered a positive return of 6.58% in the last one month.